A few weeks ago, I was enjoying a lazy Saturday morning loitering on social media, when I got an unexpected message from Apple Pay. It was a payment confirmation to Uber. I checked the app to find 5 transactions on Uber between 1:00 and 5:00 am, when I was fast asleep. I logged-in to the Uber app to find 5 long distance trips in the Philadelphia area – I had been hacked.

I immediately checked my Amex app – the payment card on the Uber account – to block payment. There was no trace of the fraudulent transactions. I called Amex customer service and they (somewhat unapologetically) explained that transactions in their App can take up to 24 hours to appear … “That’s just how the app operates”.

What struck me about this was not that Amex could not provide data to me in real time – they clearly could if Apple could – It’s that they felt it was not necessary.

Those who use it know that Apple Pay is a better card payments interface than those most card companies currently offer – and they have done this using the card companies’ own infrastructure. Apple understands the value of a good user experience that truly addresses the needs of a card customer … many times much better than the card companies themselves seem to do.

In the last few years, we all know how Apple disrupted the media distribution, mobile phones and photography industries. They did this not because they were attracted to the economics of these industries, but because they wanted people to buy more iPhones, iPads and iPods.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

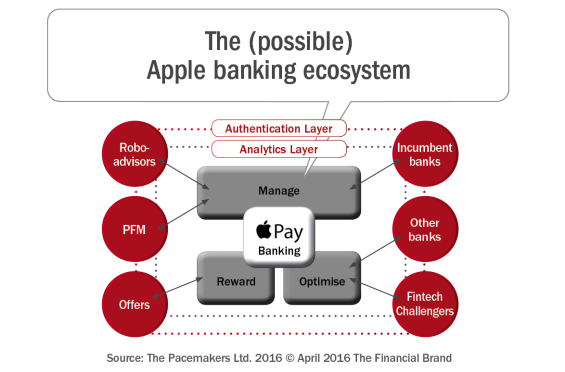

The Template for Apple Bank

So a question many should ask is: What if Apple decides that banking is the next service they need to provide to sell more boxes? What would Apple Banking look like? I would suggest that they would build their proposition on top of two key services they are very good at: authentication and data analytics.

This platform would engage with a number of third parties that would provide a banking service superior to anything in the market. Considering Apple’s customer base, skills and financial strength – Apple Banking could easily become the world’s most formidable challenger bank.

The Apple Banking platform would offer three main services that would enable customer to do the following:

- Manage: Brilliant user experience to understand and supervise how customers manage their money enabling users to control their money.

- Optimize: Provide customer the knowledge and the ability to be always getting the best provider for their financial needs

- Reward: Use their understanding of the customer to provide them relevant and valuable rewards

Manage

First and foremost Apple Banking will be a mobile application integrated with Apple Pay. Apple is very good at making complex processes appear simple to the end-user. The Apple Pay proposition, even in its current incarnation, is a distinct improvement on many other mobile payment propositions in the market. Apple Banking would do the same.

Customers would be able to engage with their banking platform in a simple and clean interface that provides them with a snapshot of their financial situation. Powerful PFM (good examples of Personal Financial Management businesses are Quicken, Mint, Meniga, Strands, MX and Geezeo) would provide customers with clear insight and possible actions that they could take to get the most from banking provision.

Apple would get customers’ permission to access their bank accounts and populate the Apple Banking application with real-time customer transactional information. This would then be re-presented to customers in a way that is straightforward to understand and easy interact with.

This interface would enable customers to interact with their bank through the Apple Banking interface, making it possible for the customer to do anything they can do on their Bank’s web and mobile offerings through their App. A brilliant example of good banking services UX is provided by the Finnish non-bank wallet Holvi (recently acquired by BBVA).

To get access to live customer data, Apple could use the (few for now) existing banking APIs or resort to a screen-scraping solution. Yodlee and eWise are good examples of businesses that already offer this service. Apple will then be able to reinvent the digital banking UX available to most bank customers.

Within this new UX, Apple could provide insight on the quality, pricing and features of the services customers are receiving from their bank. This would be equivalent to a whole-of-market impartial shopping comparison, using real customer data that requires almost no effort for customers to set up. Customers would quickly see if they are getting value for money or if they would be better off with another provider. A good example of this approach is provided by Ontrees.

All of this would reduce the need for customers log in to their bank to bank. Customers would begin prefer to use Apple Banking to other interfaces available to them gradually becoming dis-intermediated from their bank, eventually resulting in the customer loyalty to shift from legacy banks to Apple.

This would also lead customers to see banking as a commodity with Apple Banking as their trusted advisor protecting them from being taken advantage from the unscrupulous banks. All of which neatly leads to the next feature of Apple Banking.

Optimize

Once Apple Banking becomes the primary way customers engage with their bank, providing them with insight on the quality of the banking services they are receiving, the next logical step is to enable customers to optimize their banking relationship. Apple Banking could not only show customers which provider would offer them the best service and value for money – they could also make it extremely easy for customer to move their custom to the best provider.

Apple Pay’s core proposition is to identify and authenticate the customer at the point of sale. Apple owns most of the data a bank needs to open a new customer account. Apple captures demographic data, details on ownership of other financial products and even biometric information that could be relatively easily bundled into an authentication / account opening service for banks.

Apple Banking could allow customers to authenticate and open a new account with a new provider with a few taps. Making the commoditization of the bank complete. The challenger bank Mondo is aiming for such an approach.

Reward

Once Apple Banking is able to provide all of the above the services to their customers, the next step is provide rewards. Apple Banking could leverage Apple’s relationship with retailers and manufacturers to provide cash-back offers and incentives to their customers. This would be a supercharged version of the big-data cash-back propositions provided by businesses like Cardlytics and Meniga.

Apple has gone out of their way to announce that they would not use customer data for marketing purposes without their consent. But if customers consent, the richness of the data that Apple has access to would enable rewards that could be more substantial and better targeted than any other provider today.

Could/Will It Happen?

If Apple decides to launch Apple Banking it would give banks a real run for their money. Apple has a better grasp on user experience and customer engagement than most businesses – not just banks. They have close to a billion iPhones in customers’ hands, with a few hundred million having Touch-id authentication built-in. It has a trusted brand, very deep pockets and the skills to completely revolutionize the retail banking industry.

The attractiveness of the banking sector for Apple is not in its financial return. Banking is a relatively low margin, highly regulated and difficult business – so it’s unlikely that Apple will want to become a bank. Apple’s interest is in becoming an even more integral part of its customers’ life, creating an even higher barrier for them to switch hardware provider.

So, while Apple Banking may not be a ‘bank’, it could provide a highly competitive banking customer interface. In a few years we could see that, not only does the world’s biggest taxi service not own any cars, and the world’s largest hotel chain not own any property, but the world’s greatest bank doesn’t have a banking license.