Since the beginning of 2023, as interest expense rose for institutions across the country, the forecast amongst bankers has been fairly unanimous: We will get several—at least three—rate cuts from the Federal Reserve in 2024. The hope was that higher rates would cool the economy, inflation would decline, and the industry would enjoy a golden year with assets booked at higher rates relative to falling deposit prices.

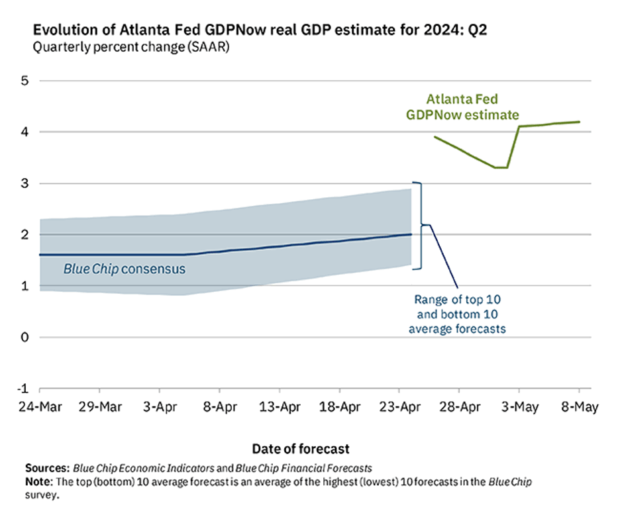

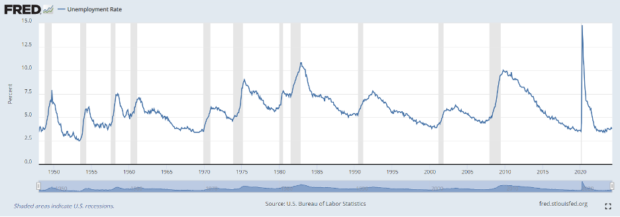

Now that forecast is fading. Inflation is not staying down. The Atlanta Fed’s GDPnow estimates a strong 4.2% growth for the U.S. economy in second quarter, even though first quarter came in 1.6%. Unemployment has been as low as it is today on only a few occasions in recorded history. The Fed may not decrease rates at all in 2024.

Do current economic conditions mean profitability will be harder to come by? Not if institutions maximize margin and volume together. These are the best years we’ve had in a long time for driving profits from deposit gathering. Let’s take a deeper look at why that is.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

A Closer Look at the Economic Data

Before examining how volume can drive profitability, let’s examine inflation, GDP, and unemployment more closely.

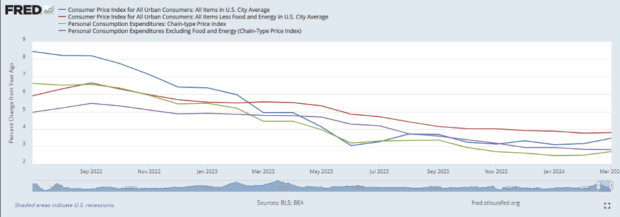

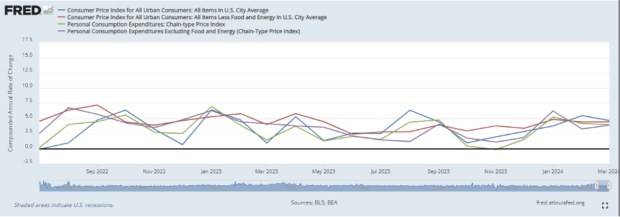

Inflation data can be deceptive. Since the Fed moved to a restrictive monetary policy stance, most attention has focused on the “percentage change from a year ago” graph from the St. Louis Fed. But that data pictorially over-states the decline in inflation.

The same data shows no change – and even an increase for certain indexes – when reported month to month. The Fed is looking at both of these angles. Banking executives should do the same.

Meanwhile, the U.S. economy has grown in real GDP since the Fed began raising rates. The 10-year average for U.S. GDP growth is around 2%. The first quarter of 2024 was the first quarter with GDP below that average, at near 1.6%. But the first quarter is not usually the best of the year for GDP. Blue Chip forecasts second-quarter GDP at 2% and GDPnow at 4.2%. If the former is right, it’s an average quarter for GDP. If the latter is right, the second quarter will be the strongest GDP in a quarter since monetary tightening began, aside from third quarter 2023.

The Fed also assesses unemployment when deciding monetary policy. The U.S. economy is running near the historic low for this century.

Economic data doesn’t tell us what will happen, but it should inform banking executives’ plans to gather deposits.

Even if each data point turns in the other direction and Fed Funds declines 0.75%, deposit prices would only see a portion of that. It’s not a monumental change for funding costs.

Rather than waiting and hoping for minimal relief, banking executives need a strategy that puts their hands on the controls of their institution’s profitability. Attracting deposit volume is the best way to do that, especially when institutions can’t control markets for deposit pricing.

Doesn’t Cost of Funds Control Profitability?

Half of deposit profitability is volume. But I don’t mean mathematically half.

Consider volume in loan growth: An institution will compromise on rate if it can make up for it in volume—for very large and credit-worthy borrowers, for example. Even if the alternative were several smaller loans at higher rates, by comparison, the larger loan can still provide more profit. The size of the loan is half of the reason for its profitability; its rate is the other half.

The same applies to cost of funds. A 300-basis point spread sounds great. The institution might get a 300-basis point spread on $1 million of deposits. But how much more money would be made by a 150-basis point spread on $10 million of volume?

There’s no proprietary process involved—it’s just math. That’s why volume will be the star of deposit profitability in 2024. Institutions have two legs to stand on in generating margin—spread and volume. If prices don’t come down, perhaps management should focus on driving volume up.

The astute banker here will ask: Isn’t the best way to gather more deposits by offering a higher rate than my competitor?

Institutions can’t ignore their competitors entirely. Fortunately, there are objective guideposts for profitably attracting deposit volume: U.S. Treasuries and Federal Home Loan Advances.

Dig deeper:

- How to Master Deposit Pricing with Data-Driven Personalization

- How Data Can Defend Against Deposit Attrition

- More from Neil Stanley: Beware Aggressive Deposit Growth Tactics Risks

Objective Guideposts for Attracting Deposits at Scale

This week, a one-year U.S. Treasury bond is at 4.94%. Certificates of deposit booked at 4.4%, therefore, need no subsidization. The customer buying that CD offers the institutions both a profitable margin and a chance to remain their preferred financial institution – with all the opportunities for cross-selling that come with it.

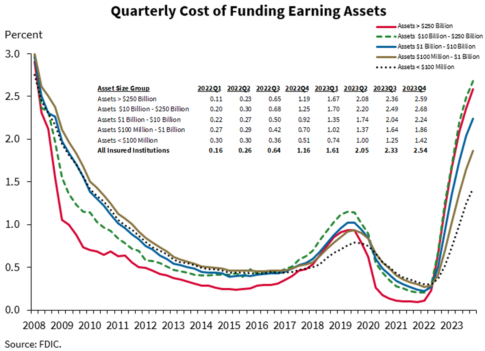

After rate increases began in 2022, larger banks accelerated to higher funding costs while smaller banks appeared to put their efforts into lower cost of funding. Yet, even with a funding cost of 2.54%, those large banks could profitably “buy” depositors at scale, and they are playing for keeps with their technology and wide product offerings.

Could it be that the low-cost provider is not necessarily the winner?

Federal Home Loan Advances provide the other, more meaningful, guide rail for gathering volume profitably. Pricing on advances is more meaningful too, because it removes dependence on interest income to achieve profit. Instead, a deposit is profitable if its rate saves interest expense.

If time deposits, for example, are booked below FHLB advances, the institution knows it could not have done better by buying wholesale or brokered funds. This also widens the margin between the funding book and assets, whether loans or U.S. Treasuries. In March, a sampling of institutions that approached deposit gathering in this way booked an average of $15 million in time deposits at an average spread to FHLB advances of 1.71%.

At branches, these guide rails become the outline of the playing field for frontline staff when incorporated into a negotiation method that proceeds sequentially from basic offers to retention offers. Rather than pushing products in ways not effective or appreciated by depositors, the finance department can define a pricing approach that provides ample margin. Frontline can focus on attracting as many depositors as possible by retaining rate-sensitive customers, respecting curious customers with value-added conversations, and allowing sleepers to remain asleep.

Banks and credit unions must stand on both legs of profitable deposit gathering – spread and volume – this year and every year. If they do, they regain control of their profits, which will depend less on trends in deposit competition or the decisions of the Federal Reserve.

Neil Stanley is chief executive officer and founder of The CorePoint. With over 30 years of experience at three high-performance family-owned banking groups, he has held various roles, including Holding Company Vice President, Chief Liquidity and Investment Officer, Chief Credit Officer, President of Community Banking, and Bank CEO.