Today’s high-rate environment is a first for many bankers, and it’s presenting challenges regarding the products they’re offering and how those products are priced. This is especially true for financial institutions with substantial balances among the 30% of depositors motivated by rate. Perhaps more than ever, success in retaining balances and acquiring new deposits requires a personalized approach.

Financial institutions and their leaders face a Catch-22: Pay more to retain balances and, in doing so, shrink margins and alienate investors — or pay less to maximize margins and risk shrinking your deposit base.

So how can bankers find rate-setting equilibrium when the dispersion of rates is so wide and high-rate offerings are so easy for consumers to access?

Strong fundamentals, including underlying analytics and disciplined rate-sheet pricing remain critical in this environment. The greatest degree of success, however, lies in taking a more personalized approach to understanding what various customer segments are seeking and then working to connect with them using the right tools to tailor offers and experiences.

The Deposit Pricing Challenge

Sophisticated banks have been using a marginal cost of funds (mCOF) model that measures the change in the overall deposit cost, including the effects of repricing and attrition. The upside of using mCOF is that it evaluates alternatives based on the greatest growth in new money and/or retention of balances at the lowest cost, enabling Financial institutions to prioritize their actions for maximum benefit.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Within this framework, traditional strategies for dealing with rising rates have centered around “fencing” growth balances from retention balances. For example, many financial institutions offer a higher-rate money market account that requires new money, or they create off-term CD maturities at an elevated rate that depositors can opt into. These fences typically have resulted in more than 60% of “convenience” balances — those less sensitive to rate than to other factors — remaining in the core portfolio, with only the most sensitive 40% moving.

While these traditional strategies are still necessary, they’re less effective today because of rate dispersion and the ease of chasing rate. Even when financial institutions have used them to achieve a tenfold growth to deposits, repricing remains — typically over 50% (and as high as 85%) of balances come from existing customers.

The Maturity Bubble

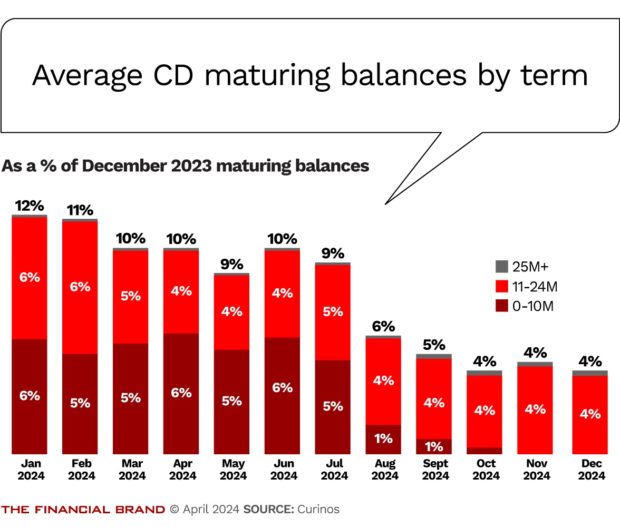

As rates have risen, most providers seeking deposit growth have focused on CDs. Many assumed market rates would soften by the end of 2023 or early 2024, so they stacked maturities by offering successively shorter terms to avoid margin compression as rates eased.

Now that the Federal Reserve forecast is “higher for longer,” many organizations find that they have 10% or more of their total deposit portfolio maturing at the same time (Figure 1). This could create balance risk, most acutely during the first half of this year, although we expect most maturities to be extended through 2025, based on current renewal trends. But it’s complicated: A sizable majority of those renewing — as much as 85% — will be doing so for the first time, when they’re especially rate-sensitive.

To respond to the dynamics of today’s marketplace, financial institutions would be well served to consider these actions:

Develop a clear picture of the market and competition. F

Financial institutions need to understand what competitors are offering by segment — age, wealth and income at a minimum — and how challenged those competitors may be by geography.

Grasp and categorize depositor behavior. Financial institutions need granular understanding of the deposit behaviors of their customers to both forecast deposit needs accurately and develop targeted strategies to preserve and grow balances. Many organizations don’t have enough data or the analytic tools and muscle to identify and develop strategies at this level, putting them at a competitive disadvantage.

Align channels, people and marketing for coherent CX. Traditional financial institutions have broad channel, product and market constraints exacerbated by uneven experience among their customer-facing personnel. Direct banks, on the other hand, operate with laser focus and simple messaging (e.g., higher rates). Traditional players need to clarify objectives at the customer level to deliver consistent experiences across channels and through their people.

Personalization is the Key

Improved targeting, messaging, offer-flexing and iterative testing at the micro-segment level can help financial institutions broaden their knowledge of consumer behaviors while earning deposits at scale. To manage the coming CD maturity bubble in particular, Curinos counsels providers to embrace these strategies and actions:

Targeting.

Identify customers unlikely to renew with promotional offers. This might include expanding the relationship to checking or moving to a term that can help spread maturity risk. Apply segmentation based on demographics (including age, wealth and income) and/or behavior (including balance profiles, channel preference and preferred incentives, such as cash, rate or rewards) and examine response history based on messaging.

This two-pronged approach can help financial institutions present the right offer at the right time to maximize response. Understanding the likelihood to renew and at what rate can help financial institutions set the optimal “go-to” rate to retain the bulk of deposits. It can also focus promotions on those customers who may need incentives to renew.

Read more about deposit growth strategies:

- The Great Checking Account Migration: How Marketers Grab Growth

- Winning the War for Deposits: Strategies to Drive Real Growth

Dynamic delivery. By flexing message tone and offering currency, sequence and timing through micro-segmenting, financial institutions can learn the most relevant experience for each customer cohort. In some cases that may mean reinforcing the overall value to the customer, while in others, it may include making the customer aware of a promotion to encourage further engagement.

Test and learn. With a library of offers and dynamic creative, financial institutions can learn consumer preference for relationships and engagement. While most providers learn through A/B testing, many still have a manual process to capitalize on the findings. In today’s rapidly changing deposit market, that’s not good enough. Reducing the cycle time to learn and deploy is tantamount to success. According to data generated by Curinos’ Amplero Personalization Optimizer, automating the test-and-learn program can drive 70% more lift compared to naive or manual A/B testing.

This same process can be used for initiatives that go beyond CD renewals, including liquid-balance augmentation. Identifying which customers can grow balances, the rate at which they’re likely to switch and how long those balances are likely to stay can help financial institutions match offers to the value of the deposits they seek. This has been shown to save as much as 10 basis points on deposit costs or grow balances faster by targeting those who care most about rate. The same insights can be applied to prospect acquisition to improve the duration and cost of new-to-bank balances.

Dig deeper: How Digital Banks Keep Pushing CDs Higher

Always-on Marketing Makes it Personal

Always-on personalized marketing using AI-based, self-learning experience engines can go beyond deposit gathering and retention to automate and optimize all customer-engagement and marketing efforts. Specifically, these solutions can:

- Leverage customer insights to maximize response across multiple creatives and offers. This is preferable to having to rely only on the responses from the best-performing messages of the past.

- Significantly reduce the expense-of-journey definitions of traditional marketing-automation systems by learning the journey rather than asserting it

- Maximize response by automatically segmenting customers based on behavior and their preferences for tone, creative, incentive, channel and sequencing.

- Expand relationship trust and loyalty through regular relevant contact with customers so messages don’t always have to focus on sales, which often reduce response rates.

- Support message consistency across all channels so customer-experience journeys are consistent based on the empirical learnings of the platform.

When interest rates were near zero, additional deposits generally flowed from the checking relationship. Today, it’s mostly about rate. To win now, financial institutions need to be selective — gaining additional deposits at acceptable rates while minimizing how much of the back book is repriced. This means segmenting customers and knowing how to motivate each segment. Without the right tools to personalize the offer and the experience, bankers are flying blind, and that can get harrowingly expensive.

At Curinos, Hank leads a team of subject matter experts to define solutions leveraging the company’s marketing solutions used by financial institutions. He brings over 30 years of strategy, product, pricing and marketing experience with financial institutions of all sizes across North America, Australia, and the UK. He has worked with clients in developing value propositions, defining rate and fee-based pricing strategies, as well as insights to target retail financial solutions to customers with the greatest potential for financial solutions.