The Financial Brand used Google Trends to see how the economic crisis was affecting people’s feelings about their finances and the general state of things.

The Google Trends tool searches Google’s records to see how often people search for certain terms. It graphs out the relative frequency with which these terms have been searched over the last five years. In each graph, the top data line represents people’s searches, while the lower data line shows references in the news. (Tip: You can use commas to compare multiple search terms.)

Using Google Trends, you can get a sense of what people’s feelings and fears are. For instance, in a classic case of “saying one thing but doing something different,” people are increasingly looking for any “silver linings,” yet — at the same time — they are buying more “ammo.”

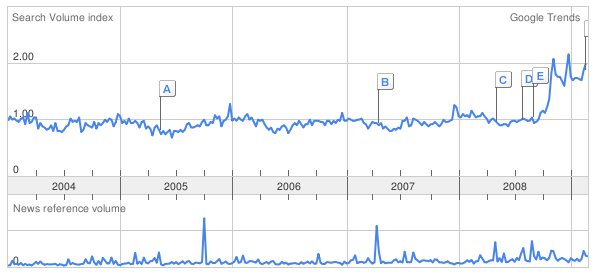

“Silver Lining”

People started looking for “silver linings” right as the subprime mortgage mess triggered a recession.

Notice how the media is increasingly looking for “silver linings” to share with a weary public.

“Ammo”

As the stock market crashed last November, people starting looking for more and more “ammo.”

“Unemployment Benefits”

A grim indicator of the jobs market.

“Home Safe”

People want more safes for the home.

“Coupons”

People’s interest in “coupons” is growing, along with the media’s usage of the term.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

People have become increasingly concerned about the insured status of their deposits.

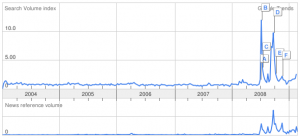

“FDIC”

The first spike is when IndyMac failed. The second occurred when Wachovia was acquired.

This graph also suggests people might be looking to move their deposits.

“NCUA”

The biggest spike happened last fall as deposit insurance limits were increased to $250,000.

Google has already proven it can track the flu as it spreads across the country. Could Google Trends be used as a leading indicator of economic trends too? These graphs show when economic fears became part of the common zeitgeist:

“Subprime”

“Subprime” became part of our vernacular in Spring 2007.

“Crisis”

There were whiffs of “crisis” by Fall 2007, but it wasn’t clearly obvious we had a

fully-blown “crisis” on our hands until the stock market crashed a year later.

Notice media references (the bottom data line) don’t really kick in until Fall 2008.

“Bankrupt”

This graph essentially follows the same trend as “crisis.”

“Socialism”

Obama’s tax plan spiked references and searches for “socialism.”

And here are graphs for a few financial services:

“Online Banking”

Notice the phenomenal growth in searches for “online banking.”

“Refi”

After a lull in 2008, interest in refinancing is again surging.

One thing is for sure: People’s interest in Twitter is up, up, up!

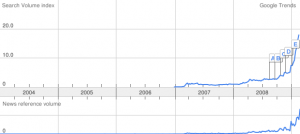

“Twitter”

Can the popular social media tool keep up with demand, especially when it has $0 income?

[ratings]