Traditional banks and credit unions can’t afford to lose people to simple pain points embedded in the customer experience — there are too many banking alternatives in the modern world which could easily (and will) win people over.

These problems are fairly easy to fix, but they require understanding where customers are getting frustrated in the digital and in-branch banking experience.

Customer experience software company Lightico highlights nine painfully broken steps in the customer lifecycle that put relationships to the test for banks. Here are six of the most important pain points for financial institutions to address:

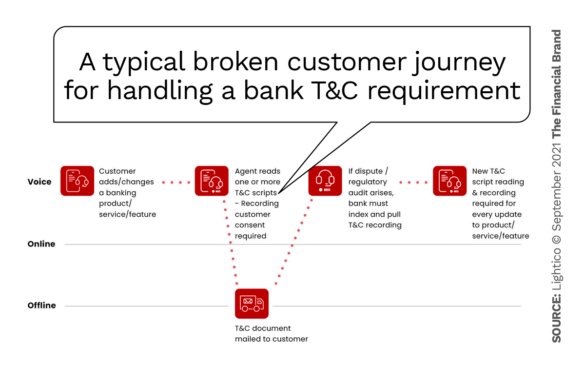

1. Terms and Conditions Are Failing

Deloitte surveyed 2,000 Americans in 2017 and found that a whopping 91% of them click “I Agree” on terms and conditions contract without ever reading a word.

That’s not so surprising considering that The New York Times found that the average person would have to set aside 76 days of work time just to read through tech company policies alone. These contracts and policies are thrown at people just about every time they download an app, let alone apply for a loan or credit card.

Some financial institutions tried to bypass this step for consumers and instead delegate the job to employees, mandating they read off scripts with summarized terms and conditions when people call customer service instead of performing the same task online.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The problem, Lightico points out, is that these scripts “can be misread by agents or misunderstood by customers, prolonging the process and opening risks for disputes and compliance issues.” It becomes a pain point for both the institution and consumer when the latter must dispute claims from a virtual agreement, just because they misunderstood a verbal consent approval.

One solution, suggested by Lightico: Instead of sending out consent forms for each product or service, banks and credit unions can send out one blanket terms and conditions contract.

Read More:

- Top 7 Customer Experience Trends in Banking

- 6 Ways Digital Is Transforming the Customer Journey In Banking

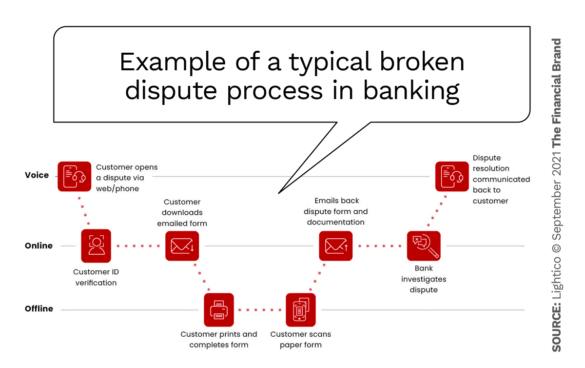

2. Dispute Processes Not Up To Speed

A dispute of any kind can easily and quickly test the trust between customer and financial institution — and frustration can quickly escalate to customer churn, lowered NPS, and regulatory complaints.

Where are financial institutions going wrong? Lightico argues that their legacy systems rely on the wrong processes.

“Instead of taking the opportunity to show their customers why they’re in good hands, many dispute processes today make their customers move between channels and complete multiple documents,” the report states.

As a result, institutions end up with open cases and excessive turnaround times, not to mention mounting customer frustration. In the end, people must submit proof of the issue and end up contacting multiple departments before even getting an issue solved.

Fixing this requires a shift in the customer service gameplan, but it can be done. Corey Besaw, the Vice President of Solution Design for CX software company Ubiquity, says the three most common disputes are related to account takeovers, ATM withdrawals and P2P transactions.

If your institution is running into these kinds of disputes often, Besaw recommends taking these steps:

- Reprioritize Your Queue: Your financial institution’s initial instincts might be to work the oldest cases first. However, it’s better to prioritize the queue “based on the underlying risk of the transaction, the potential for funds recovery or the opportunity to complete an investigation before provisional credit is due — while keeping in mind the regulatory timeframes.”

- Resolve Claims Before Provisional Credit Is Due: One of the ways to expedite disputes before waiting for a chargeback to file is to run an outbound call to the merchant, who is often very willing to help. “Maintaining a list of those merchants for your analysts saves a lot of time,” says Besaw.

3. Legacy Loan Deferment Systems Are Too Slow

The pandemic exemplified, in many ways, that banks and credit unions cannot rely on broken systems to keep their customers satisfied. Yet, when customers specifically needed loan deferments and modifications during Covid-19, most institutions were utilizing the same systems they had used for years to get the information they needed to accept the deferment or modification, Lightico explains.

Even though many institutions took steps — often manual — to expedite decisions, the basic process was just as slow as it has always been: banks and credit unions needed to confirm people’s identities, review the outstanding balance of the loan and collect proof of the borrower’s inability to pay back their loan. Then, the providers needed to draw up a new loan to satisfy the customer’s request, get the new terms and agreement to the customer to sign and hopefully get the new contract back shortly after.

While the actual chain of actions may not change much, banks and credit unions need to rework the process to make it fluid. Oftentimes, the existing system forces people offline to fill out paperwork so they can send it to their financial institution via snail mail or fax — both older solutions. At the end of the day, people would rather just use the digital online channels which they are already comfortable with.

4. Account Transfers Adding Grief

There are moments in every consumer’s life when they’re going to need extra help with their finances. A few that Lightico notes: the death of a loved one, divorce, illness or injury disabilities and unemployment.

Take the example of a relative of a deceased customer who wants to pay off that customer’s loans. If this relative isn’t a customer of the bank, he needs to go into the branch to verify his identity or they must fill out information online so he can assume the responsibility of the loan. This can take hours.

Or they try and fill out the paperwork online because that seems easier. The website automatically takes them to a secured web portal for ID verification. Only after they are approved and the financial institution emails them back a form to fill out can they take the next step.

Yet, “receiving a crowded PDF form filled with legal statements and stipulations is difficult to understand and complete,” Lightico outlines, noting that at this point the relative is “more likely to wait until they can print and sign that form manually and then must find a fax machine or scanner just so they can send it back to the bank.”

Read More: Banking Must Measure Customer Experiences Across Entire Journey

What should be a simple account transfer for this individual can soon turn into a discouraging process. These situations are not uncommon and can be very damaging to financial institutions’ reputations.

The CX software company suggests that banks and credit unions re-evaluate their account transfer processes and ensure that the touchpoints in and around such transfers are upgraded — for the sake of both customers and employees alike.

5. Replacement Card Processes Too Complex

Compared with estate-related account transfers, getting an additional debit card or a card replacement should be an easy fix. All customers should hypothetically have to do is let their institution know they need a new card, give them a few quick details why and the plastic card is sent out shortly after. However, this is not always the case.

“For many banking customers that process today is still unnecessarily complex and lengthy,” says Lightico, “and that’s creating unnecessarily painful journeys.”

At larger financial institutions, most of the processes can be done via mobile app — especially if they have a virtual assistant which can walk people through a replacement debit card application quickly.

However, customers of smaller institutions may be “forced outside their channel of choice,” Lightico maintains, as they get stuck calling their bank’s representative. Or, maybe because the issue wasn’t solved over the phone, they need to make a trip to their local branch instead of “engaging from any location or on their own time.”

“For many banking customers [the replacement card] process today is still unnecessarily complex and lengthy, and that’s creating unnecessarily painful journeys.”

— Lightico

6. Fraud Resolution Held Up By Friction

Lastly — but certainly not least — just as dispute resolutions are bogged down by unnecessary friction, fraud resolutions are too often a tangled mess that already-anxious customers have difficulty wading through.

The issues, which can ultimately be fixed, are often found in the fraud claim process. Financial institutions try to assimilate technologies into their digital strategies without making sure these same technologies integrate well with one another, which “prolongs and complicates the entire fraud claim process,” Lightico explains.

Customers willing to complete fraud applications digitally are “continuously bounced across online and offline channels,” the report state. Instead of a single, streamlined process, people are required to fill out multiple ID verifications before ultimately completing paperwork to prove the fraudulent activity.

While this process is necessary for banks and credit unions to truly verify fraudulent transactions, it’s essential that institutions look for ways to expedite the process and help consumers solve the problem via a single channel.