Brand makeovers stress everyone, but none more so than marketers. Among the raw points: long-standing traditions that must be tactfully discarded, the risks of alienating certain legacy constituencies, and endless decisions to weigh for the a new look-and-feel.

Brand makeovers stress everyone, but none more so than marketers. Among the raw points: long-standing traditions that must be tactfully discarded, the risks of alienating certain legacy constituencies, and endless decisions to weigh for the a new look-and-feel.

Unlike with IT projects, where non-tech people tend to hold back — sometimes more than they should — marketing programs make an easy target for novices and armchair observers. And, of course, when it comes to branding, everyone’s got an opinion. Who doesn’t think their comments about a particular color swatch deserve to be heard?

“Be prepared to listen to a lot of people who don’t understand branding tell you how much they know about branding,” says David Jones, chief marketing officer at WECU (pronounced WE-kyoo).

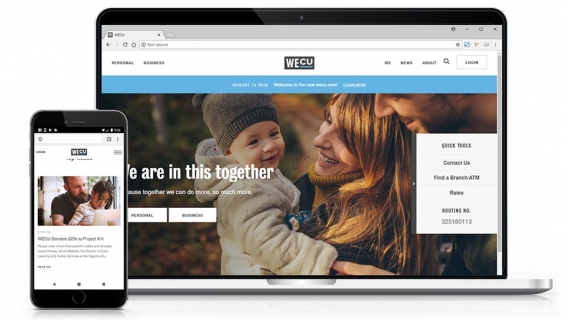

Although it has not formally changed its legal name (it is officially Whatcom Educational Credit Union), with the rebrand, the credit union now emphasizes “WECU” to encompass its much broader member base. The 82-year-old community-chartered financial institution has $1.6 billion in assets, 98,400 members, 11 banking offices, and close to 400 employees. Its recently completed rebranding program encompassed new signage, new ATMs, new cards, and a new look inside the branches. WECU also concurrently redesigned its website.

Here’s what else Jones had to say when he sat down with The Financial Brand to discuss the challenges of rebranding a retail financial institution.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why rebrand WECU in the first place? What was the objective?

CMO David Jones: Three years ago, we had transitioned from a CEO who had led the credit union for 40 years to our current CEO, Jennifer Kutcher. That change was a natural starting point for the organization to reevaluate where it had been and where it was going.

The goal was to build an aspirational brand — one that will not only serve us well today, but position the organization for a new chapter. To do that required us to strike a balance between not alienating our long-term membership — keeping the brand relevant and authentic to them — while at the same time setting up the credit union for future growth opportunities. We also wanted the brand to more strongly reinforce our values and mission.

Traditional financial institutions should choose a brand that is bold, strategic, and differentiating. We’re all competing against not only other financial institutions, but also fintech providers. Because we’re competing for people’s money outside of our own vertical, credit unions and community banks must look as appetizing and compelling as national brands.

How did you approach the rebranding process?

CMO Jones: You have to do your homework. Conduct research to assess the current receptivity and awareness of your brand so you’re not working from opinion, intuition, or just general “know-it-all-ism.” We did surveys and focus groups with staff, members of our board, and a cross section of the Whatcom County market.

It takes somewhere between 12 and 16 months, depending on the extent of what you’re trying to accomplish and the size of your organization. But expect the process to take longer than you estimate. If you’re going to do it well, rebranding takes time. Our project took about 20 months.

Who was on your ‘rebranding committee’?

CMO Jones: The entire rebranding process was led by Marketing. A broader review was conducted by the senior management team and by our board of directors. There was a working team that helped assist with the launch, including representatives from numerous departments.

For instance, our Facilities team supported environmental changes in branches. Organizational Development helped coordinate internal communications about the brand and its relationship to culture. IT helped with rebranding the internal intranet site as well as desktop, lock screens and digital signage.

As the process neared completion, we also assembled volunteers from all departments. Prior to the weekend of the brand launch, these volunteers retrofitted all branches and administrative offices with brand collateral, materials and swag.

How did you tackle the new brand identity?

CMO Jones: Specifically, for the logo, we considered 25 different options. Across all assets — brochures, signage, etc. — there was a multiplying factor that makes the number of concepts hard to estimate. Just with credit cards, for example, we looked at probably 50 different concepts. And with everything there were multiple fonts, colors, and styles to consider.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

How did you build consensus internally among your senior leadership team?

“When people who don’t understand branding tell you how to do it, fall back on research.”

CMO Jones: When people who don’t understand branding tell you how to do it, fall back on research and insight-gathering to bring people away from statements purely based on opinions, and closer to strategically driven decisions on messaging, positioning, tone, aesthetics, color palates, tag lines, photography, etc.

Ultimately those reviewing the work deferred to the opinion of the marketing group. However, throughout the whole rebranding process Marketing held multiple check-in reviews with senior management and the board. As the subject-matter experts, it was critical that marketing had the strongest voice in the room — ensuring that we never presented work we didn’t wholeheartedly believe in.

How did you pick a branding partner?

It’s hard to find an agency that does all things well. They all tell you they do everything well, but they don’t.

CMO Jones: We first asked our peers and business partners for referrals. Then we completed a thorough online search for a marketing agency.

It’s important to know what you’re looking for and what you need. We needed a firm that understood branding and digital capabilities because we were doing both a rebrand and a website overall. Financial services experience was a plus, but not required.

We spoke with 15 firms, and then weeded those down to six. We then prepared a mini-RFP that we asked each firm to complete. The document asked for the agency background, relevant experience, size of the firm, sample work, and an estimated budget based on our rough scope of work.

We evaluated the responses and followed that up with rounds of phone and in-person interviews. Then we picked the winner, Seattle-based strategy, branding, and design agency Urban Influence.

During the evaluation process, in addition to skills, we also looked for cultural fit. We wanted to work with a marketing agency that understood — and shared — the same cultural values we had. Naturally we considered budget, as well as the degree of confidence each firm was able to instill in us about its ability to hit timeline and budget targets.

It’s hard to find an agency that does all things well. They all tell you they do everything well, but they don’t.

One other point: It’s helpful to have an internal graphic design staffer to do small stuff after the agency delivers the big initial pieces. This will save you money and time. However, do not hire the CEO’s nephew or some friend of the organization who recently had a couple of graphic design classes to do any of this work.

How was the rebranding budget established?

CMO Jones: We did a line-item budget, outlining every asset from external signage to coffee coasters that needed to be rebranded. We estimated our total budget cost based on the list of thousands of such items that needed updating. After all that, we added 10-15% for unforeseen needs and issues.

When doing a rebrand it’s important to realize that this is a process that should take place — at least at a significant level — only once every 20 years. It’s going to be substantial, and it’s important to do it right.

How did you roll the new brand out?

CMO Jones: Internally, the launch campaign included a rally of 350 of our employees to introduce the new brand, and a reveal to the volunteer board of directors.

The market launch included social media, print media, digital advertising, terrestrial, and internet radio advertising. We also received a significant amount of local media coverage and social media chatter.

To amplify the significance of the launch event, we coordinated two additional announcements. First, we made a $25,000 contribution to a local non-profit, and second, we offered a short-term savings certificate promotion with the country’s highest rate.

Overall it was a very successful launch and the feedback was very good. Now that it has launched, we’re learning how to live out the new brand with our members and each other.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

What does it mean to ‘live out the brand’?

CMO Jones: The brand is a reflection of our culture and core values. For instance, one of our values is “do what’s right,” which essentially is always being mindful that our job is to help members find solutions to problems and engage with them on a meaningful and human level. No banking jargon. No complicated financial speak.

When we do that we are “living out the brand.” Then it becomes clear that the rebrand is not limited to aesthetics and a new logo, but it’s really about how we show up and present ourselves every day to our membership.

If you flip it, our members are the recipients of this energized, focused, collective engagement. That’s why we purposely took an inside-out approach to the brand launch — launching internally first — because we knew that if we didn’t live it, we couldn’t represent it to our members.

What advice do you have for others contemplating a rebrand? What would you do differently?

CMO Jones: We underestimated the time needed to cycle through the multiple review sessions internally. Specifically, because most people outside of marketing have never been through a rebrand — a significant moment in an organization’s history — it can be daunting. There is much learning that accompanies the evolution, and much socialization of the work internally that needs to be done. Plan a lot of time for that.

Also, prepare for a healthy dose of constructive criticism along the way, including after the launch. It’s easy to focus on the minority of negative comments versus the majority of positive comments. Make sure you pause and enjoy the positive and encouraging feedback you get as well.