Golden Pacific Bank has spun off a fresh sub-brand targeting small business owners. The SmartBiz program uses an “advanced technology platform” that the bank says allows it to “reduce the cost of borrowing and extend credit faster.”

SmartBiz is a joint effort between Golden Pacific Bank in Sacramento, California, and BillFloat, a technology company with a proprietary online credit delivery platform for financial institutions.

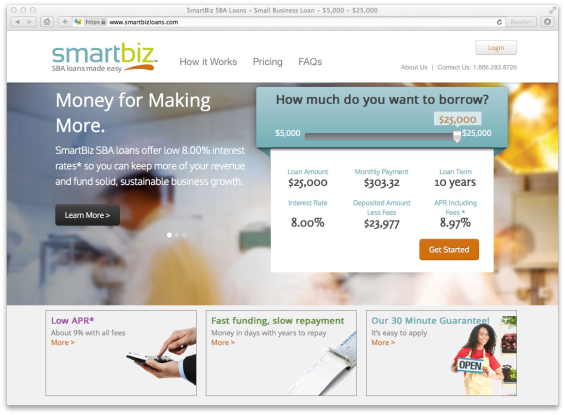

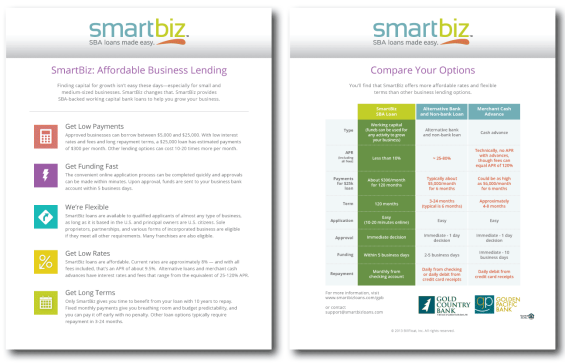

Golden Pacific says its SmartBiz SBA loans have been automated — starting with an online application — to chop the typical bank lending process from as many as 90 days down to only two to five days. According to the bank, SmartBiz SBA loans offer longer terms, lower rates (starting at 8.97% APR), and lower monthly payments than many other loan options available to small businesses.

Looking at the project, you’d never be able to guess Golden Pacific is an institution with only $132 million in assets. The streamlined process — an innovative idea in itself — is matched by an equally clean and contemporary looking website. The execution and delivery of the concept is splendidly simple, and likely to connect with the small business owners it targets.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The online application is straightforward and is phrased in plain English. Applicants can create a user name and password which allows them to return later to complete an unfinished application, or check back on the status of a submitted application.

“SmartBiz is designed to make it easier for businesses to obtain the affordable funding they need,” explains the copy on website. “Most banks won’t lend $25,000 to a small business because it’s simply too costly — their processes aren’t automated like ours. Besides, who wants three months of back and forth paperwork?”

SmartBiz SBA loans can be made to restaurants, landscapers, HVAC contractors, caterers, auto repair shop owners, spas, doctor and dental practices, small manufacturers and many other types of businesses including franchisees. Businesses that qualify for a SmartBiz SBA loan typically have $50,000 to $2 million in annual revenue, and have 1 to 20 employees.

SmartBiz loans are available to small businesses with a solid credit profile and at least two years of tax returns. Collateral is not required, but each principal owner must personally guarantee the loan.

SmartBiz loans have the longest repayment terms of available alternatives — 10 years. A loan for the maximum $25,000 amount for the full term would leave the borrower with a reasonable monthly payment of $302.32.