While mobile banking has been readily adopted by consumers, adoption by small businesses has been even more impressive. According to a survey of small businesses conducted by Raddon Financial Group, mobile banking usage has now surpassed the halfway point among small businesses in the U.S.

The survey showed that 52% of businesses with up to $10 million in annual revenue rely on mobile banking to access and manage their accounts. For millennial business owners, mobile banking is even more of a must have, with 68% using their smartphones to conduct banking operations.

It is no surprise that small businesses have taken to the mobile channel in high numbers, as it allows business owners who are often short on time to manage their day-to-day banking activities on their own terms. Among small businesses surveyed, 80% of those using mobile banking said it saves them a significant amount of time.

The adoption stats are interesting, but why should financial institutions care? There’s a multitude of reasons, but let’s start with the five that are most important.

1. Small Businesses Love Mobile Technology

More than half (56%) of small businesses indicate a financial institution’s technology resources have a significant impact on their decision to use that institution’s services. The impact of technology increases as the size of the business grows, with larger businesses placing even more emphasis on technology.

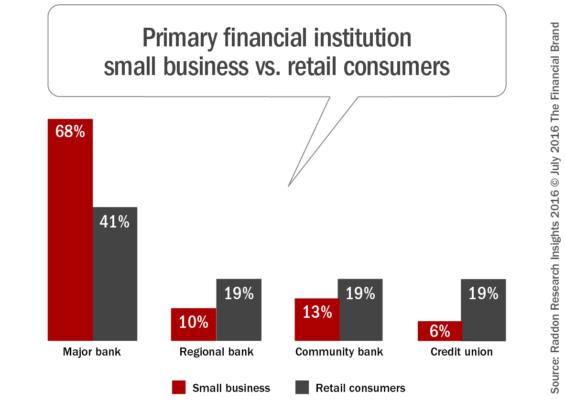

To date, mega-banks are dominating small business market share with 68% of all primary business banking relationships. By comparison, only 41% of retail consumers cite a mega-bank as their primary financial institution.

Technology such as online and mobile banking offerings have played a role in mega-banks capturing more than their fair share of the desirable small business market. Other financial institutions will need to bridge this technology gap in order to compete.

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation. Read More about Creating A Community with CQRC’s Branch Redesign Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Creating A Community with CQRC’s Branch Redesign

The unfair advantage for financial brands.

2. Mobile Banking Builds Satisfaction and Loyalty

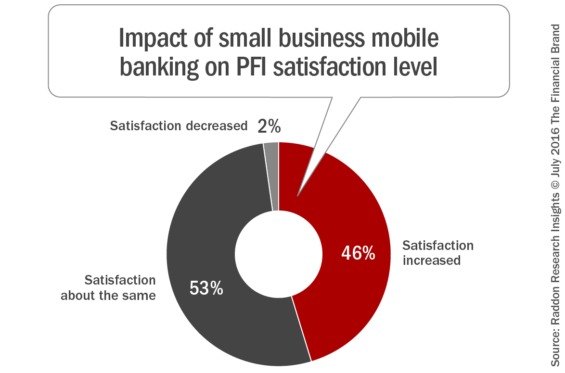

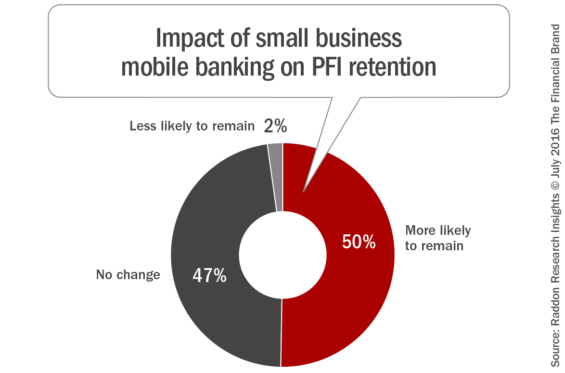

Mobile banking fosters deeper relationships and increases satisfaction with the financial institution. Nearly one-half (46%) of small businesses that use mobile banking say that their satisfaction with their primary financial institution has increased since they started using mobile banking. At the same time, 50% of mobile banking businesses feel that their use of mobile banking has made them more likely to remain with their financial institution.

3. Mobile Banking Builds Engagement

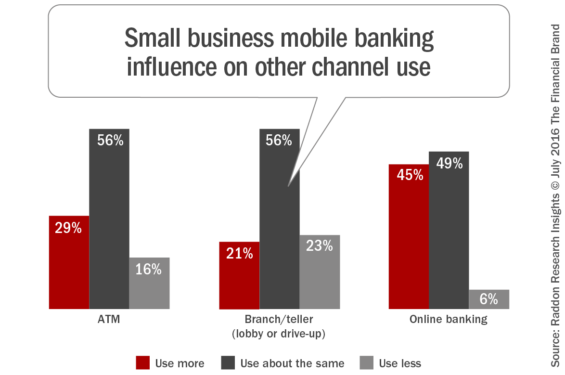

Mobile banking for business is a critical component to fulfilling the promise of multi-channel, omni-channel, opti-channel, and whatever other buzz-worthy channels you can think of. In short, small businesses say that mobile banking hasn’t supplanted their usage of other digital channels such as online banking.

In fact, 45% of mobile banking small businesses feel that mobile banking has actually increased their usage of online banking. This may be because businesses that use mobile banking are more engaged with their financial institutions and want to interact via the channel of their choosing, which may vary depending on their needs at any given point in time.

4. Mobile Banking Builds Profitability

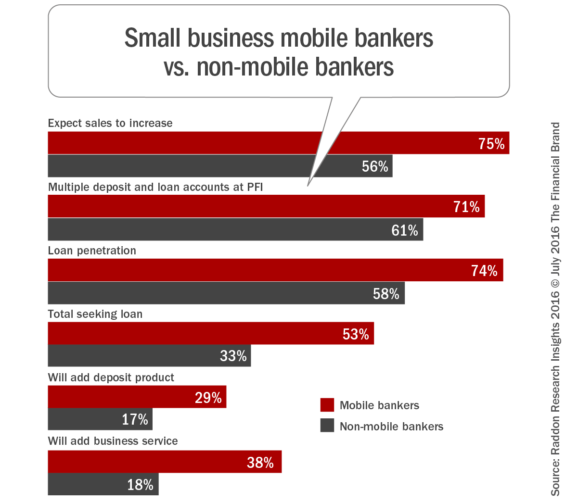

Small business that use mobile banking are appealing customers and prospects since they are usually in the growth stage of business development and use more commercial accounts than non-mobile businesses. These types of businesses are likely to be more optimistic about sales in the next 12 months, with 75% of mobile banking users anticipating an increase in revenue, compared to the 56% of non-users.

Along with this optimism comes a higher propensity to expand relationships with their mobile banking financial institution. This includes an increase in the likelihood that the firm will be in the market for new loans, deposits, or other business services.

5. Mobile Banking Use Will Grow

Mobile banking will only grow in terms of future use and importance to the small business owner. Among the 48% of small businesses that do not use mobile banking today, the most common concern is security, which was mentioned by 46% of the non-users. Specifically, this group is mostly concerned with the risk of identity theft (78% of those with security concerns) or their company’s bank account being hacked into (70% of those with security concerns).

It is reasonable to expect that concerns over security will diminish as the channel matures, similar to what has occurred with online banking. Advancements in biometric authentication may also help spur adoption, with more than one-half of those with security concerns (52%) indicating biometric logins such as fingerprint, voice authorization, or eye verification may help appease their security concerns and increase their likelihood to use mobile banking.

As mobile continues to become an integral part of the lives of both consumers and small businesses, financial institutions need to keep pace with these expectations in order to attract and retain customers. Small businesses place value on mobile banking and are evaluating whether or not your mobile offering is meeting their needs – and saving them the most valuable of all commodities – time.

Financial institutions must provide intuitive, user-friendly mobile banking services and advanced capabilities that go beyond the needs of the traditional retail banking consumer. Providing a seamless, optimized experience for business banking and payments will create a key advantage when competing for business customers.