Traditionally there are several reasons why a financial institution would undergo a rebrand: the institution has outgrown the old brand, the bank is looking for a competitive edge or maybe as a result of a merger or acquisition.

Eyal Lifshitz, the founder of newly rebranded Bluevine, says his digital bank is entering a new era, going from teenagerhood to full-blown adult.

It’s fair to ask — given that Bluevine just turned nine — why the digital bank would need a rebrand so soon. Bluevine, which partners with Coastal Community Bank, has over 425,000 small businesses as customers and has originated $13 billion in loans. Larger megabanks and institutions (many with more than a century’s worth of experience) rebrand on a much longer timeframe.

As Lifshitz explains, it’s all about ensuring the brand feels right to the bank’s small business customers: creating a modern, classy brand that uses the same vernacular business owners use to describe themselves.

“Our identity has really evolved over these last nine years,” he explains. “The rebrand captures how we think about ourselves, how we think about serving small businesses, and how we see ourselves as an innovator.”

The rebrand also coincides with a new product rollout, designed to give Bluevine a competitive edge serving what Lifshitz considers a poorly underserved market: business owners.

Read More: The Future of Business Banking: Fintech Innovation + Human Advice

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

An Unusual Resume Even for a Fintech Leader

Many digital bank founders have a crazy backstory by the standards of the usual banking career path. Some walk away from high-level executive roles at megabanks to start something wholly new. Others are serial tech company entrepreneurs.

Lifshitz is different: his career kicked off with a three-year stint as a Commander in the Israel Defense Forces, where he worked in counterterrorism. That was followed up by a job at Texas Instruments as a System & Algorithm Engineer. He is fluent in both English and Hebrew.

He didn’t even know he wanted to launch a company until six months before Bluevine was founded. “I was pretty safe in my career,” he says. “I worked at a very large tech company, then worked at McKinsey and Greylock Partners out of Israel.”

But Lifshitz comes from a family of small business owners, so entrepreneurship was part of his experience. It also gave him some valuable insights.

An Insider's View:

Part of Bluevine's success is due to its founder's understanding of small business issues — learned by watching his family's struggles as business owners.

“I know the pride that my dad had running a small business. Fundamentally, most small business owners just want to do their own thing,” he explains. “But, they have a lot of problems.” There were always issues for his family, he noticed, specifically in getting access to financial resources.

Launching Bluevine, he says, felt like an opportunity to create value for this segment.

Why Bluevine Went for a Rebrand

The insights gleaned from his family’s small business endeavors inspired some of Bluevine’s rebrand.

One of the biggest elements of the new brand is the language the bank uses. For instance, instead of using the words ‘small business’ or ‘small business owner’ around the site and in marketing, Lifshitz says his team has been conscious about removing the term ‘small’ from the phrase.

“That’s not how they speak,” he explains. “They say ‘No, I run a business’ or ‘I’m a business owner.’ Part of it is understanding how they describe themselves, what solutions they’re looking for, how they’re looking for them, being very clear about the value.”

The choice of fonts and typography was inspired by Lifshitz’ desire for the brand to have a “slick and modern, but not alienating” look.

Part of that modern look was making the bank name all lowercase letters. It’s a good mix between “being a cutting-edge innovative technology company, but at the same time, we are 100% small business.”

Learn More: Banks Must Tap Fintech Partnerships to Grow Small Business

Combined Solution for Accountants and SMBs

Even though the term ‘small business’ is omitted from the bank’s marketing, SMBs are Bluevine’s specialty. Lifshitz maintains that small businesses aren’t typically considered a high-profile customer for larger institutions.

Bluevine’s founder prides himself on his ongoing conversations with business owners, even when he goes to the dentist. After the dentist finishes checking his teeth, Lifshitz will ask “How do you work with your accountant?”

When Face to Face Helps:

Sometimes the best way to learn what small business owners need is to speak to them where they're at — like when you're at the dentists office.

The answer always sounds like an arduous process, he says. Lifshitz doesn’t understand why a streamlined banking-accounting software product hasn’t been offered to small businesses earlier. He considers it low hanging fruit. “It just goes to show how much more there is to do for the segment.”

Business owners need access to reliable banking services, even more so than a regular bank customer, Lifshitz says.

“A consumer checking account: there’s not much money coming in and you get payroll that comes in once or twice a month and then you have some expenses,” he explains. “But as a small business, they constantly have money in, money out.”

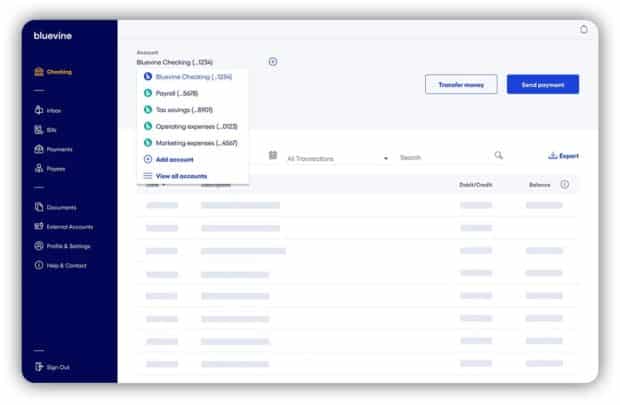

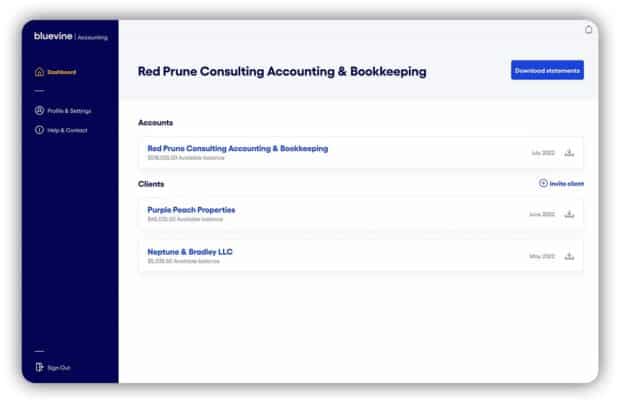

Bluevine’s product adds an ‘accountant role’ to the bank’s Business Checking account, which means a business owner’s accountant can easily access selected financial information. It eliminates the need for unnecessary back-and-forth communication, Lifshitz says.

Accountants can also have all customers in the same system, without logging in and out of client accounts — a problem Bluevine’s CEO says is common on the accountant’s side. The accountant integration can be paired with QuickBooks.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Dig Deeper: All-Digital Grasshopper Bank Pushes Into BaaS and SBA Lending

Servicing Small Business Customers Without a Branch

Working off a solely digital platform is advantageous a good chunk of the time. But, as Lifshitz points out, it isn’t always easy developing banking solutions with small business owners who still work frequently with cash and need brick-and-mortar servicers.

He says the average small business in the U.S. still frequents their bank branch at least once a week.

“The reality is traditional banks — while they do have digital offerings — lean very heavily on the fact that they have a branch network,” Lifshitz says. He explains Bluevine works to overcome the confines of a traditional bank and accommodate a business owner’s needs through other methods, including higher check deposit limits than most institutions.