Instinctively, being called a “progressive bank” just sounds more appealing than being known as a “traditional bank.” You would think that more traditional financial institutions would all want to transform themselves into progressive institutions.

Ultimately, however, labels matter little. It’s the actions that count.

A winning approach is less about fitting into a particular financial institution category and more about serving customers the best you can, says Kate Drew, Director of Research, CCG Consulting. For some financial institutions, that means staying well in front of the curve while others do better taking a wait-and-see approach.

That doesn’t mean that ignorance is bliss, however. “Whether you call yourself progressive or traditional, you need to understand where the industry leaders are heading and how that might impact your business and future plans,” explains Drew.

It’s one thing to be behind the curve due to budget or even security concerns, she says, but it’s quite another to simply not be focused on the right areas.

Telltale Sign:

If your financial institution is still spending time beefing up online banking while your competitors are implementing advanced mobile banking tools, you have a problem.

At this point, all financial institutions should acknowledge the obvious trend and concentrate on delivering seamless customer experiences that are device agnostic.

To get a better grasp on the current state of banking, CCG Catalyst surveyed 109 C-level banking executives about their current digital capabilities, their priorities, and their plans going forward. The survey focused on four core areas: 1. retail banking, 2. commercial banking, 3. segmentation/targeting and product development, and 4. technology and innovation.

In a report, the firm categorized financial institutions as either traditional or progressive banks, based on a few criteria. To be considered progressive — which comprised 30% of respondents — an institution has to acquire less than 50% of its technology from a single vendor, work with fintechs as an integral part of their strategy, and have made at least one fintech investment.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Key Differences Between Progressive and Traditional Banks

Based on the survey results, the following are the most significant differences between forward-thinking banks and those that take a more traditional approach:

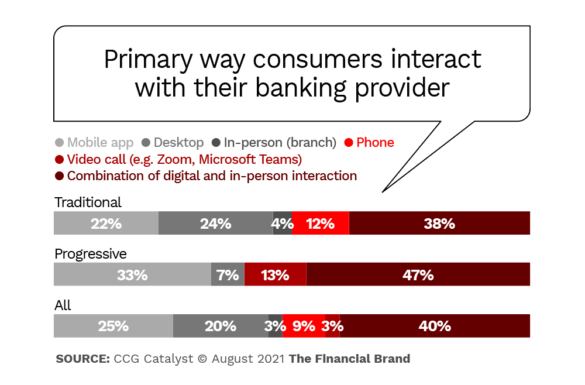

- Customers at progressive banks are much more likely to interact with their bank via mobile (33% to 22%).

- Customers at traditional banks are much more likely to interact with their bank via desktop (24% to 7%).

- Progressive banks are more likely to offer spend analytics to customers (60% to 44%).

- Progressive banks are more likely to offer account aggregation services to customers (67% to 48%).

- Traditional banks cite improving the customer journey as a higher priority than progressive banks (66% to 47%)

Read More: The Rise of the Hybrid Consumer in Banking (And Why It Matters)

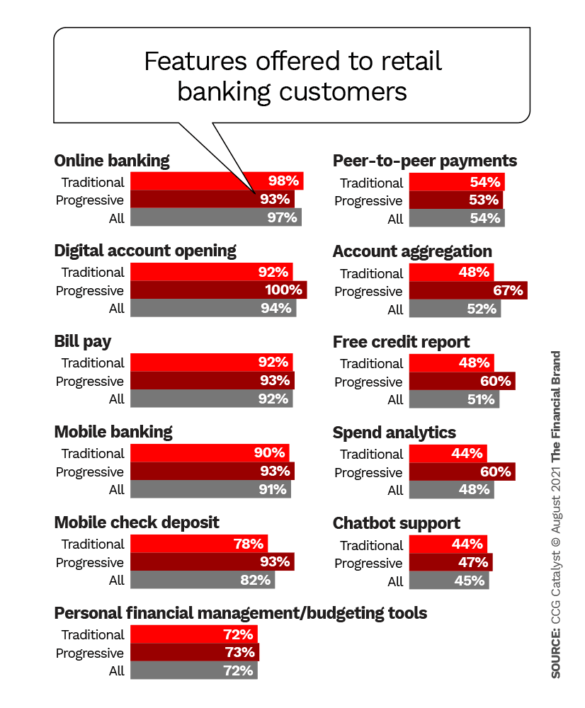

Looking at specific retail products and support features, the survey found that several products — including bill pay, budgeting tools, P2P payments, and chatbot support — are offered in similar percentages between progressive and traditional banks. In other areas, however, progressive banks are clearly leading the pack. For instance: account aggregation, spend analytics, mobile check deposit and free credit reporting.

Every progressive bank offers digital account opening compared to 92% (granted, still a high percentage) of traditional banks.

SMB banking: The coming battleground

Due to their typically more complex relationships and more stringent due diligence, business banking tends to lag retail banking when it comes to digital. CCG Catalyst predicts that digital onboarding for commercial customers — including small and mid-sized businesses (SMBs) — will become a battleground as customers, who had a taste of digital lending with the Paycheck Protection Program (PPP) loans, want to continue to apply for and close loans digitally.

Big Variance in Customer Targeting Abilities

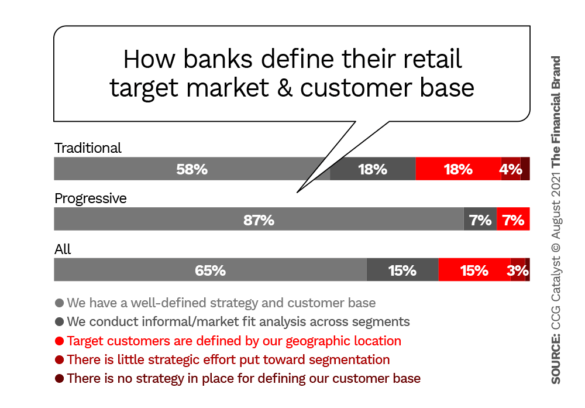

Progressive banks are far and away more focused than their more traditional brethren in going after the right customer in the right way. Since digital banking eliminates geographic boundaries, financial institutions can define their customer base based on segmentation criteria other than physical proximity, such as occupation, ethnicity or home ownership.

Almost nine in ten progressive banks (87%) say they have a well-defined strategy for defining their retail base, while only 58% of traditional banks claim to. On the business banking side, 81% of progressives have a well-defined strategy versus 58% of traditionalists.

Lagging Indicator:

All institutions, progressive or traditional, have been slow to adopt the agile product development methodology common at fintechs.

While progressive institutions are doing a good job at customer segmentation, they have more work to do to launch products quickly.

Read More: 10 Digital Marketing Tips for Banks & Credit Unions to Implement ASAP

One Trait In Common: Overconfidence

Only 13% of banks overall (14% of progressives and 9% of traditionals) think they are behind on technology and innovation. In reality, they are likely further behind than they realize, Kate Drew maintains, but this is more nuanced than simple denial.

Take API readiness. Traditional banks say they are more prepared to use application programming interfaces. But that could be because they define API readiness differently than progressive banks, or they just don’t think it’s a big deal.

While it’s true that many banks have been using APIs internally for years, the ability to leverage APIs with third parties to deliver best of breed services is a different animal that requires a more flexible technology infrastructure. And progressive banks are coming at API with a stronger foundation than traditional banks.

Not on the Same Page:

Three quarters of progressive banks say they have full access and control over data inside their organization compared with just half of traditional institutions.

“Progressive institutions recognize adopting a true API-first approach is a big effort,” notes Drew. “Traditional institutions may be operating with a narrower view of API readiness and may not fully absorb where the industry is headed.”

CCG Catalyst’s advice to them: Revisit what API-enabled infrastructure means for their bank.

Read More: How U.S. Institutions Can Play the Open Banking Game and Win

Hunter Versus Hunted

Do progressive banks look at traditional banks as prey? Paul Schaus, CCG Catalyst Founder and CEO thinks so. He envisions a future where progressives slowly but surely acquire more traditional institutions. “As the number of progressive institutions expands, the industry will likely march forward in the way a rising tide lifts all boats,” says Schaus.

Tides change twice a day, but Schaus predicts that the transformation to a largely progressive financial services industry won’t happen that quickly. “This march will be slow and take time,” he believes. Of course it won’t happen in a vacuum. While banking is transforming, the nonbank competition will only become more widespread.