In a way, the movement toward technology-powered personalization, is bringing banking full circle. The business once was a highly personal — loans made on a handshake, tellers who knew most everyone who came in. It was “personalized, but not scalable,” as financial marketing expert Joe Welu describes it.

That “old way” yielded a very different paradigm as retail banking providers began to mass market credit cards, mortgages, checking accounts and more. “Everything started to become just a transaction,” says Welu, CEO and Founder of marketing software company Total Expert.

Advances in digital technology now enable banks and credit unions to know their customers again — their preferences, interests, and where they are in their life journey. And the technology allows this to happen at scale.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Using Data to Shift The Focus Away From Transactions

Banking providers have long had tons of account and transaction data. What’s changing: Instead of leveraging this data to do more transactions, they are beginning to use it to develop better products and provide consumers with a better experience, according to Welu, who spoke during a webinar hosted by The Financial Brand. That’s a better recipe for long-term growth in a rapidly changing consumer banking marketplace.

It’s not only a timely shift in emphasis but a necessary one as consumers, especially Millennials, look to companies they deal with for more than basic transactions. They have come to expect a personalized experience, digitally and otherwise. “Our belief is that education-centric marketing engagement and communication — where you’re advising a customer based on the right product for them for where they are in their life — has huge impact,” Welu observes. He cites a statistic from J.D. Power to back that up: Nearly 90% of retail banking customers who are highly satisfied with the advice provided by their financial institution say they “definitely will” reuse their bank or credit union for another product.

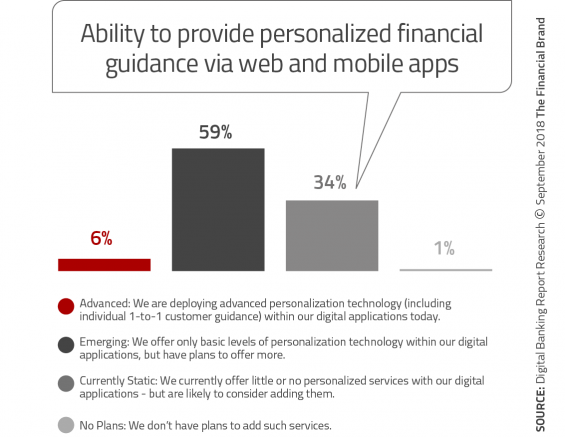

Problem is, most banks and credit unions are a long way from where they need to be in the “advice” category. Citing data from eConsultancy, Welu notes that four out five consumers still view their relationship with their financial service provider as purely transactional. And according to The Digital Banking Report only 6% of financial institutions say they are deploying advanced personalization technology.

Read More:

- 94% of Banking Firms Can’t Deliver on Personalization Promise

- The Psychology of Personalization in Banking

Moving Beyond ‘Dear Valued Customer’

“We understand Millennials are not much for coming into the bank and our selling opportunities are less frequent, so when we do have an opportunity, the offer has to be spot-on for the consumer at the right time,” observes Mike Davies, President of United Community Mortgage Services, a unit of Georgia-based United Community Banks ($13 billion in assets). “I don’t see technology replacing any portion of the human element, which we rely heavily on, but we do expect technology to really enhance our relationship with our customer.”

Davies, who spoke during the webinar, says this isn’t all rocket science. Personalization can start with little things such as moving away from the still-common “Dear Valued Customer” salutation in emails and other marketing communications.

“Not using ‘Dear Valued Customer’ might seem like a small detail,” adds Welu, “but all of a sudden you’ve just shifted the nature of the relationship from one in which the consumer thinks, ‘I’m just one of millions of nameless customers,’ to ‘Hey these guys really know me.’

Nevertheless, the marketing technology executive believes more is needed. “You can personalize an email campaign, but if you don’t look at the underlying data and what type of products you’re prescribing to the customers and why, you’re really not going deep enough.”

Shifting From The ‘Funnel’ to The ‘Flywheel’

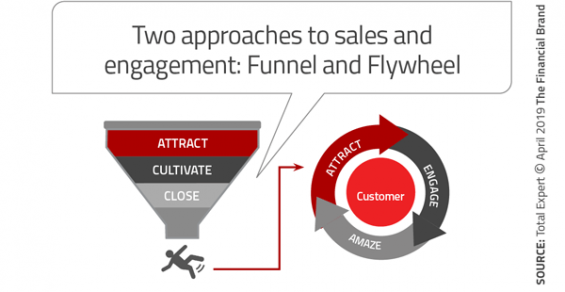

Much of the focus in banking has been “How do we get consumers in the front end,” according to Welu, and not necessarily “How do we keep them?” The “Front End” — or “Attraction” — stage is the top of the traditional sales funnel used by most financial marketers. Attraction is followed by “Cultivate” and then “Close” at the small end of the funnel. Welu believes, however, that there is a fundamental shift going on at some financial institutions to move away from the sales funnel to what he calls the “flywheel.”

The beginning of the process is the same — “How do I win the consumer?” — but then it subtly shifts to, “How do I deliver awesome experiences at every interaction so that people go out into the community as a raving fan and become brand advocates?”

“When you have happy customers like that,” Welu states, “it creates momentum.”

“The funnel is a destination,” says Davies. “The flywheel is more like a journey. Filling one need perpetuates another because we’ve been able to tailor opportunities based on peoples’ specific needs.”

Top-of-funnel brand marketing is still important, Welu adds, as are all the traditional community-minded efforts of banks and credit unions. But these need to be augmented with more personal engagement. “The new capabilities for using data enable banks and credit unions to be true to who they are,” he states.

Simple Action Steps to Get Started With Personalization

First, inventory what you’re already doing towards these goals. Then lay out the destination of where you would like to be in 6 to 12 months and start mapping small steps to get there. E.g. Evaluate 1. If you have the right tech partner in place (there will likely be multiple partners), and 2. If you have the right internal team set up.After that you can begin to tackle projects such as installing the right tech stack to effectively use internal data to communicate with the customers in the way that is personal and relevant.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Two Big Personalization Hurdles in Banking

The journey to personalization is difficult, however. In working with a range of financial institutions, Welu has seen two particular hurdles that keep bank and credit union marketers from progressing.

1. Bogging down with overly complex customer journeys. “The biggest mistake we see when financial institutions begin thinking about a customer-journey strategy is thinking that it has to be complex to make a difference,” says Welu. They end up getting into 18 month-long projects and nothing is actually deployed.

He describes how bank and credit union marketers can begin simply by putting typical customer characteristics on a whiteboard and flowing through options from the initial welcome stage in a simple “If ‘Yes,’ then this”/”If ‘No,’ then that,” approach.

For example: Children? Yes/No. A “Yes” leads to “529 Savings Plan” to “Life Insurance” to “Financial Planning,” etc. Then do the same for homeownership, auto ownership, and so on. Ultimately it gets more complex, of course, as you build out personas, but not at the start.

2. Failing to remove data silos. This is an ongoing struggle because of sheer scale in some cases and because data can get bottled up in so many places at the typical bank or credit union. You have to look at all the departments and functions, says Welu — marketing platforms, operating systems, loan origination software. For example, if a consumer starts but doesn’t finish a loan application online, that partial data now sits in a data silo unless you’ve taken steps to integrate that function. Clearly IT has to be involved to let the institution look across business lines.

Davies says that United Community Bank’s leadership recognized that “data is king” and hired a chief data officer. And while Marketing “owns” personalization, he notes, a committee oversees the process. Representatives from IT and Digital sit alongside Marketing.

“There’s no secret sauce to breaking down silos,” says Davies. “Ultimately it comes down to relentless communication between all the stakeholders.”

Read More:

- Data Analytics Performance Gap Ruins CX in Banking

- Personalization: Moving From Optional to Necessity in Banking

- CRM Adoption Takes on New Urgency at Community Institutions

Personalization Payoffs, Hard and Soft

The underlying premise of personalization is for financial institutions not to just “sell more stuff,” Welu maintains, but to be able to become trusted advisors. That is an ongoing process, but even a 5% increase in customer retention typically brings a 25-95% increase in profits, Welu states. And he cites Boston Consulting Group data indicating banking providers can expect a 10-30% lift in revenue from personalizing the customer journey.

Not all benefits can be easily quantified. Davies describes two that his bank is seeing:

“Personalization increases the probability that we’re spending our time wisely.

“More importantly it lets the customer know that we know them and that our call or message to them, or conversation with them, isn’t just a pot shot. It’s about something we thought would be relevant to them, which helps build our credibility.”