I’m coming to an uncomfortable conclusion: Marketing Analytics may be close to taking a place on the Buzzword Bingo Board.

I’m coming to an uncomfortable conclusion: Marketing Analytics may be close to taking a place on the Buzzword Bingo Board.

I’m a true believer in the role of marketing analytics in contributing to marketing success. But many of the articles that I’m seeing border on implying that simply deploying marketing analytics results in marketing success. Some definitely cross the line.

I’ve argued before that one of the problems we have with the term analytics is its definition. At a executive team meeting of a large bank, I was chatting with one of the execs who hit the nail on the head when he said: “I don’t think we’re on the same page regarding what analytics is.” Bingo. He went on to say: “We’re limiting the discussion to just advanced statistical techniques.” Jackpot.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

But, There Are Red Flags

But there are additional data points that raise some red flags.

The first comes from studies conducted by Duke University’s Fuqua School of Business. For the past few years, they’ve asked CMOs (across a range of industries, not just financial services) what percent of their marketing budget goes to marketing analytics, and what percent they forecast that percentage to be looking out three years.

Reality doesn’t ever seem to catch up to CMOs’ forecasts, according to the Duke studies.

For the past three years, CMOs have continually overestimated what percent of their budget will get allocated to analytics.

I guess if you don’t spend enough on analytics, you can’t accurately forecast how much you’ll spend on analytics.

What Is the Impact Of Marketing Analytics

Also troubling is the impact that marketing analytics has on overall marketing performance. In the latest Duke study, respondents were asked “to what degree does the use of marketing analytics contribute to your company’s performance?” On a seven point scale, the highest-scoring industry (CPG) came in with a average score of 4.5. Of 11 industries, only one industry scored lower than banking/finance/insurance with its 2.7 score. Ouch.

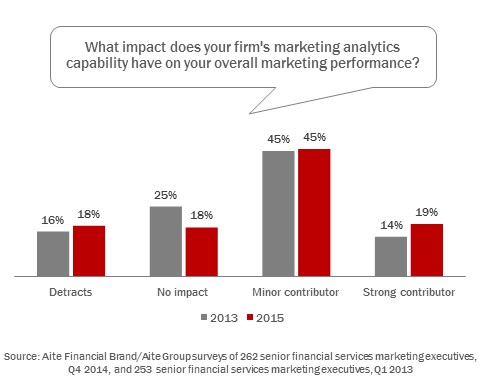

Recent Financial Brand/Aite Group Marketing Surveys don’t paint a much more optimistic picture, I’m afraid. The percentage of FIs that say their marketing analytics capability is a strong contributor to their overall marketing performance is still a small minority, at about one in five FIs. On the other hand, the change in that percentage from 2013 is up five percentage points representing a 33% increase, so maybe that’s a positive sign.

***

If marketing analytics capabilities aren’t contributing to overall marketing performance, then I guess firms’ analytics capabilities aren’t that good.

Problem is, most marketers have to guess about that as well.

According to the Duke study, 70% of all firms surveyed, and 60% of B2C companies, don’t formally evaluate the quality of their marketing analytics.

Is it me, or is there something perverse about that finding?

To summarize, marketers allocate about 6-7% of their marketing budgets to marketing analytics, which is three to six percentage points lower than what they thought they would be spending. In financial services, few banks or credit unions believe that marketing analytics is a strong contributor to overall marketing performance.

Some Insights Looking Forward

Yet analytics is held out by some as the key to growth, differentiation, and profitability, and the savior to all of marketing’s problems.

Apparently not, according to the data.

The problem isn’t with marketing analytics. It’s a medical problem. Well, sort of. The problem is a marketing condition known as Silverbulletitis: A condition in which the sufferer expects easy answers and solutions to difficult problems.

The modern business highway is strewn with the remains of buzzwords that held out promises of superior business performance. You can find a list of those buzzwords on the Bingo card at the beginning of this post. I’m fearful that there’s a spot being cleared on that board — undeservedly — for marketing analytics.

Bottom line: Keeping marketing analytics off the Bingo Board will require leadership that will come from…I’m not sure where.

IT? I don’t think so. Marketing? That’s where it should come from, but the reality is that in many banks and credit unions, there is simply no critical mass of analytics skills to create and execute a vision for marketing analytics.

I guess it will have to come from the vendors. That’s a bit worrisome, though, when many (OK, some) of them can’t get past meaningless platitudes and unverifiable claims.

At the bank exec team meeting alluded to earlier, a (large and very well known) vendor who presented at the meeting spewed an endless barrage of statistics, claiming 60% lift here, 54% increase in response rate there, not to mention 2x improvements in this and 4x improvements in that. I don’t think anyone on the bank’s exec team was buying into any of it.

Marketing analytics vendors have an opportunity to create a vision–and more importantly, a path–for how marketing analytics can be used to improve marketing results in the 13,000 financial institutions that don’t have more than $50 billion in assets.

Those 13k FIs need marketing analytics vendors to cut through the BS about how analytics is going to deliver “true 1:1 personalization blah blah blah,” and create a vision for how marketing analytics can help to better: 1) identify segments of customers; 2) identify unmet needs of a meaningful number of customers; and 3) determine how and where to invest marketing dollars.

If the only benefit you’re going to get out of marketing analytics is predicting the next best product (or action) to offer–and to customize or personalize a message and/or an offer–then you’re screwed. You won’t know why a message or offer worked or didn’t work, and it’s likely that you still won’t be delivering that message at the right time or place. I’ll also bet that you will drown in the effort to define all the possible “next best actions” that you could take.

This leads me to something that is better suited for another rant: The difference between Micro-marketing and Macro-marketing. Too much of the discussion about analytics is on micro-marketing (i.e., figuring out how to market to an individual consumer) versus macro-marketing (i.e., understanding the broader trends and developments in the market as a whole).

Marketing analytics vendors have an opportunity to create a meaningful vision and path for marketing analytics in banking. Or they can clear the slot on the bingo board.