When a bank fails, it seems the other remaining financial institutions in the community are reluctant to aggressively market themselves to the failed bank’s customers. They don’t want to seem insensitive to the hardship placed on the community, nor come across as if they were dancing on the grave of their fallen peer. The psychology is understandable, but the strategy is a huge mistake and a massive missed opportunity.

Many financial industry experts agree that 2010 is on track to see as many bank failures as there were in 2009 — around 150, or between 2-4 each week. If a bank was seized in one of your communities this upcoming Friday, how would you respond?

Get your battle plan together now — before then next bank fails — so you can be ready.

Barnes Bank failure presents Goldenwest opportunity

At 4:50 pm Friday January 15, the Barnes Bank was closed by the FDIC and Utah Department of Financial Institutions. Within hours, Goldenwest Federal Credit Union had mobilized its resources, launching a coordinated, all-out response. Goldenwest wanted to make they sure picked up more than just a fair share of new business. Among Goldenwest’s tactics:

- Staff went door-to-door, handing out flyers and informing people about the benefits of banking at Goldenwest. The credit union had 16 residential and 6 commercial groups canvassing the area. By the end of the first week, the credit union has reached some 4,000 homes and businesses.

- Handed out flyers in the local Barnes Bank parking lot.

- Kept their doors open on a traditional bank holiday — Martin Luther King Day — to accommodate Barnes Bank customers. (The bank was seized Friday, January 15. MLK Day was Monday, January 18.)

Found an office space right across the street from Barnes Bank headquarters location on Saturday, signed the lease on Monday, and opened a new temporary branch 10 hours later. By Tuesday at 9 a.m., Goldenwest was up and running.

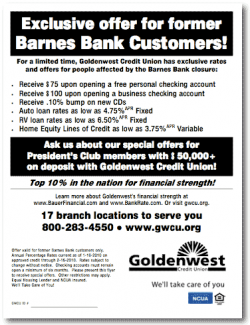

Found an office space right across the street from Barnes Bank headquarters location on Saturday, signed the lease on Monday, and opened a new temporary branch 10 hours later. By Tuesday at 9 a.m., Goldenwest was up and running.- Instituted specials for Barnes Bank customers, including $75 for all new personal checking accounts, $100 for all new business accounts, a five year in-house mortgage special rate of 4.99%, and a seven year in-house mortgage loan rate of 5.74%. Auto loans were offered at 4.75%, and home equity loans were as low as 3.75% with no closing costs. There was also a special bump rate CD.

- Goldenwest’s chief Twitter representative reached out to anyone tweeting about Barnes Bank’s failure.

- Staff posted information and status updates on their Facebook pages.

- The credit union personally called all new members from Barnes to thank them.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Ben Joe Markland, Sales & Training Manager at Goldenwest FCU, told The Financial Brand how the whole thing got started. “Essentially, our boss called us that Friday night (the day the bank announced it was closing) and asked us to come in on Saturday at 9 a.m.,” Markland explained. “By 10 a.m., we were going door to door and tweeting.”

Ben Joe Markland, Sales & Training Manager at Goldenwest FCU, told The Financial Brand how the whole thing got started. “Essentially, our boss called us that Friday night (the day the bank announced it was closing) and asked us to come in on Saturday at 9 a.m.,” Markland explained. “By 10 a.m., we were going door to door and tweeting.”

The payoff seems to be worth all the extra hours and effort. In the first four days, Goldenwest brought in over 400 accounts and $3 million in deposits.

“We have since tripled our numbers of January, and doubled for February,” Markland said.

Goldenwest is in the process of building a permanent 4,300 square-foot branch to replace the temporary location across from Barnes’ HQ. It is expected to be open by June.

Some other things you can do:

- Make sure your 100% of your staff knows what’s going on. Give them all the facts about the failed institution and equip them with talking points. Make sure they know how to answer questions about your organization’s safety and stability.

- Update your website homepage with a message that specifically addresses the situation with the failed bank. You could have something as simple as “We welcome Acme Bank customers!”

- Contact the local media. Tell them what you’re doing, and explain how you are a safe, stable financial institution. If you’re doing this many things, they’ll run a story for sure. Make sure your CEO is available for interviews.