Long gone is the “era of plenty” for marketing budgets, with volatility becoming the new status quo.

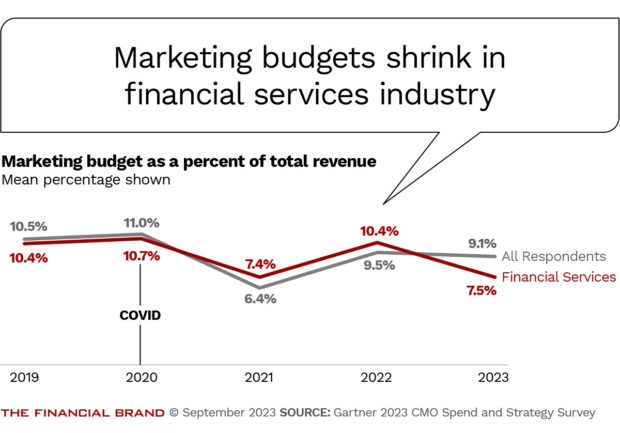

According to chief marketing officers in the financial services industry, the marketing budget as a percentage of company revenue has dipped down to pandemic-era numbers, decreasing from 10.4% in 2022 to 7.5% in 2023.

Marketing budgets in other industries held relatively steady by comparison, Gartner’s annual survey of CMOs shows.

Financial services CMOs are being forced to do more with less, to an even greater degree than their counterparts in other industries. The question then becomes, how do they tackle these pressures they are facing?

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Customer Price Sensitivity Is a Challenge for Banks — and Transparency Matters

The pressure isn’t coming just from the shrinking budget, but also from an increase in marketing costs.

The top reason for changes in investment priorities is due to an increase of input costs that support marketing campaigns and operations — in other words, the cost to engage in marketing has gone up, while marketing budgets have gone down.

The financial squeeze affecting marketing budgets means:

1. Banks are getting less marketing output for their investment.

2. Bank’s customers may also notice fallout from such a squeeze, including pricing (a real issue minimally addressed by industry leaders).

Financial services CMOs recognize they are less transparent than other industries when explaining to customers the factors that contribute to price increases, with only 20% engaging in the practice. This should be alarming, given that there has been an increase in price sensitivity.

In fact, chief executives in financial services cited greater price sensitivity as the second highest shift in customer behavior they will face through 2024, according to a separate Gartner survey.

Price-sensitive customers prefer transparency as they weigh whether to switch to a cheaper alternative. Authentic communications about the facts go a long way to gaining favor and mitigating dissatisfaction.

Financial services CMOs must lead with promotional messaging and referral program perks in marketing campaigns to tap into the cost consciousness of customers, who are facing the same financial squeeze marketers are dealing with.

The New Marketing Mix: More Social Media Ads, Less Email

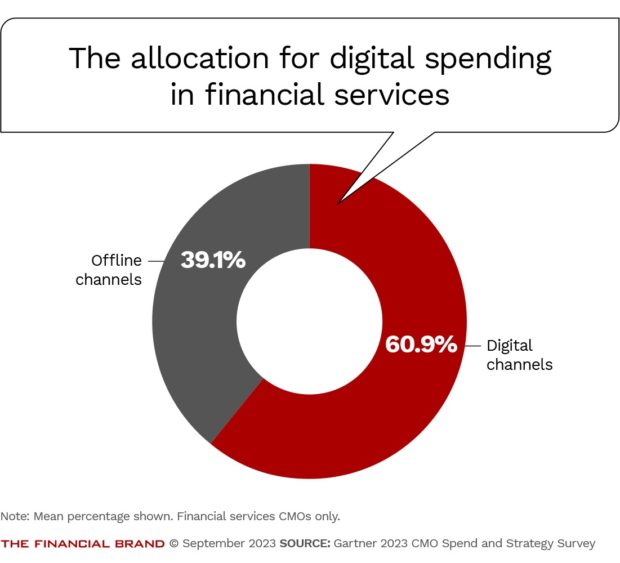

Financial services companies are heavily favoring digital channels over offline channels. The allocation of spending for 2023 has 60.9% of marketing budgets going to digital, leaving just 39.1% for offline.

Though most other industries also skew their spending in favor of digital, financial services companies have the highest digital allocation across industries, tied with travel and hospitality.

The tilt towards digital is consistent with the survey results from 2022.

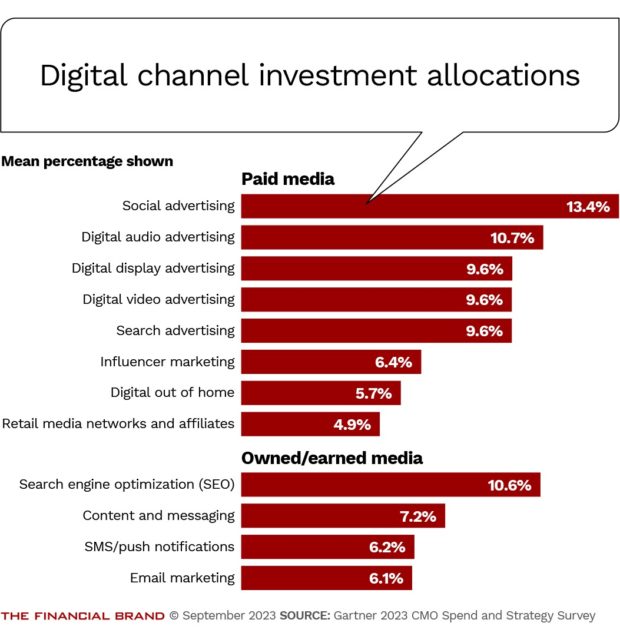

In addition, the top three offline channels in 2023 are the same as 2022 for financial services marketers: event marketing (17%), sponsorships (16.4%), and partner co-op, which is partnering with other brands to create mutually beneficial promotions through offline channels (14.6%). From conferences and other events for investment management to direct mail for credit cards, financial services marketers stick with what works.

But the spending within digital has shifted. Email had been the top digital marketing channel in 2022, accounting for 10.9% of the spending. It dropped out of that top spot in 2023, despite its versatility across uses like lead nurturing, cross-selling, and targeted outreach. It fell to a 6.1% share of the marketing budget.

In its place, a new marketing mix prioritizes social media advertising as the top paid channel and search engine optimization as the top owned/earned channel. The top three digital channels overall for financial services CMOs are social ads (13.4%), digital audio ads, which includes podcasts and audio streaming services like Spotify and Pandora (10.7%), and SEO (10.6%).

After friends and family, search engines are the most common channel consulted when researching products and services, leading marketers to hope their SEO efforts pay off. This is more of a slow burn strategy since SEO efforts today yield benefits much further down the road.

Search advertising is still among the top paid channels (tied for third at 9.6% of spending), but the competitiveness of search ads from aggregators and content publishers has marketers wary of the results.

It’s important to keep what works, especially with offline channels. Likewise, quickly change what doesn’t work in digital channels. Despite that nagging fear of missing out, marketers don’t have to invest in every channel simply because it exists, especially if they lack the requisite digital marketing capabilities. With the exception of pilots or innovation programs, CMOs should not invest money in tactics or channels that have yet to make significant progress against their marketing objectives.

Read more:

Capability Gaps Emerge as the Emphasis on Digital Increases

With a constantly evolving martech landscape, changes in privacy, and a growing list of platforms and channels, digital is forever more dynamic, necessitating a more valuable intangible skill: adaptability.

When asked to highlight the areas with the largest gaps between current capabilities relative to what’s needed, digital marketing ranked as the top choice for 14% of CMOs, behind only marketing operations excellence. It also made the top three combined choices for 30% of respondents, higher than any other capability gap.

It's Time to Prioritize Talent Development:

Financial services CMOs need to attract younger customers, which requires improving the digital prowess of the marketing team. Those who are best suited to developing digital expertise have a unique blend of both creative and analytic skills and an uncanny ability to learn new things.

A top concern for financial institutions is that their core customer segment is aging out. CMOs must shift these digital efforts to repackage products and services, improve messaging targeted at younger audiences, and ramp up social media advertising necessary to achieve relevance with this future customer. None of this is possible without the right digital marketing talent.

Digital marketing competencies go beyond expertise in a specific domain or channel. The top digital marketing experts in the financial services industry often have two things in common: an intersection of unique skills across the creative and analytic spectrum and an uncanny ability to learn something new.

Industry marketing leaders that build their in-house digital expertise are well positioned for an uncertain future, no matter the tools, technologies, or platforms it brings with it.

Read more:

- Gallery: The Best Annual Reports from Banks and Credit Unions

- Marketing Smarter on a Community Bank Budget

Improve the Perception of Marketing by Demonstrating Impact

The marketing function’s proximity to the revenue stream can vary greatly across financial services business lines, compounding challenges to quantify marketing’s impact in an industry in which products and services are often intangible.

Just over half of financial services CMOs (52%) believe that marketing is perceived as a profit center, while the remainder believe it is perceived as a cost center. By comparison, a greater proportion of CMOs across all industries (61%) say marketing is perceived as a profit center.

In a cost-cutting environment, questions about the value of contributions from marketing don’t bode well when it comes to budget conversations.

The Marketing of Marketing Needs a Boost:

The share of financial services CMOs who believe marketing is perceived as a profit center:52%

Financial services CMOs must proactively promote the value of the marketing function to change perceptions with key stakeholders. It’s important that they view marketing’s contributions as strategic and understand the benefit to the bottom line.

A necessary component to changing negative perceptions is a set of well-defined marketing goals that align with broader business goals and measurable progress against achieving them. While external benchmarks are helpful for justifying costs and serving as a point of comparison, CMO credibility with other senior leaders hinges on the ability to meaningfully quantify the contributions being made to the business.

Financial services CMOs must also spend time developing value calculations to demonstrate the importance of the marketing function. They should be able to confidently make defensible statements, such as “for every $1,000 dollars invested in marketing, the company yields 15 account sign-ups (with an average value of $200).” Most lines of business have clear growth plans — it is essential to crystallize the connection between marketing investments and those growth plans.

Overall, financial services CMOs are at a crossroads. If they can focus on their customers, prioritize channel budgets, increase emphasis on digital, improve communications around the marketing function and quantify the value it provides, they will be able to navigate these choppy budgetary waters. However, ignoring any of these categories puts the marketing budget at risk of becoming a cost-cutting target — yet again.

About the survey:

The annual Gartner CMO Spend and Strategy Survey was conducted in March and April 2023. The 410 survey respondents were CMOs and marketing leaders in North America and Northern and Western Europe across different industries. Company sizes and revenue varied, but the vast majority of respondents reported annual revenue of more than $1 billion.

The survey included 44 financial services respondents from North America and Europe. This consisted of 30 from banking, 13 from asset/wealth management and investing, and one categorized as “other.” Annual revenue for the financial services companies was split evenly, with half under $1 billion and half over $1 billion.

About the author:

Ross Cosner is a vice president and analyst in the Gartner’s marketing practice.