At a time of social unrest and economic uncertainty, financial services marketers would do well to rethink their assumptions about the consumers they serve.

Ready to inspire them is a battery of new research about American demographics — data and insights that push past the entrenched categories of Boomers, Xers and Millennials. From the wealthy middle class riding post-Covid prosperity to nose-the-grindstone remote workers willing to work all hours for financial freedom, the American marketplace is increasingly nuanced.

Here are five emerging groups to think about as you focus your strategy and tactics for 2024:

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Mini-Millionaires: The New Upper Middle Class

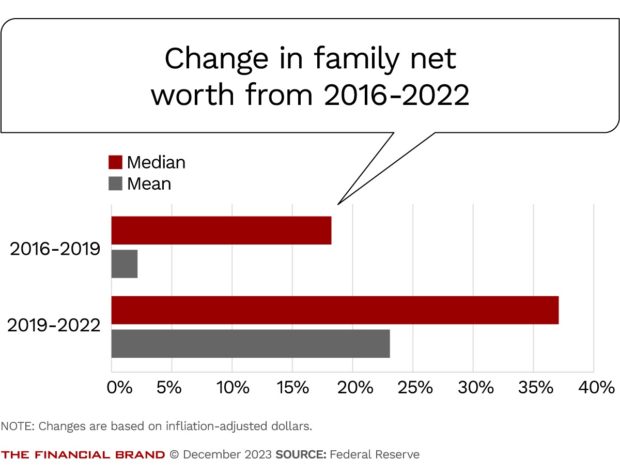

America is so prosperous that the mean household is now worth more than a million dollars, according to the Federal Reserve’s survey of consumer finances. But this group is not predominantly made up of your classic movie millionaire of limousines and private yachts. These are typically middle-class professionals who have been brought into the vaunted millionaire class thanks to recent economic circumstances.

As Covid-19 locked up restaurants and bars, families that substituted once pricey outings for board games and streaming movies generated significant excess savings that built up their bank balances. Many used that additional capital to pay down credit card debt, which further improved their cash flow.

This demographic has also benefited from soaring property values and a stock market that, while volatile, is near record highs. This group will be influential in 2024 as they seek services ranging from mortgages and home equity loans to advice on investment portfolios and college savings funds. They will need advice on how to best manage their finances given that they own highly valuable real estate but continue to earn wages more associated with middle-class professionals than with millionaires.

Learn more: How to Define the Generations

The Overemployed: When a Side Hustle is a Second Job

The growth of remote work during the pandemic gave rise to a small but identifiable demographic of people simultaneously working two full-time jobs. Digital bank Current says this group is now so prevalent that 20% of the bank’s clients who have payroll deposits have two jobs, according to chief executive Stuart Sopp.

One website openly cultivates a community of the Overemployed, with tips on how to escape detection while juggling the two jobs. For many, a strong work ethic and time saved by not commuting allows them to sustain both roles. Others work 20 to 30 hours per week on each job even if it means chronic absenteeism and subpar performance. The motivating factors for most members of the Overemployed are the quest for financial freedom, early retirement, or the ability to own a home in high-cost cities.

This group may be important in 2024 as the cost of living for professionals – particularly the debilitating cost of housing – leaves homeownership increasingly out of reach for many people, especially living on a single income. This group will need financial advice around how to meet their aggressive savings targets, how to maximize market returns, and what tax strategies can help them keep more of their double incomes.

Read more:

- The Fintech Success Story of Current

- Growth in Home Equity Lending Cools Off as Interest Rates Hit Pain Point

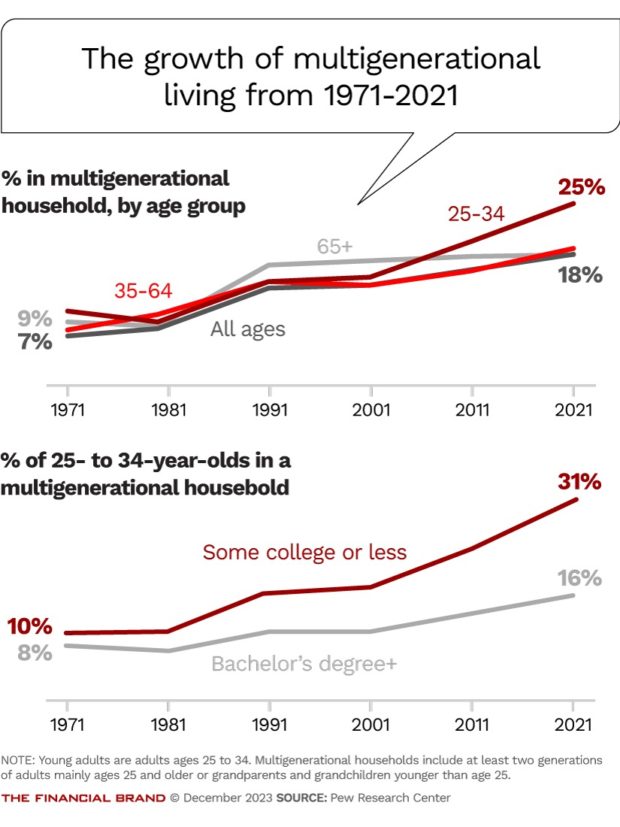

Multigenerational Households

The soaring real estate prices that helped turn many homeowners into millionaires have sent a significant percentage of young adults back to living with their parents. One-quarter of people aged 25 to 34 lived in multigenerational households in 2021, compared with just 9% in 1971, according to the Pew Research Center. Black and Latino families, who were disproportionately left out of the pandemic-fueled asset inflation that created the Mini-millionaires, are around twice as likely as White families to live in intergenerational households.

Another factor keeping families under one roof is the rising cost of senior care that creates additional incentives for young adults to live with their aging relatives. Around 16% of these young adults have college degrees, which in part reflects the growing burden of student loans. Accessory dwelling units, typically small construction near a house, are increasing in popularity and can serve as options for families seeking to have two or more generations living in the same place.

Rising housing prices and the possibility of a softening economy could make this group an important cohort to watch in 2024. The specific dynamics mean they will need a tailored set of financial advisory services. The younger generations of these households typically manage their own cash flow but have little practical experience in managing household expenses, navigating mortgages and refinancing, or understanding their household’s overall financial situation.

This cohort needs cross-generational solutions that could help alleviate young adults’ student loan burden and prepare them for health care costs to be faced by elderly relatives, as advice on drafting wills, powers of attorney and health care proxies to ensure a smooth transfer of assets from one generation to the next.

Dig deeper: How to Turn Your Website into a Personalization Treasure Trove

Affluent, But Stuck at Home

While soaring property values have given middle-class families a massive boost to their asset base, soaring interest rates have left much of that wealth trapped in their homes. Families that built up wealth through mortgages below 4% now own pricey homes with few ways to access the equity. But families now looking for more space, a better location, or better amenities would have to borrow at current rates of close to 8%.

For those families, even buying a new home for the same price could double their mortgage payment. This cohort describes middle-class homeowners working on professional salaries who can stay where they are but do not have the means to leverage their assets. This group could be an important demographic in 2024 as the economy begins to slow and families have a greater need for liquidity.

Though mortgage rates may fall in 2024, even a drop to 6% would leave financing too expensive for this group to make significant shifts. Financial institutions and fintech entrepreneurs should focus on creative solutions that would give short-term liquidity to this cohort.

Gray Divorcees: The Age of Mid-Aged Divorces

The number of people filing for divorce over the age of 50 is steadily climbing. More than one in three people who get divorced are over 50, according to one 2022 study, while the Pew Research Center found that the rate of gray divorce nearly tripled between 1990 and 2015.

This group will be important in 2024 as the uncertainty of the economy and the challenging housing market make it more difficult for married couples to split into two separate households. Given that couples over 50 are likely to have a significant portion of their net worth sunk into their homes, gray divorcees will need advice on creative financial solutions that will allow them to extract home equity or find another home amid the challenges in the housing market.