Financial industry executives agree that measuring the results and impact of their marketing programs is hazy at best. Most have no idea how much their institutions should be spending on marketing or what they get in return for what they do spend. In an industry characterized by intense competition and razor thin margins, this has to change.

Every year, The Financial Brand fields an annual survey exploring the marketing challenges facing retail banks and credit unions. Insights from the 2016 Financial Marketing Survey reveal major gaps between how senior marketers see themselves in their role and how non-marketing executives view marketing.

What Do Our Marketing Efforts Accomplish?

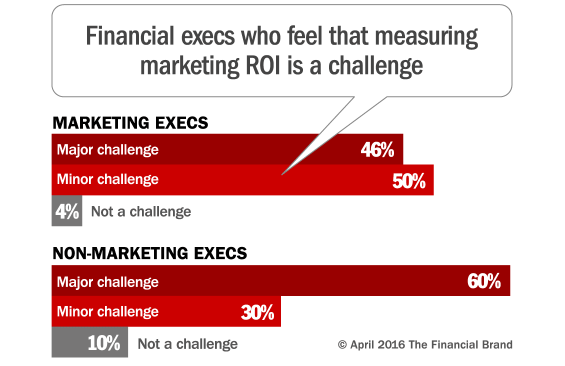

There is one thing both marketing and non-marketing executives agree on: “measuring performance and proving results” is the number one challenge they face today.

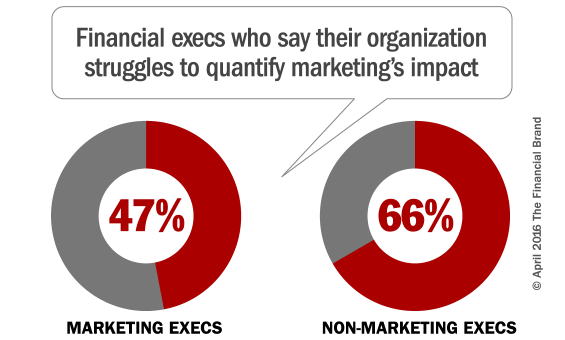

Taking a deeper look into how their organizations assess the success of marketing efforts, both marketers and non-marketers agree that they struggle to quantify the results and impact of their marketing, and they could do a better job establishing their marketing ROI. In fact, fully two thirds of non-marketing executives admitted they have difficulty quantifying the results and impact of their marketing efforts.

Despite the fact that executives question the ROI of marketing, they still believe that marketing is critical to their success. Strikingly, a full 93% of non-marketing C-Suite executives say that their C-suite believes marketing directly helps achieve their organization’s strategic goals. In other words, top executives want to invest in marketing, but no one is providing them evidence that the dollars spent are actually working.

Given the fact that executives can’t determine the effectiveness of their marketing spend, it should come as no surprise that they face big challenges when trying to define the appropriate marketing budget. Marketing leaders are less certain about how to do this than their non-marketing peers, with 47% concerned about their ability to accomplish this fundamental responsibility.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

I Smell Smoke!

The big burning question: “What’s the ROI of marketing??”

The implications of this question are clear: in an enduring low-interest rate environment, financial institutions are struggling to maintain profitability and any expense that does not have an obvious ROI is going to be scrutinized, cut or reduced. Quite frankly, a reduction in budget is the right course of action if marketing leaders can’t demonstrate their impact on top and bottom line growth.

How did we end up here? For one thing, financial marketers tend to come from the less scientific backgrounds than many of their peers who possess powerful analytical skills. To their credit, their right brain dominance helps them create the innovative programs needed to cut through the clutter and set their institutions apart. But in the Digital Age, marketers need more left brain computing power. You can’t manage a marketing plan successfully these days without being able to crunch numbers.

In all fairness, much of marketing wasn’t measurable until recently. But with all the digital marketing and media metrics available today, there’s no excuse; they should be drowning in numbers. There’s no reason to be talking about soft metrics like “clicks” and “engagement” when C-level executives are concerned with sales and revenue. What’s the correlation??

Unfortunately, the financial industry has been late to jump on the “marketing analytics bandwagon.” CEOs and CFOs read Harvard Business Review and McKinsey Quarterly articles that tell them that “all marketing activities are measurable.” “Why aren’t ours??”

CEOs and CFOs are feeling acute pressure to cut every nonessential dollar of expense, and most marketers have not been able to demonstrate that their programs are actually an investment in the bank’s future income stream.

Marketing leaders at banks and credit unions are feeling the heat, and rightfully so. Clearly they need to grab the reins and demonstrate — through data and facts — that what they are doing is achieving quantifiable results.

The Buyer’s Journey

In the old days, financial marketers bought a range of traditional media — radio, newspaper and TV (as their budgets permitted). In recent years, they have augmented these with digital display, paid search and social media advertising. The fundamental principle underpinning these media plans assumes that broad reach and a high level of frequency will ensure that prospects see the message multiple times. The problem with this approach is that the marketer is paying for a considerable amount of waste.

Today, smart marketers begin with a clear understanding of what type of customer is being targeted, and how that customer researches and buys the product in question. There have been huge leaps forward in how both consumer behavior and media consumption patterns can be tracked, analyzed and segmented. That allows financial marketers to have a pretty accurate read on what specific media are being used at each step of the “buying journey.” Utilizing tools like Scarborough and Nielsen are critical to making sure that money is being focused where it is most likely to advance consumers through the buying funnel.

Media Mix Modeling

Until recently, only companies like Bank of America and Proctor & Gamble could marshal the dollars and analytical horsepower to run mathematical models that determine exactly what medium and what ad was influencing a consumer to consider and buy their company’s product.

Media mix modeling uses complex math — multivariate statistics, regression analysis and genetic algorithms — to correlate media spend with actual sales. Companies like MarketShare, Google Analytics 360 and Visual IQ pioneered this type of analytical methodology over the past decade. And that’s why some of their services run upwards of $250,000 per year.

Fortunately for smaller organizations, similar methodologies are available today for a fraction of that cost. If a financial institution can provide at least three years of media plans and sales results, there are many different third-party service providers that can help them determine what drives sales and what doesn’t. Typically, an institution could invest around 2% of their overall budget into this type of ROI analysis and wind up saving 10-20% through reduced waste and more precise targeting.

The Great Branding Misunderstanding

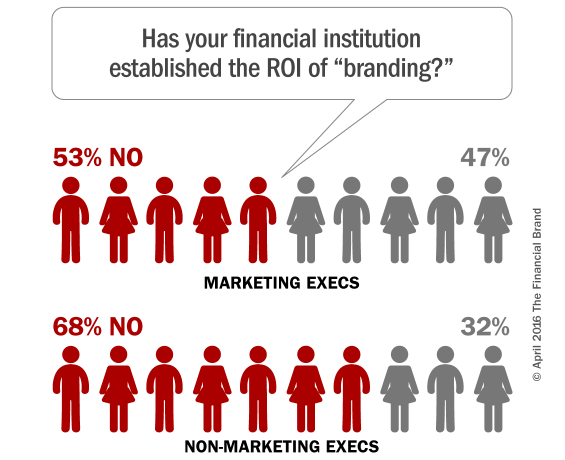

Branding appears to be an enigma among both marketers and their non-marketing peers. The vast majority (93%) of institutions say they have formal branding initiatives underway, and about one quarter of all their marketing resources are being allocated to brand-building activities. And yet, the objectives, measurement and ROI of these activities are all in question. According to the study, 53% of marketing leaders and an astonishing 68% of non-marketing executives say they have not been able to clearly establish the ROI of their branding initiatives. Worse, only 22% of non-marketing execs believe that their branding initiatives have yielded positive results.

Branding has long been a “black sheep” in financial marketing. CMOs deeply believe that their company will be forced to compete on price if they lack a strong, differentiated and well-articulated brand. Other C-level execs — often believing that a “brand” is little more than a logo or tagline… or worse, wasteful and fluffy ad campaigns — prefer to deflect the conversation toward product sales. They intuitively see a connection between product marketing and ROI; they do not, however, understand how an investment in branding translates into anything concrete or tangible on the balance sheet.

Branding is certainly critical if a financial institution hopes to grow market share and rise above the me-too din of rate-based, fee-sensitive offers. But this isn’t achieved by running hollow “brand spots” that feature warm cuddly children and puppies… just like many other brands do today.

No, what is needed is a clear understanding of what exactly sets your organization apart from others. Who specifically are you trying to attract? What is important to them? What unique value proposition do you have for them? Only after answering these essential questions are you ready to launch a truly effective “brand campaign” that can drive results. If you watch market leaders in other industries, their “brand” campaigns often feature differentiated products. This brings up an important lesson: branding and product don’t have to be mutually exclusive. Strong, well-defined brands know who they are, who they serve and what they stand for. This makes it much more easy to innovate new products and solutions that resonate with your target market and differentiate your brand in fresh ways.

Another critical lesson here is that brand building is never accomplished only through advertising. In fact, there are compelling case studies from companies like Zappos that suggest that exceptional client experience and social word of mouth can be at least as effective in getting your name out there. Have you ever seen an ad for Zappos? And yet you probably have a good idea of what their brand is about.

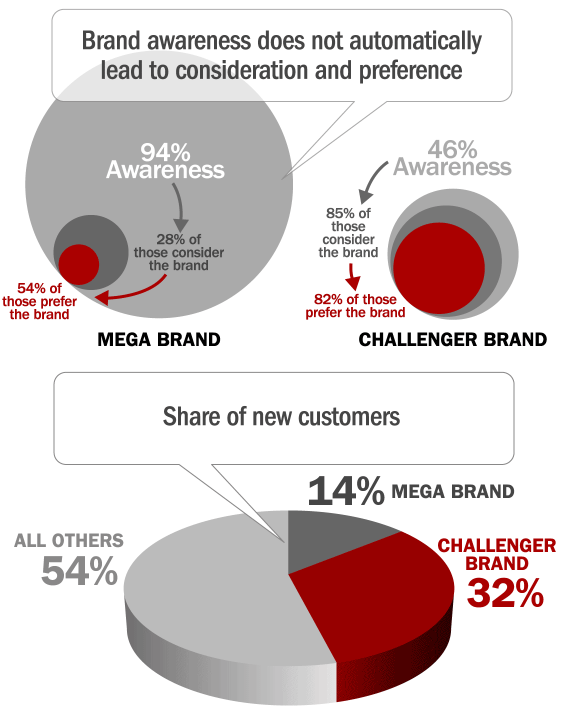

No matter how you decide to build your brand, it should boil down to simple math — the kind of equation that any CFO would love. You need to increase unaided awareness of your brand so that when a prospect decides to change banking providers, they think of you (or at least places you in the consideration set). But, it’s not enough for them to just think of you — they need to think good things about you. That’s called “creating brand preference.” Increasing awareness — then managing and increasing conversions through the consideration and preference stages — drives increased sales.

What’s more, while large organizations often have an advantage with brand awareness, they often struggle creating brand preference. In the chart below, 94% of the public is aware of Mega Brand, but only 14% would prefer to do business with it. Contrast that with the smaller Challenger Brand, whose awareness is only half as much, but because it is well liked and respected, the challenger does a much more effective job converting awareness into preference. Even though the Challenger Brand is much smaller, their share of switchers is more than double that of Mega.

This is how the math of branding works. And calculating what one percentage point of growth in commercial loan or retail deposit market share is worth helps you size how much time and money your organization should be spending on building a strong positive brand image.