When we talk to consumers who use banks and credit unions, one of the top desires that we hear is that their primary financial institution should charge “fair fees.”

This expectation comes from about 80% of people who bank with community banks, large multi-location banks and credit unions. In fact, when all of these people are considering defecting to another institution, fees are often one of the triggers.

So, when people seem ready to walk, must banks and credit unions immediately drop fees or increase interest rates to prevent defection?

Actually there is more to the story than just the actual fees or interest rates.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

How Important are Fair Fees Compared to Other Expectations?

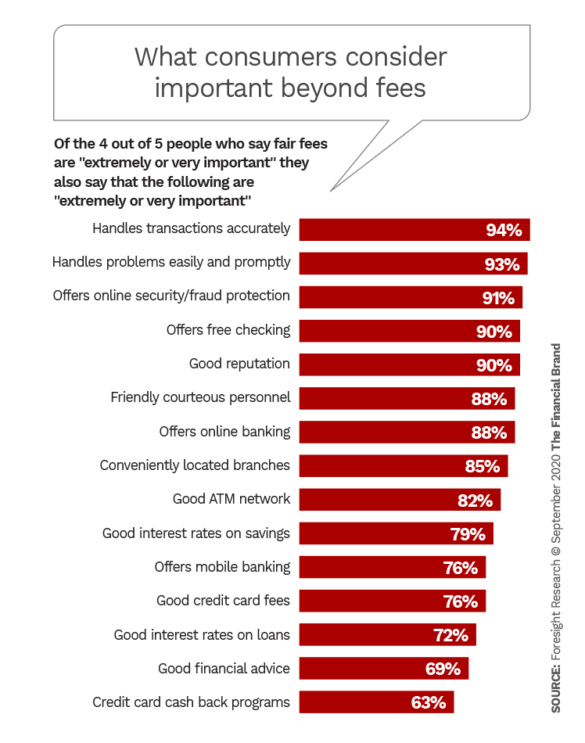

“Fair fees” is a difficult perception to manage because it is vague. We recently interviewed nearly 11,000 bank customers and credit union members — and four out of five said that fair fees were “extremely or very important.” Then we drilled down on those respondents and asked what else they considered extremely or very important.

We found that even among those customers who say fees are extremely/very important, other fundamentals of banking top the list. Handling transactions, handling problems, having friendly and courteous personnel, and online security/fraud protection all contribute to a good banking experience.

Once again, the banking experience trumps other needs and wants. Of course, free checking is also near the top of the list. So those are the items that banks and credit unions should be touting — even among those customers who are highly focused on “fair fees.”

Does it make sense to lower rates or offer incentives (like credit card cash back programs)? Perhaps, but in the overall scheme of things these items aren’t as high on the expectation list as other factors. About seven out of ten bank customers and credit union members who say fair fees are extremely or very important also say that these fee related products are extremely or very important. By contrast, nine out of ten customers more often expect good solid bank policies and an excellent banking experience.

Read More:

- What to Cut, What to Keep as Bank Marketing Budgets Get Squeezed

- 12 Success Strategies for the Future of Financial Marketing

- 5 Trends Shaping the Post Pandemic Future of Financial Marketing

- Financial Marketers Moving Mobile Ads to the Front Burner

How Marketing Can Focus on Fair Fees

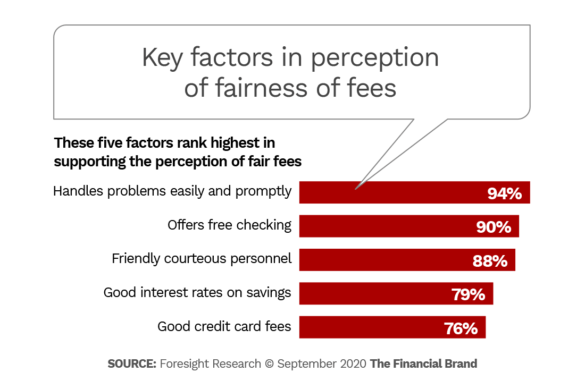

We took the analysis down another path as well. We reasoned that while fair fees are not as important as many other attributes, if you wanted to improve the perception of fees at your financial institution then what messages should you send out?

First, let’s focus on the actual scope of the challenge. How many customers and members are actually grumbling about fair fees? It is a small number, only about 4%, but with another 26% in the “neutral” zone. So, overall, just short of a third of the customers and members are not really satisfied with fees, so attacking this problem probably makes sense. To improve satisfaction or attract new customers, we must know what messages resonate with the market.

Regardless of whether we want to reduce churn or to attract new customers and members the communication needs to have the most impactful content. Simply saying we have fair fees is vague and not very compelling. Here are the specific attributes, from the main chart, that are most often associated with the perception of fair fees. Addressing these specific attributes are extremely or very important in moving the needle on the perception of fair fees.

Interestingly, and a little surprisingly, the messages fall into two basic categories.

• The first category is the elements that comprise the basic banking experience — handling problems easily and promptly and having friendly and courteous personnel. They also are at the top of the expectation list of consumers expressing concern for fair fees.

• The second category is specific fee/interest-rate related products: free checking, good interest rates on savings and good credit card fees. Why does this come up as opposed to, say, good interest on loans?

We believe the answer is obvious, when you think more deeply about it: Many more people have checking, savings and credit cards than loans with their primary financial institution.

Read More:

- 6 Ways Financial Institutions Can Keep Their Marketing Mojo

- Why Financial Institutions Should Continue Advertising, But Differently

- 4 Ways to Avoid the Rate Trap When Marketing Banking Products

- Ally Bank Pokes Rivals’ Negative Online Reviews in Fun Campaign

How to Bring Down Churn Rates Based on Fee Perceptions

About 17% of the bank customers and credit union members surveyed who are only moderately satisfied or not at all satisfied with fees say they are planning to switch to a new primary financial institution in the next year or two.

The objective is to reduce that churn. The messages that are most effective in moving these customers and members into the highly satisfied group are those shown in the second bar chart.

During the pandemic it may be somewhat more difficult to demonstrate handling problems easily and promptly. And during a period of closed lobbies and limited hours, interaction with personnel is somewhat more difficult. However, free checking, good savings rates and credit card fees are certainly items that can be communicated and remain compelling messages during these troubled time.

When we analyze satisfaction with fair fees by the type of primary financial institution, not surprisingly, we find a decided advantage for credit unions versus community banks or large multilocation banks. We also find that satisfaction with credit card fees and interest on savings is higher at credit unions. Regarding handling problems, offering free checking and friendly personnel, our research found that community banks are behind both credit unions and the large multilocation banks.

Marketing Your Institution’s Products to the Other Institution’s Churn

As mentioned earlier, 17% of the customers and members who are highly or moderately dissatisfied with fair fees, told us what they would look for in their next primary financial institution. This, of course represents an opportunity for the competition. But that advantage cuts both ways.

Not surprisingly, 13% said the most-important or second-most-important items that they would look for to select the new institution was fair fees. Among this group, 23% reported free checking and that item was at the top of the list. Next was friendly and courteous personnel (13%), interest rates on savings (13%), handling problems easily and promptly (13%), and credit card fees (6%).

Devising messages that highlight these advantages are the type that would be best to attract the churn caused by dissatisfaction with fees at their current primary financial institution. So, a message that communicates something like this: “Dissatisfied with fees? We offer free checking, good credit card and savings rates, all wrapped up in an excellent banking experience” might be effective.

Where are they planning to go to meet these needs? Overwhelmingly, our research found, they look to their current secondary financial institution.

So, if you are that secondary financial institution delve into your lists of customers or members who do not already have checking, savings or credit card accounts with you and market away.