Bank of America is shifting its ad focus from brand to products in a $40 million ad campaign for Q4. The campaign uses straightforward demonstrations to show how simple banking is at BofA, featuring flagship products like Keep the Change, Add It Up and Power Rewards. The overall take-away BofA hopes consumers come away with: “Bank of America helps me get control and spend wisely during this holiday season.”

The campaign is built on three assumptions about consumers:

- People want help getting control of their finances.

- People are saving more and want to continue doing so.

- People are looking for ways to save when they spend.

Key Question: Are people really looking for ways to “save when they spend?” Isn’t that an oxymoron?

BofA created a table outlining how they see their key campaign takeaways aligning with consumers’ needs:

BofA’s stated objectives for the campaign include:

- Demonstrate solutions that help customers spend wisely and get control of their finances.

- Increase and maintain the BofA’s “share of media voice.”

- Continue to rebuild trust and confidence among consumers.

The campaign’s product focus is a big shift away from the brand ads BofA has been running for the last few years. Perhaps the bank is feeling pressure on its bottom line and is choosing a more retail-oriented approach in lieu of what the bank refers to as the “broad value propositions and storylines” of past creative.

The campaign, which was developed by BofA’s primary ad agency BBDO NY, includes a mix of TV, online and point-of-sale merchandising. The digital experts at Organic were also called in to provide support. It is scheduled to run through January 2010.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

TV Commercials

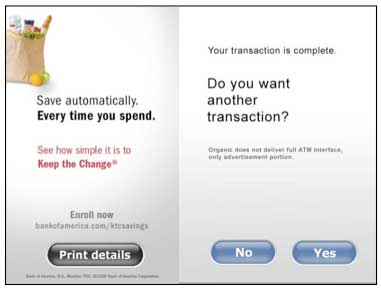

The campaign’s showpiece is a series of six 15-second TV spots:

- Chuck shows us how easy it is to earn cash back at the pump.

- Charleen shows us how easy it is to earn cash back swiping her card for holiday gifts.

- Mary Ann shows us how easy it is to pay a bill online.

- Joanna shows us how easy it is to check your balance online.

- Melissa shows us how easy mobile banking is.

- Chris shows us how easy it is to make sure his check is deposited in the ATM.

The use of 15-second spots is a bit of a departure from BofA’s previous media buys. The bank usually opts for longer spots — sometimes up to a full minute — and doesn’t often have this many spots in rotation. The decision to use 15-second spots could be a consequence of the economy, or it could simply be that BofA felt it didn’t need more than 15 seconds to communicate its “simple” message. After all, if it takes 30 seconds to explain how simple something is, how simple can it be?

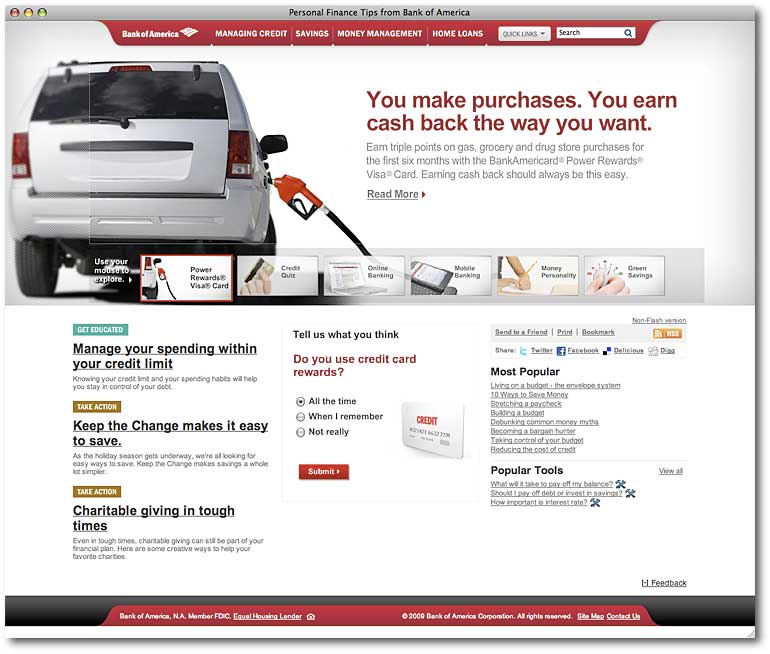

Dedicated Subsite

BofA has tagged its ads with a special URL, bankofamerica.com/solutions, that redirects to the bank’s financial education subsite.

The site has six feature sections, articles, a survey, financial tools and one-click buttons for sharing the site on popular social networks like Twitter and Facebook. It’s pretty robust, and worth a look.

Pop Quiz

The subsite has a 10-question quiz to test people’s “money personalities.” Some of the questions are a little strange, but overall the quiz is better than the kind typically produced by a financial institution trying to classify one’s “financial profile.”

Q6. When I get down, a trip to the mall and coming home with something nice for myself is a great pick-me-up:

[ ] Absolutely. Spending money on a little treat always makes me feel great, at least for a while.

[ ] Sometimes, although I might feel a little guilty about splurging.

[ ] Never. The only thing that makes me feel better when I’m down is checking the balance on my retirement fund.

There’s also a 12-question quiz on the basics of credit, with questions like:

Q1. What information can be found on your credit card statement?

[ ] Your payment due date.

[ ] Your APRs for different types of transactions.

[ ] The amount of your available credit.

[ ] All of the above.

In-Branch Merchandising