Smart, successful advertising requires more than talent. It requires discipline. You might have a very creative ad, but if doesn’t contain a clear message relevant to the target audience along with a call-to-action, it’s going to miss the mark. Or you might find yourself with a campaign that generates a lot of leads to the website, but very few convert to new accounts. Here are some solid guidelines to help ensure that you create campaigns that make the cash register ring.

1. Don’t be a follower.

Too many advertisers get caught up in what their competitors are doing, assuming their competitors are smarter and in the know. That is rarely the case. If you want to be a success, carve out your own distinctive brand. Do your homework, know your strengths, understand your target audience, and make a brand promise that is relevant and meaningful. Most important, be unique. No one became a success by following everyone else.

2. Don’t overlook your website.

Too many financial institutions focus their efforts on their ad campaigns, and ignore the fact that they have an outdated website. If your site needs an overhaul, don’t bother investing more in advertising until you fix it. In today’s world, even consumers who might choose you because they live nearby are likely to “check you out” online. If your website looks archaic, this could stop them dead on their tracks.

Make sure your website is consistent with the brand you promote in your campaigns. It should have the same tagline, fonts, colors, message and brand personality. Ideally, it will be easy to navigate, explain your brand and products succinctly, and make it easy to apply for them. And don’t forget to regularly test your online application. Many financial institutions have invested money in online ad campaigns, only to lose prospective customers due to a complicated, time-consuming or broken online account opening process. Some even have links to dead online applications.

Read More: The Key to Writing Bank Ads That Work

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

3. Don’t jump on every bandwagon that rolls by.

The advertising world is changing constantly, and there’s always some new fad. But that doesn’t mean that every new thing that comes along makes sense for you. QR Codes are a great example. For a while, they were touted as the hottest thing to hit the advertising world. But how many QR codes have you actually clicked on? They’re helpful when you actually have compelling additional information or a big payoff, but they’re not for everything. Simply slapping a QR code on your marketing materials that does nothing more that point to your general homepage is not necessary or helpful, it’s just gimmicky.

Then there is Foursquare, a popular social tool that rewards visits to an advertiser’s location. But the last thing most banks and credit unions want to encourage is more branch transactions. You are responsible for knowing understanding the tools you’re using and how they fit within the context of your organization’s goals. Choose options that can help you achieve your objectives, and forget the rest.

The QR code on this subway poster is so small, people would have to stand on the tracks to scan it. You really have be careful using QR codes in any outdoor advertising.

4. Find the benefit.

People don’t buy products – they buy the benefits they derive from them. For instance, consumers don’t buy a Volvo because of side airbags and all-wheel disc brakes. They buy Volvo because it provides them with a sense of safety. Think about what benefits you provide to your customers. Do you save them time? Do you make their life easier? Your advertising will always work harder when it contains a consumer benefit.

Read More: 10 Tips For Killer Headlines

5. Refine your understanding of the target audience.

Most banks and credit unions want to generate more accounts from 18-34 year olds. But rarely do they take the time to get to know this target, and how to relate to them. To begin with, an 18-year-old is very different from a 30-year-old. Therefore, you’ll want to consider each in terms of the products you offer and where you offer them. Let’s start with the 18-year-old. Most likely, his or her parents will choose their first checking account. Consider how to reach both parents and kids before the kids go off to college. On the other hand, a 30 year-old could very well have young kids of their own at home. Think about how and where you can reach out to newly formed families.

Key Insight: If your demographic target encompass consumers separated in age by more than 10 years, you need to keep segmenting your audience down into smaller and more refined clusters, because people’s financial needs shift in rhythm with their lifestages at least that often.

6. Clearly define your goals and expectations.

You will always have better success with advertising campaign if everyone agrees what each campaign’s goals are from the beginning. Let’s say you’re being asked to deliver a checking promotion. What is your ultimate goal? Are you simply trying to increase the number of relationships? Or do you have average balance expectations? Or do you need to grow deposits overall by a certain amount? The CEO and fellow execs in the C-suite always want to know: What are we trying to accomplish by when and how much will this cost?

Your primary objective can have a huge impact on the texture and composition of your campaign. If the overall goal is simply to generate deposits, you don’t care about the number of accounts you open. You could target a narrower, upscale audience with a product offering a higher rate or generous offer in a unique, targeted promotion. But if you’re after sheer volume of new accounts, then you’ll want to use mass media to advertise a product with wider appeal.

Read More: Crafting Killer Creative Strategies

7. Be consistent.

Some advertisers feel they have to change their tagline, or their colors, or their look-and-feel every year. Some even think they need to “mix it up” with each new campaign they run — “That’s how we keep it fresh.” But when you do this, you are simply dulling your identity’s ability to build your brand. If you know what your brand stands for, you shouldn’t have any problems picking the right voice for your copy, the right colors and fonts, the right imagery. And once those decisions have been made, there isn’t any reason that you shouldn’t stick with that for years.

Now that doesn’t mean you have to keep repeating the same layout over and over. Don’t be dull and repetitive; the point of consistency isn’t to squelch creativity. Being consistent simply means that consumers should be able to recognize your brand from one ad to the next ad.

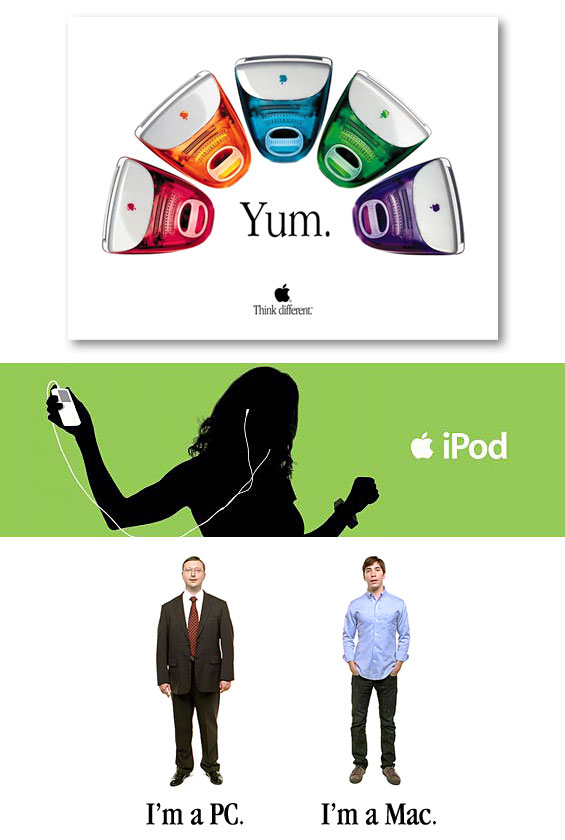

Think about Apple’s advertising. It’s always clean, simple, smart, clever and attractive — which is what their brand and their products is all about. You can spot an Apple commercial from a mile away. While Apple’s products have evolved significantly over the last 35 years, the brand and its personality has remained consistent. Just think how much harder your ads could work if you did the same.

8. Have the courage to stand out.

In research, consumers often say that there is very little difference in banks. Imagine how successful you could be if you were different.

Just because you’re a financial institution doesn’t mean your advertising has to be dull and uninspired. People like to use their small budget as an excuse. But the truth is that a limited budget is precisely what drives innovative advertising. It is your creativity that will make your budget go farther, not the other way around.

A unique, entertaining ad will be more memorable than a typical, conservative ad, and you won’t have to run it as many times for the same effect. One financial institution ran a radio campaign for a community bank with a young guy loudly ranting about his lack of money — hardly your typical bank ad, but it had new customers coming into the bank just because they liked the advertising.

In the end, smart, effective advertising requires more than a creative idea. The idea first has to be grounded in consumer insights and a relevant message. From that, a brand personality (ideally a distinctive one!) is created that must be carried through to every touch point of the brand — from the website to social media to traditional advertising. When all of that happens, you’ll find that you strike a chord with your target audience… and strike it rich with your revenue goals.

Read More: Advertising Clinic: Transforming Weak Bank Ads Into Strong Performers

Julie Burmeister is the President and Creative Director of The Burmeister Group, an Atlanta advertising agency who specializes in creating successful, memorable brands for financial institutions.