Consumer irritation with fees, coupled with poor service and unmet expectations, has fueled increases in defection rates among customers of large, regional and midsize banks, according to the J.D. Power & Associates 2012 U.S. Bank Customer Switching and Acquisition Study.

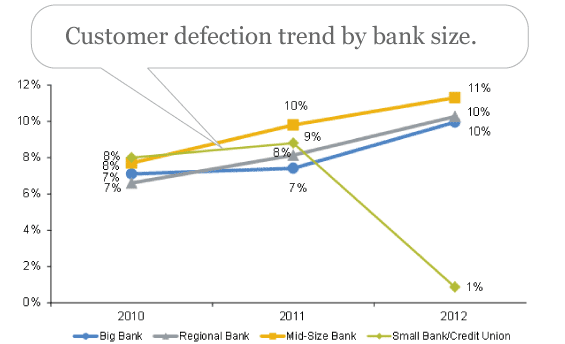

The study, now in its third year, examines the bank shopping and selection process, finds that 9.6% of customers in 2012 indicate they switched their primary banking institution during the past year to a new provider. This is up from 8.7% in 2011 and 7.7% in 2010.

Among big banks, regional banks and midsize banks, defection rates averaged between 10.0% and 11.3%, while the defection rate for small banks and credit unions averaged only 0.9%, a significant drop from the 8.8% number seen in 2011.

BofA, Wells Fargo and Citi lost an aggregated 1.5% of their customer deposits. Previously, BofA had said the rate of customer defections increased 20% during the fourth quarter of 2011.

Roughly half of the customers leaving a large bank in the past year ended up moving their money to another large bank.

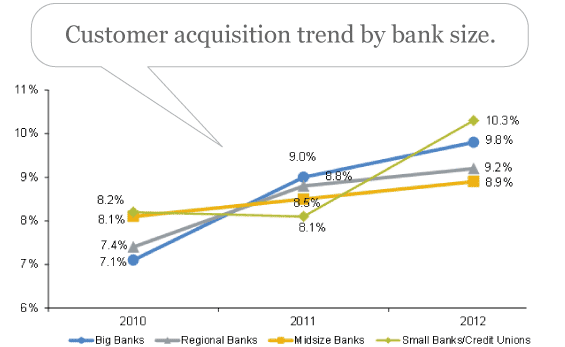

Not all big banks suffered. In fact, J.D. Power was stunned by how well several big banks were able to acquire new relationships.

“In light of the Bank Transfer Day promotion, I expected a decline in acquisition,” admits Michael Beird, Director of Banking Services at J.D. Power & Associates. “But three of the top six banks actually improved in acquisition.”

The beneficiaries of the increased exodus from larger banks are (unsurprisingly) primarily smaller banks and credit unions. Acquisition of new customers by smaller banks and credit unions increased by 2.2 percentage points to an average of 10.3%.

For its study, J.D. Powers defined big banks as the six largest financial institutions based upon total FDCI deposits — $180 billion and above. Regional banks were defined as those with $33-$180 billion in deposits. Midsize banks were defined as those with $2-$33 billion in deposits. Small community banks and credit unions were defined as all financial institutions with deposits less than $2 billion.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Fighting Attrition and Battling Defections

What can financial institutions do to combat switching? Beird says that depends on the size and type of financial institution. To fight attrition, Beird says large banks need to focus on aligning fees with value.

“If customers are getting poor service, it exacerbates the fee issue,” Beird observes. “On the other hand, if the service and products exceed customer expectations, fees become less of an issue — like Frost Bank or AmericanExpress.”

| Primary Shopping Triggers | Big Bank Customers |

Reg. Bank Customers |

Mid. Bank Customers |

Small Bank/CU |

|---|---|---|---|---|

| Fees/rates | 34% | 31% | 18% | 10% |

| Life circumstances | 16% | 22% | 28% | 38% |

| Unmet expectations | 13% | 9% | 15% | 14% |

| Better customer service | 9% | 9% | 5% | 6% |

| Advertising | 7% | 6% | 8% | 6% |

For small financial institutions, the challenge is meeting consumers’ needs with limited facilities and resources. Beird says mobile and online banking should help small banks and credit unions create alternatives to the brick-and-mortar convenience consumers expect.

“But that will come slowly,” he notes.

All financial institutions need to keep their eyes peeled for signs of unrest and potential defections.

“Problems and complaints are a critical indicator,” Beird points out. “Customers who have had at least one problem in the last twelve months — fees, service issues, transactional problems, etc. — have a higher inclination to switch banks than those who don’t. Following up with those customers is key.

When asked if the factors that drive consumer away become the same criteria they use to evaluate new banking providers, Beird says yes… and no.

“There is some alignment, but customers leave for multiple reasons and then reassess what’s most important in selection criteria,” Beird explains. “For most big banks, customers choose them for the convenience factor, i.e. branches and ATMs. For smaller banks, it’s for better service and lower fees.”

Switching From Defense to Offense

Not all financial institutions are fighting a purely defensive battle against switching and attrition. Some banks and credit unions smell opportunity, and are aggressively pursuing new relationships. But Beird warns against relying too heavily on promotions to lure new customers.

“Promotions work, but only in the short term,” Beird cautions. “Customer loyalty is thin when customers move for promotions or incentives.”

Beird thinks smaller banks and credit unions would have more success if they concentrated their marketing at consumers’ life stages — things like moving to a new city or changing jobs.

“Catching people going into life changes, rather than those who just went through them, is a way of seizing opportunities and prospects,” Beird advises.

Fees and Poor Service vs. Bank Transfer Day

For those in the banking world hoping for more clarity about the impact of Bank Transfer Day, the J.D. Power study will be of little help. The company had already initiated its research project in the field by the time BofA’s debit fee brouhaha exploded, so they were unable to gauge the role and impact of Bank Transfer Day on switching behaviors. However, fees were a key central theme in J.D. Power’s findings.

“The focus on fees as a shopping trigger would indicate there was a strong alignment to the issues that drove Bank Transfer Day,” Beird speculates. “However, if consumers were satisfied with the way their bank treats them, it was fairly clear they would not leave simply over increased pricing.”

J.D. Power’s data indicates that more than half of the people who cited fees as their reason for shopping also described their former bank as having poor service.

“In many ways, these customers were likely looking for a reason to cut the strings and would have done so eventually,” Beird adds. “Bank Transfer Day seized the moment of frustration because customers were upset over bank experiences that did not meet their expectations or satisfy their needs.