The risk of a marketing compliance blow-up has become a stark reality for many C-suite executives. It is increasingly top of mind as governing bodies tighten rules around acceptable content and claims made by companies.

Your team may produce fantastic marketing strategies and sparkling creative content, but relying solely on manual processes to enforce compliance fails to account for human error — especially when there is a revolving door for internal marketing people and agency partners.

Ensuring that automated technical processes are in place is vital for safeguarding your marketing department against walking blindly into a compliance disaster.

Compliance, always a challenge, has grown tougher yet. Ten years ago, the volume of creative content produced was smaller, agency partners were fewer, and media channels were not so overwhelming. Managing the visual basics and compliance requirements for marketing was an easier task.

As the volume and scale of marketing have evolved, so too have the associated responsibilities. This rings especially true for those in regulated financial services industries where a breach of the rules can result in hefty fines, lawsuits and reputational damage.

To ensure creative compliance, all creative content produced needs to meet certain requirements and must not only be checked for false claims but have the appropriate disclaimers included, with signoff from relevant internal stakeholders. Without automated technology, this tends to be a long list of requirements for a busy marketer to remember and an even longer list to implement manually. Dozens of federal, state and sometimes even local rules may apply.

Every marketer has felt elements of this pain, to some degree. Hard lessons have taught veterans that compliance works best when built into day-to-day operations, as opposed to an afterthought, five minutes before the deadline. After all, six words no one wants to hear at the eleventh hour — or later — is “I have to check with Legal.”

That is the scope of the challenge. Now here are six ways that technology can protect your business and, in the process, make life easier for financial services marketers:

1. To Ensure Compliance, Start With It From The Beginning

Capturing the correct information at the start of a project or campaign is vital to ensuring great creative output, as well as understanding the compliance requirements and risks that may come along with it. Get your team thinking about marketing compliance sooner than later. Ensuring that creative content complies from the beginning makes it easier to manage potential conflicts further down the track, cutting down on the inevitable back and forth later on.

Briefing systems traditionally were just a Word document with a few questions to help the creative team. They’ve evolved.

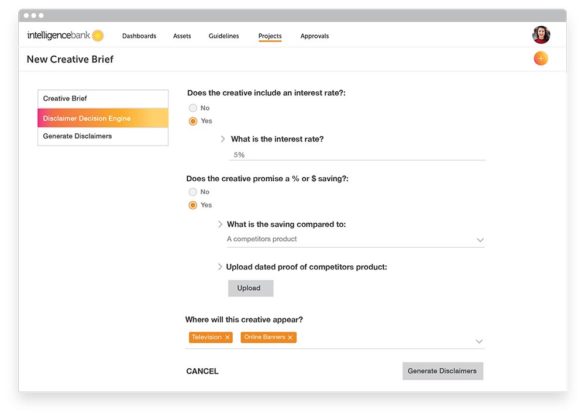

They now set the parameters for the entire creative process, including signoff from Legal and other relevant stakeholders. Using IntelligenceBank’s online briefing tool, marketers can not only create comprehensive online briefs to inform the creative process, such as unique selling propositions, support points, media mix, budgets and other information.

They can also provide smart decision engines so creative compliance can be self-assessed. In other words, before the creative materials are sent to Legal, marketers can easily follow guidelines and automate the checking of disclaimers themselves. This puts creative compliance in the hands of everyone throughout the process, instead of relying on a handful in the legal function, where bottlenecks inevitably occur.

2. Ask the Critical Upfront Question: How Risky Is This Creative?

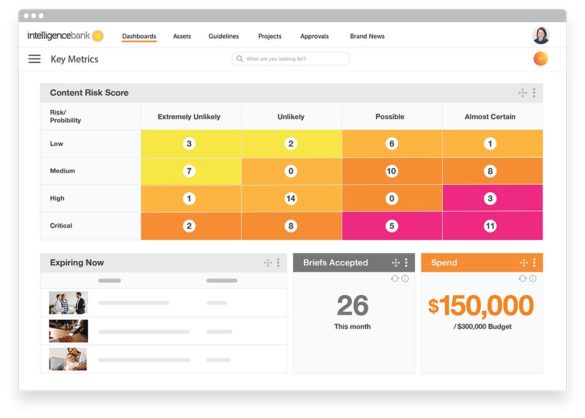

How do you know when your content needs an approval? And how high up the chain do you need to go to get it? These questions can be answered automatically by integrating key marketing risk questions into the briefing process. Doing so with our tools will generate the IntelligenceBank Content Risk Score.

To use the risk score feature, within the creative briefing forms you can set criteria which automates a content risk score, so you can prioritize who needs to see and approve it. For example, say you are marketing a new credit card and advertising price points. The marketing collateral would be flagged with a high-risk score, because even a small mistake in the terms and conditions section could lead to regulatory mayhem. By contrast, a social media post on the company’s annual fun run, on the other hand, would carry a lower risk score.

With content risk scores, teams can easily categorize content in development by its risk profile. This allows better determination of what takes priority and automatically ascertain which internal stakeholders need to approve the content.

3. Conditional Workflow Approvals Help Keep the Work Moving

The demands and pressures of today’s marketing departments mean that creative work is being produced faster and in larger volumes than ever before. The number of new media channels, level of personalization and range of content types has propelled marketers and creatives into a complex new world, making the approvals process an even more challenging and crucial task.

It’s in this supercharged environment where conditional workflow approvals can help. They enable teams to streamline the creative approval process by directing approvals to the appropriate people based on brand, product and even regulatory frameworks. For example, if it’s a new product, the media spend is over $500,000 and a price point is being advertised, the creative may have a hierarchical approval whereby the creative goes to the brand team for approval first, then legal and compliance before it is released. For other communications, approvals may be less involved and where the offer is “less risky,” it can simply be noted in the system that they have been self-assessed.

When work is scrutinized or comes under fire from a regulatory authority, creative workflows and approval tracking provide an audit trail and version history that makes it clear who approved what and when, and importantly, captures the decision-making process.

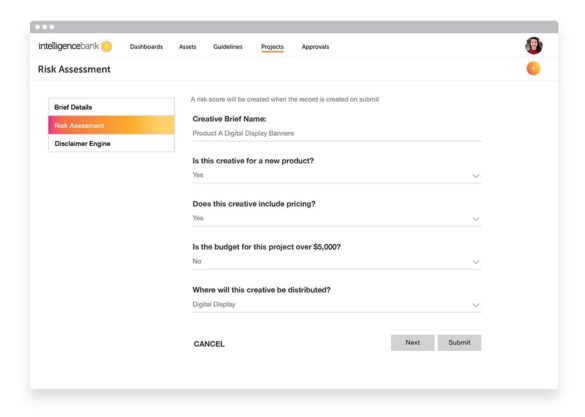

4. DIY Marketing Risk Assessment Can Also Hasten Workflow

Legal and compliance considerations can lead to time-consuming processes that are often only performed at the highest level of risk. Yet, without a process to elevate high priority jobs and filter out lower priority requests, Legal often gets loaded with all sorts of requests, creating a bottleneck of work.

The simplest way to streamline this process is for Marketing to self-assess marketing compliance issues and to categorize projects according to risk profile. Most importantly, Marketing must make it simple to find out about disclaimer requirements before the project starts. This creates a clearer picture of the marketing risk profile before it gets to the legal team for approval, speeding up the production process.

When completing a brief, savvy marketers also include a risk self-assessment, as well as an automated disclaimer engine. Configured with a brand’s risk controls and disclaimers, which are all integrated within the brief, it provides the marketing team with smart decisioning that informs the team about what to consider based on the components selected in the brief.

5. Single Source of Truth Makes a Critical Touchstone

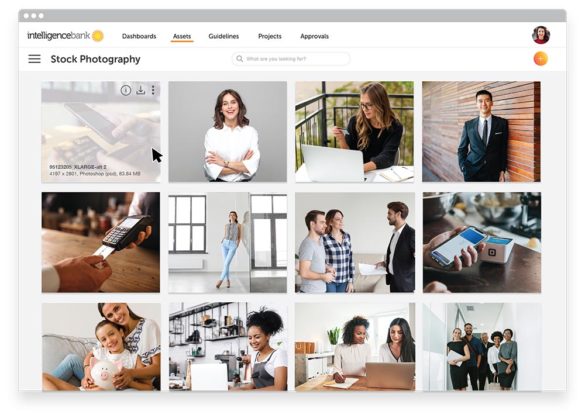

Several shared drives and multiple cloud services. Multiple agencies. No single source of truth. This is how marketing compliance nightmares begin — when there is a lack of control over brand assets and no one is 100% sure where the latest versions of approved files have been saved.

In order to avoid this, your operation needs one place where all of your approved creative content is accessible. One of the easiest ways to do this is to have it all centralized in a Digital Asset Management platform (DAM).

DAM systems are critical for creative compliance because they integrate with email marketing, web content management systems and other marketing platforms. Unlike shared drives, DAMs permit setting of granular permissions. Agencies and staff can be restricted to view only the folders and files they are working on, or when downloading sensitive material, a request can be triggered for download approval.

Without a DAM platform in place, marketing operations start to experience content control leakage. People begin using wrong, outdated or draft versions of assets —all of which can land a business on the front-page news for the wrong reasons.

6. Leverage Artificial Intelligence and Machine Learning

Artificial intelligence, conditional logic with digital forms and machine learning are all being used to speed up the compliance process. More than ever, marketers are expected to get creative work out the door immediately. At the speed with which it’s being produced, legal and compliance departments are finding themselves overrun by the number of projects needing review.

Of course, this is in complete conflict with “agile-first” marketing. By using AI to automate creative tagging, creative reviews can be made less manual, but still ensure that the quality needed to meet regulations is intact — all without compromising the speed to market.

Marketing compliance works best when it’s part of the day-to-day operations, versus being a diversion in the process. This is where marketing operations software can be used to prevent a marketing compliance breach while enabling financial brands leaders to breathe a sigh of relief knowing they have streamlined processes in place to meet their regulatory requirements.