According to a study by GfK and Personetics, only 27% of US consumers view their banks as “trusted partners.” 40% say their banks are nothing more than a necessary utility.

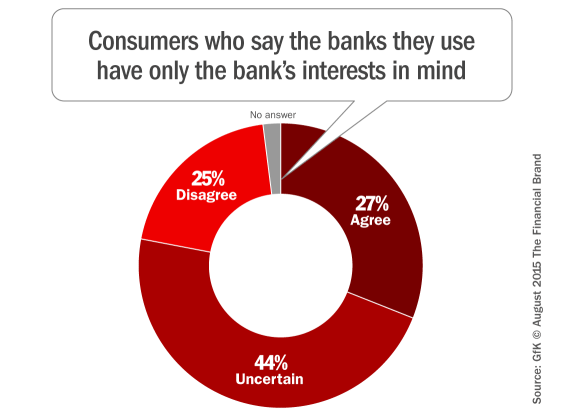

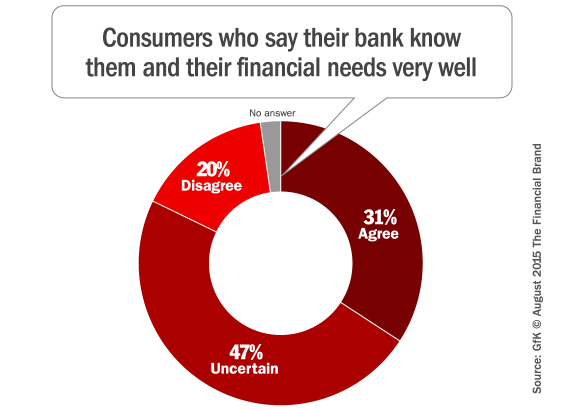

The study, which surveyed 1,000 US adults in April 2015, found that less than one-third (31%) of consumers feel their banks know them and their financial needs well. Nearly the same percentage (28%) says that their banks put their own interests ahead of their customers’ needs.

As part of the study, researchers segmented US consumers into three distinct groups based on whether the customer perceives the relationship they have with their bank as a:

- Necessary Utility – must use to manage day-to-day finances

- Useful Service – helpful but not personal to the customer or his/her situation

- Trusted Partner – offers personalized guidance and support

The research revealed that only about one in four consumers see their bank as trusted partners. The bulks of consumers in the study said they see banks merely as a necessary utility — no different than their power company, phone company or cable provider. About a third of consumers feel indifferent, viewing their banking provider as generally helpful, but not on a direct, personal level.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Things change when banks get personal. The study found that perceived value in an increasingly digital banking environment is not just about access, data and ease of use. When consumers see their banks as trusted partners that help them with their day-to-day finances, a variety of other important measures are also enhanced. In fact, when banks give consumers personal help and attention, satisfaction indicators basically double:

- Consumers likely to promote the bank’s brand more than doubles, from 35% to 74%

- The proportion of customers potentially defecting to other banks falls from 34% to 7%

- Consumers who say they feel happy when dealing with their bank nearly doubles, from 36% to 66%

- Consumers who feel gratitude towards their bank jumps from 34% to 63%

- Those who say they are pleasantly surprised when dealing with their bank increases from 20% to 39%

And when people get better service from their banks, they aren’t just happier with the bank, they are happier in general. Consumers in the study reported significant improvements in their overall emotional state. The percentage of those who say they are “looking forward to the future” jumps from 35% to 59%. Those who “feel a sense of control” goes from 52% to 73%. All those positive thoughts… thanks to a bank that treats them a little better.

The one glimmer of hope for banks in the study: only 5% of consumers said they are likely to switch banking providers in the next six months. This low number suggests consumers don’t see much difference between one institution and another — why bother switching if all banks are essentially the same, and nothing will improve if they move their business? All this consumer indifference and inertia should keep the vast majority right where they are, giving banks time to improve relationships with their existing customers.

“The way banks interact and communicate with customers is shifting rapidly, from face-to-face to digital channels, and technology is opening up new opportunities to drive trust and engagement in ways that previously were not possible,” said Personetics CEO David Sosna. “Success in this new digital banking era will be defined by a bank’s ability to deliver meaningful, trusted interactions that help customers manage their financial lives.”

“At a time when consumers have so many financial options, banks need to do more to shore up their all-important relationships with customers,” said Keith Bossey, Senior Vice President at GfK. “Our findings suggest that this trend is actually weakening engagement and loyalty, in no small measure because customers are not finding their bank helpful when it comes to improving financial well-being.”