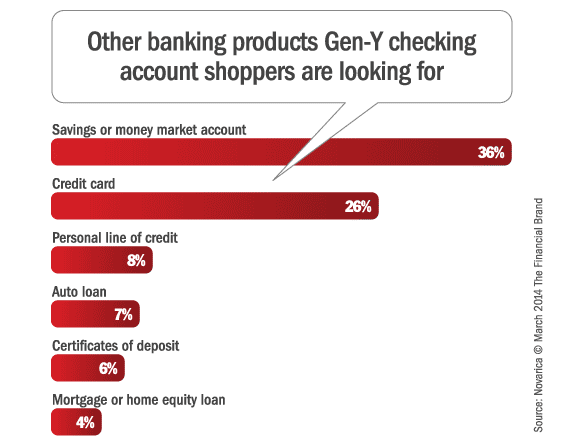

A survey of checking account shoppers on FindABetterBank found that 63% are also shopping for other banking products. 72% of shoppers under 30 are shopping for more than just a checking account – 36% also want a savings or money market account and 26% also want a credit card.

Base: Shoppers under 30 that indicated they plan

Base: Shoppers under 30 that indicated they plan

to open a new checking account within 90 days.

We do a lot of one-on-one observational research of consumers shopping for banking products. One observation we see almost without exception — especially among young consumers — is how product-centric they are while shopping online: They look for the best checking account, credit card or savings account and most don’t care if each product comes from a different institution. This is a real challenge for financial marketers because growth depends on customer (or new member) acquisition and cross-selling. Most institutions would fail if all of their customers had only one product.

Read More: Why Gen-Y Opens Accounts In Branches And Not Online

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

But based on every indicator, young consumers are the most ripe segment to cross-sell, despite their product-centric shopping behaviors. Why? Consumers under 30 are actually less likely to open an account online than older consumers, and they’re more likely than older shoppers to use two or more channels during their buying process.

How should financial institutions capitalize?

Align channel experiences. Research has revealed that younger consumers would rather open accounts in branches because they want to make sure they’re getting what they really need. When we observe Gen-Y consumers, we see how a poor online presentation eliminates many institutions from consideration. One way to align channel experiences is to train the branch sales staff to sell using website content instead of the traditional tri-fold brochure. Of course, branch staff can’t effectively use the website to sell if it isn’t working when shoppers are alone online at home.

Reward deeper relationships. Many institutions already offer rate discounts if certain loans are paid through an account transfer from a checking account. But a small percentage of young consumers are shopping for mortgages compared to the number that are shopping for checking accounts or credit cards. Data suggests young consumers are more likely than others to be interested in additional account features like debit rewards cards. Checking accounts that reward customers for deeper engagement could persuade younger consumers to consolidate more of their financial products under your roof.

Cross-sell in the branch. Given young consumers’ product-centric online behavior, it can be difficult to get them to notice cross-sell offers through an online experience. But young consumers will go into a branch to open an account and when they do, this is going to be your best opportunity to cross-sell to them.