A report from the US PIRG Education Fund analyzes consumers’ complaints and the banks were the worst offenders, breaking the data down state by state. The report, “Big Banks, Big Complaints: CFPB’s Database Gets Real Results for Consumers,” focuses specifically on the complaints consumers have about bank accounts and services.

The CFPB’s stated mission is to “identify dangerous and unfair financial practices, to educate consumers about these practices, and to regulate the financial institutions that perpetuate them.” To help accomplish these goals, the CFPB created the Consumer Complaint Database, a public repository for grievances files against financial institutions, and how those financial institutions responded.

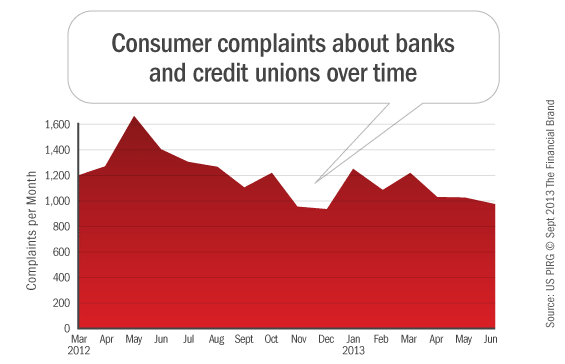

Since the database for banking was launched in March 2012, the CPFB has recorded nearly 19,000 complaints by consumers.

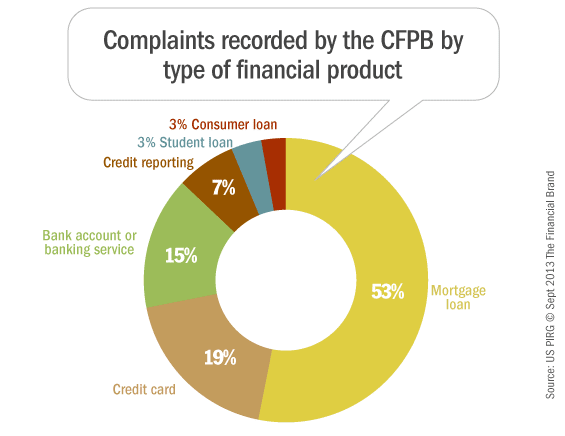

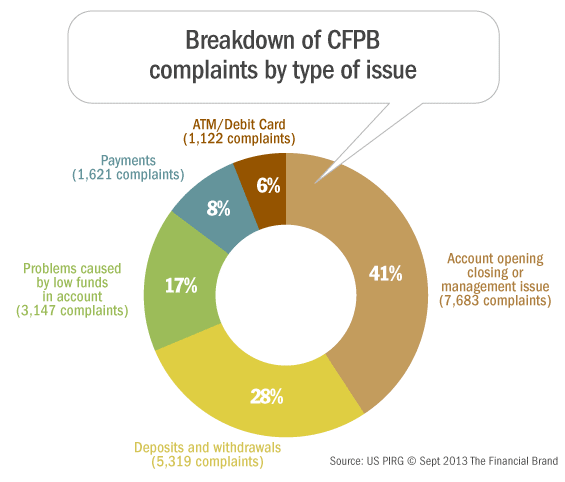

Checking accounts were by a large margin the most common cause of complaints for consumers. They were the subject of 78% of all complaints filed. Difficulties with opening, closing or managing accounts were the most frequently cited issues consumers had with banking, followed by problems with deposits and withdrawals.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Banks With the Most Complaints

Twenty-five U.S. banks account for more than 90% of all complaints to the CFPB.

The banks that generated the most complaints nationally are also the largest banks in terms of billions of dollars deposited: Wells Fargo, BofA, and JP Morgan Chase. But on a per-dollar basis, the banks that generated the most complaints are TCF National Bank, Sovereign Bank and Capital One.

Midwest-based TCF National has by far the highest ratio of complaints to total deposits among banks supervised by the CFPB, with 24.9 complaints per billion dollars in deposits. Sovereign (9.1 complaints per billion in deposits) and Capital One (6.5 complaints per billion in deposits) ranked second and third, respectively.

TCF National ranked first for complaints-to-deposits ratio for complaints related to checking and savings accounts, as well as in all five issues tracked by the CFPB.

Several banks scored poorly in multiple banking service categories. Sovereign and Capital One, for example, ranked in the top 10 for highest complaints-to-deposits ratio across all four major banking services: checking, savings, CDs and “other” services. Capital One also had big issues with account management, deposits/withdrawals, low funds, making/receiving payments, and the use of ATMs or debit cards.

Read More: Bank Staff Under Pressure: Sales Over Service?

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Top Financial Institutions by Total Number of Complaints

| Bank/Credit Union | Total Number of Complaints |

Complaints per Billions in Deposits |

|---|---|---|

| Wells Fargo | 3,453 | 4.1 |

| Bank of America | 3,135 | 3.2 |

| JPMorgan Chase | 2,032 | 2.4 |

| PNC Bank | 880 | 4.3 |

| US Bancorp | 776 | 3.5 |

| TD Bank | 772 | 4.8 |

| Capital One | 671 | 6.5 |

| RBS Citizens | 622 | 6.1 |

| Citibank | 544 | 1.4 |

| SunTrust Bank | 540 | 4.1 |

| Regions | 463 | 4.8 |

| Sovereign Bank | 442 | 9.1 |

| Fifth Third Bank | 374 | 4.3 |

| TCF National Bank | 346 | 24.9 |

| BB&T Financial | 328 | 2.5 |

| HSBC | 316 | 3.1 |

| M&T Bank | 227 | 3.6 |

| USAA Savings | 197 | 3.9 |

| KeyBank | 196 | 3.2 |

| BBVA Compass | 190 | 4.0 |

| Huntington National Bank | 172 | 3.7 |

| Ally Bank | 156 | 3.5 |

| First Niagara Bank | 122 | 4.3 |

| Comerica | 116 | 2.4 |

| Navy FCU | 108 | 2.7 |

| Union Bank | 106 | 1.7 |

| Bank of the West | 110 | 2.5 |

| GE Capital Retail | 103 | 5.7 |

| BMO Harris | 90 | 1.3 |

| New York Community Bank | 85 | 3.6 |

| FirstMerit Bank | 45 | 3.9 |

Rank of Complaints-to-Deposits Ratios by Service

| Rank | CDs | Checking Accounts | Other Financial Product/Service |

Savings Account |

|---|---|---|---|---|

| 1 | OneWest | TCF National | GE Capital | TCF National |

| 2 | Ally Bank | Sovereign | Capital One | Barclays |

| 3 | New York Community Bank | RBS Citizens | Amex | Capital One |

| 4 | Sovereign | Capital One | Susquehanna | Sovereign |

| 5 | Pentagon FCU | TD Bank | Synovus | Pentagon FCU |

| 6 | BBVA Compass | Regions | Sovereign | HSBC |

| 7 | Capital One | RBC Bank (Georgia) |

SunTrust | Banco Popular de Puerto Rico |

| 8 | Discover | Fifth Third | Navy FCU | New York Community Bank |

| 9 | KeyBank | PNC | USAA Savings | Ally |

| 10 | First Niagara | First Niagara | PNC | Navy FCU |

Rank of Complaints-to-Deposits Ratio Within Issue

| Rank | Acct. opening, closing or management |

Making or receiving payments | Deposits or withdrawals |

Problems caused from low funds in account |

Using a debit or ATM card |

|---|---|---|---|---|---|

| 1 | TCF National | TCF National | TCF National | TCF National | TCF National |

| 2 | Sovereign | GE Capital | Sovereign | RBS Citizens | Sovereign |

| 3 | Capital One | Capital One | Capital One | TD Bank | GE Capital |

| 4 | New York Community Bank | Valley National | Popular Bank | Regions | TD Bank |

| 5 | GE Capital Retail | USAA Savings | GE Capital | Sovereign | Huntington |

| 6 | First Niagara | Ally | RBS Citizens | Huntington | Capital One |

| 7 | RBS Citizens | RBS Citizens | USAA Savings | FirstMerit | USAA Savings |

| 8 | Fifth Third | Sovereign | TD Bank | PNC | Synovus |

| 9 | HSBC | SunTrust | Regions | BOK | Regions |

| 10 | Ally | Fifth Third | PNC | Capital One | RBS Citizens |

Complaints By Geographic Region

Consumers filed 2.9 complaints for every billion dollars in deposits held by large national banks chartered by the Office of Comptroller of Currency, compared to 2.3 complaints about large state-chartered banks supervised for safety and soundness by the Federal Reserve System, and 1.6 complaints about large state-chartered banks supervised for safety and soundness by the FDIC.

Based on the total number of complaints filed, Wells Fargo was the most frequently complained-about bank in 24 states. BofA was the most frequently complained-about bank in five states, and Regions was the most frequently complained-about bank in four states.

Vermont had the worst complaints-to-deposits ratio in the U.S.

Read More: Banking at Your Doorstep: Credit Union Launches Delivery Service

How Banks Are Responding

While banks respond to 95% of complaints, approximately one in every five resolutions is still disputed by the consumer.

Bank responses to complaints vary based on the issue raised by the complaint. Nearly half of all complaints related to an individual’s funds being low were resolved with monetary relief, compared with 28% of all complaints. Low funds issues include overdraft fees, non-sufficient funds fees and bounced checks.

More than one in four complaints about banking services processed by the CFPB ended with the consumer receiving some form of financial relief. The CFPB says it has helped more than 5,000 consumers receive monetary compensation as part of their resolution. The median amount of monetary relief was $110.

Roughly 1,000 consumers had their complaints resolved with some form of non-monetary relief, such as a bank contacting a credit bureau to request a change in a credit report.

An additional 5% resulted in non-monetary relief to the consumer, such as adjusting account terms.

Banks vary in the degree to which complaints are resolved with monetary relief. TCF National responded to more than half of all complaints with offers of monetary relief, compared to just 4% of responses by New Orleans-based Whitney Bank.

Consumers were less likely to dispute company responses that included monetary or non-monetary relief than other types of responses. Only one out of every nine consumers who received monetary relief disputed the company’s response, compared to one out of five of all consumers.

TCF National had the highest ratio of disputed responses to deposits, followed by Sovereign and Capital One.

Read More: Is Your Call Center Up to Par?

Could the Complaint Database Be More Useful?

To make the public database more useful to consumers, the report from US PIRG also discusses several changes that the CFPB could make, such as developing a mobile app for consumers. US PIRG also says the CFPB could make the Consumer Complaint Database more user-friendly by adding — among other data — more narrative and detailed information about consumers’ complaints, including how they were resolved, the reasons for any disputes, and how those disputes were resolved.

“The CFPB should also conduct more frequent analyses of trends and give users the tools to undertake their own analyses of the data,” the report recommends. “The CFPB should also expand public awareness of how to file complaints and access the Consumer Complaints Database by working with the prudential regulators to disseminate information about the complaints process to banking customers.”

Another recommendation is to expand the CFPB database to include discrete complaint categories for high-cost credit products such as payday and auto title loans, and prepaid cards.

You can download the entire 54-page PDF report, “Big Banks, Big Complaints: CFPB’s Database Gets Real Results for Consumers,” here at the US PIRG website (instant download, no registration required).