Statistically, data breaches are a rare occurrence in banking. Yet, personal financial data is vulnerable, and consumers are worried about the safety of their private information.

News like this make people nervous: According to a letter posted on the Montana attorney’s general website, JPMorgan Chase “may have mistakenly allowed another customer with similar personal information to see your account information on chase.com or in the Chase Mobile app.”

The breach only affected seven Montanans but it still was not a reassuring development.

On the other end of the impact scale, Capital One’s 2019 data breach compromised 140,000 Social Security numbers of credit card customers and 80,000 linked bank account numbers of secured credit card customers.

People, in general, are worried about sharing their data online. A June 2021 Deloitte study, based on a survey of more than 2,000 U.S. consumers, found 47% don’t trust online services to protect their data. Over half (57%) said “they would be willing to pay for the ability, or a service, to view and potentially delete the personal data that companies collect on them.”

Larger financial institutions are already taking such initiatives — Wells Fargo’s Control Tower has been in place for years, allowing customers to turn cards on and off (as many institutions now allow), but it also lets people see what subscriptions they’re enrolled in as well as monitor their data being shared with third parties. Data aggregator Plaid’s ‘Plaid Portal’, currently in beta, also allows people to review where their financial data is being shared and make changes.

Consumer Confusion About ‘Open Banking’

Adding to people’s concerns about sharing financial data are reports they see about “open banking.” Half of consumers have no idea what open banking is (or what it means for them), according to a survey by global API management company Axway. And even the people who do know, say they’re still worried about it.

For instance, nearly half of consumers (47%) say they don’t want to lose control of access to their financial data, another third says they’re wondering about the issues which could arise “surrounding constant monitoring of their financial activity” and 27% say they’re concerned their financial institution will use their data against them.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

It’s not all bad news. Elliott Limb, Chief Customer Officer of cloud banking platform Mambu, found in a 2021 survey that if financial institutions can address the lack of understanding around open data sharing, “it will help banks build customer loyalty and provide genuinely innovative, differentiating, revenue-generating services.”

A Winning Strategy:

As with most things, people just need to know what’s going on. If banks and credit unions can help their customers understand what open banking is, they’re more likely to embrace it.

Banks and credit unions need to start by explaining open banking and data sharing (and make sure their customers understand what it really means). If banks successfully implement and promote these systems, Mambu’s survey shows that 57% of people will be more likely to trust them.

Read More: Reputations Grow More Fragile Than Ever: What Financial Brands Can Do

The Upside For Traditional Banks

Financial data sharing is already happening in many ways, but it could soon be regulated by the Consumer Financial Protection Bureau (CFPB). The agency is expected to issue rules implementing Section 1033 of the Dodd Frank Act, which would “facilitate the portability of consumer financial transaction data so consumers can more easily switch financial institutions and use new, innovative financial products,” banks and credit unions would be required to allow people to access and easily share their own financial data.

Fintechs saw this trend on the horizon years ago and developed products and technology in advance, aided by data aggregators using several methods to make this a reality, including the controversial practice of “screen scraping.” Aggregators are now shifting to the use of API arrangements with financial institutions, aided by standards established by the Financial Data Exchange and TruSight.

When it comes to people’s personal financial data, traditional banks and credit unions certainly have a leg up on government agencies and nonbanks. A report by the Financial Stability Institute, a division of the Bank for International Settlements, says “people have far less trust in big techs.”

A survey by LendingTree also reflects the sentiment. The fintech lender found almost three out of four people (73%) say they trust their financial institutions in comparison to 51% who “feel the same about the government regarding banking and personal finance.”

These statistics yield good news for traditional financial institutions who may be concerned with their customers’ faith in them to safeguard data. But, as mentioned before, there are inevitable obstacles banks and credit unions will need to overcome. For instance, Covid-19 forced people everywhere to take a step back and BIS notes the pandemic left a quarter of respondents “less willing to share data.”

Dmitrii Barbasura, CEO and Co-Founder of fintech solution company Salt Edge, says in the Mambu report that “banks must accept that open banking is still not a fully comprehended phenomenon.”

Don’t Stop Now:

Even if consumers and small businesses are initially worried about the risks of data sharing, their viewpoint often changes if they see the value of sharing.

Regardless, people say they will be more willing to share their data once they understand what open banking means. McKinsey in its Financial Data Unbound report showed that for consumers and micro, small and medium enterprises in the U.K., “the willingness to share data doubles when customers find an appealing product or service enabled by it or understand the value it might bring them.”

These products, McKinsey’s report notes, can be something as simple as an app that tracks and improves credit scores “or a marketplace through which individuals can easily switch between different savings accounts based on interest rates.”

Benefits of Data Sharing

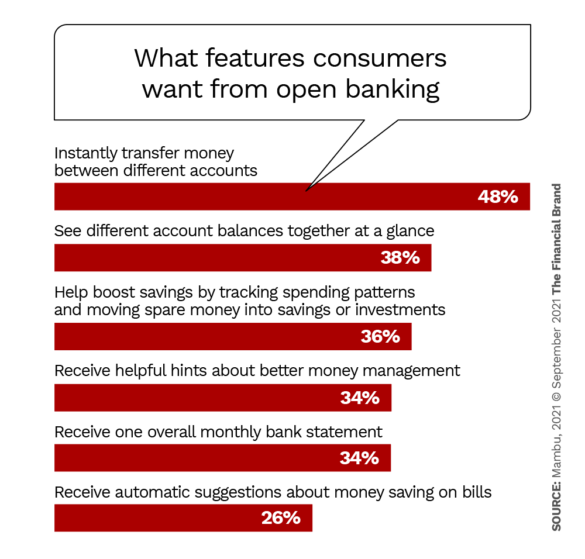

Mambu asked consumers what features they would want from open banking and almost half of the respondents (48%) say they would want digital money transfers, nearly two out of five (38%) say they’d like to see “aggregated bank balances at a glance” and another one out of three want more money management tips and tricks.

That’s just the jumping off point. At the end of the day, consumers are likely to benefit from open banking systems, according to Jim Marous, CEO of the Digital Banking Report and Co-Publisher of The Financial Brand. Therefore, setting up financial systems to be prepared for open banking includes heavy research on behalf of banks and credit unions, in addition to intense audits of an institution’s data security systems.

If the CFPB or another agency does require banks and credit unions to accept open data sharing with outside parties, there are essential ways for institutions to prep consumers for an open data ecosystem.

Looking at these systems in advance might even help reassure financial institution teams as well. Niranjan Ramaswamy, Vice President of Product Management at Fiserv, says that open banking will not alter the fundamentals of banking. It might even “extend financial data and services in ways that can solve customer problems, create compelling experiences and drive revenue growth.”

Four Steps to Prepare for an Open Data World

Ultimately, though, implementing open banking will be a lot of work for financial institutions. Here are four starting places that banks and credit unions can work into their strategy now to mitigate issues with open data sharing down the road.

1. Build With First-Party Data

Deloitte recommends investing more in first-party data, adopting a privacy-first, future-proof approach and making privacy offerings value-drive services.

Maximizing first-party data (AKA account holder profiles) in an open banking environment is imperative for any traditional financial institution. For instance, data technology company Aire asks, “when open banking cannot accurately identify and categorize transaction data, how can lenders then validate the current financial situation of their existing customers?”

It’s not enough to outsource this data from credit bureaus or social media profiles — financial institutions, according to Aire, need to “look to the validity of alternative data sources to help. The best data, we believe, rests with the consumer themselves.”

2. Use Digitally Verified IDs

As the current owners of much of the financial data out there, it is first and foremost the responsibility of traditional institutions to protect their customers’ private information. However, arguably, one of the best ways to safeguard the data is to identify the consumer.

In fact, something as simple as using a digital ID instead of relying of “antiquated username and password combination coupled with insecure SMS and email verifications,” customers and banks can work together to provide easy data sharing between the parties in a safe, private way, according to blockchain expert Alastair Johnson, writing in Forbes.

“Harnessing biometrically validated digital IDs underpinned by the immutability of the blockchain and connected to the payment source, not only removes the onus on third party businesses to keep our financial data safe but it can also remove the risk of fraudulent push payments and identity theft,” Johnson writes.

3. Double- (and Triple-) Check Fintech Partners

The beauty of open banking is customers still have to approve data sharing between their financial institution and fintechs. With that, banks and credit unions can let their customers know the safety rating of the fintech they want to incorporate into their banking strategy.

Tarun Basin, CEO of product development and consulting agency Kunai, says that “moving forward, banks should continue to scrutinize third parties’ security capabilities and monitor their protocols.” He argues that the external-facing applications — apps and websites — are a few of the most vulnerable technologies.

“A system is only as strong as its weakest link. With strict security certification processes for third parties and diligent security practices, banks and fintechs can work together to create a data-sharing ecosystem that customers trust,” Basin explains.

4. Keep Consumers In The Loop

Transparency is a big deal to people. Helping them understand what data sharing and open banking means, what the risks are and what they can do on their own to safeguard data is one of the best ways to mitigate risks.

“Approached strategically, banks can provide open banking in a way that ensures everyone, including customers, comes out on top,” Basin believes.