Plexiglass and human “traffic monitors” will go only so far to ease concerns of both consumers and employees about in-person banking while the COVID pandemic continues. Financial institutions are realizing that long-term adjustments will be required in how retail banking is conducted.

This dramatic shift has sharply increased interest in various types of conversational banking, especially as a means to ease the pressure on call centers. Most often, conversational banking takes the form of chatbots powered by artificial intelligence. But it also includes voice-activated digital assistants such as Alexa, Google Assistant and Siri, used with a variety of devices including mobile phones and smart speakers.

As consumers have had to — or chose to — use digital options to handle their banking, many have come to like the experience, when it works well. As a result, the status of digital assistants has been upgraded from “nice-to-have” to “competitive differentiator.” This has spawned new interest in “bots” among financial institutions ranging from Citizens Bank ($166 billion in assets), which launched its first chatbot during the pandemic, to Connexus Credit Union ($2.8 billion in assets), which began rolling out Alexa voice-banking capability, also during the pandemic. The availability of a variety of chatbot/voice-banking platforms has opened up the field and made deployment quicker than in the past.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Pandemic Sends Users to Erica in Droves

The poster child for conversational AI in banking right now, however, is Bank of America’s digital assistant known as Erica. The mobile app that can respond to both voice and text-based questions was growing rapidly even before the pandemic hit the U.S. in March. Ten million users had downloaded the app as of yearend 2019, about two years after its launch.

The pandemic made Erica even more attractive to stressed-out consumers. The bank added one million Erica users a month from March through May, according to Aditya Bhasin, CIO of consumer and wealth technology at BofA, in an interview with CIO. 15 million queries came to Erica in April alone as consumers sought help with their finances. As CIO noted “the uptick in queries lodged with Erica suggest that consumers are ready to seek more help from algorithms and natural language processing engines.”

Read More:

- Chatbots to the Rescue: How Conversational AI Will Save Call Centers

- How AI-Powered Sentiment Analysis Supercharges Your CX Strategy

- 16 Must-Have Mobile Banking Features that Raise the CX Bar

Voice-Banking Trails Text, But Remains a Prime Interest

The majority of Erica’s interactions are not voice-initiated. Text and “tap” are the two main ways consumers reach the bot. After Amazon launched its Alexa digital assistant — along with its Echo smart speakers — in 2014, many experts expected voice to be the predominant means of conducting conversational banking. The launch of the competing Google Assistant service only added to that expectation. And there was a flurry of interest initially. Capital One Bank was one of the first to introduce an Alexa skill, which it still uses, but its proprietary chatbot Eno, primarily text-based, has grown much more rapidly.

Various issues have hobbled AI-powered voice banking. One is the complexity of working with Amazon and Google. The process has grown simpler as the tech giants have become more familiar with the needs and requirements of banks and credit unions, but it’s still not easy.

“Getting through the Alexa and Google review process is still really quite painful,” says Rob Guilfoyle, Co-Founder and CEO of Abe.ai, a digital assistant platform provider that’s part of Envestnet Yodlee. He also says that mobile-based conversational banking is easier for bank and credit union chief information security officers to “wrap their heads around,” than voice banking using smart speakers.

Consumers themselves may have some qualms about using Alexa, Google Assistant or Siri for banking, mainly regarding privacy. But an increasing number have few qualms about using the popular “voice assistants” in their homes for entertainment and informational purposes.

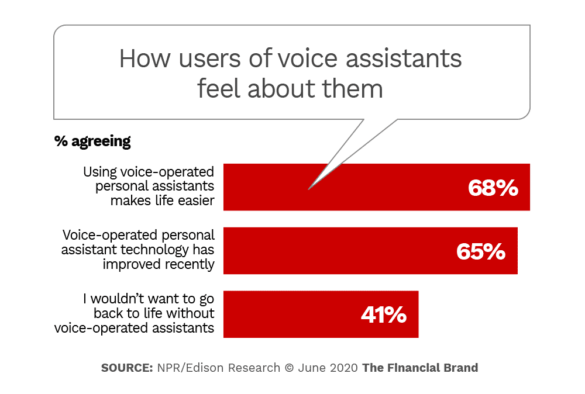

About 60 million Americans own at least one smart speaker, according to the Spring 2020 Smart Audio Report from NPR and Edison Research. That represents nearly a quarter (24%) of consumers 18 or older, up from 21% in 2019. The report found that 43% of consumers owning a smart speaker use it more often now than the first month they used it. And voice-assistant users overall find the devices and the platforms behind them are helpful.

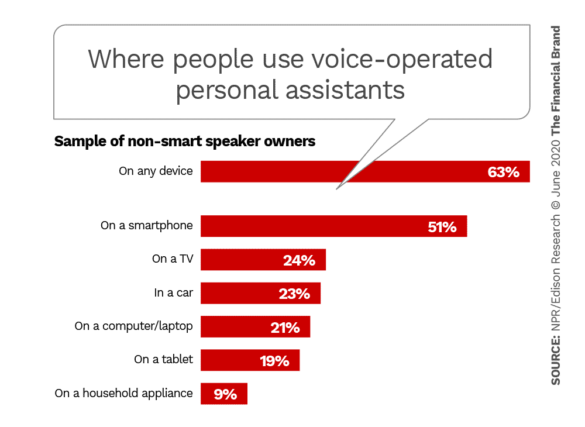

The use of Alexa and other voice assistants over a mobile phone, versus a smart speaker, is increasing, according to the NPR Edison Research. 41% of users say they use phone-based voice assistants nearly every day or several times a day (split about evenly) up from 36% the year before. Further, consumers are beginning to use voice assistants on a wide range of devices, which opens up additional possibilities for conversational banking.

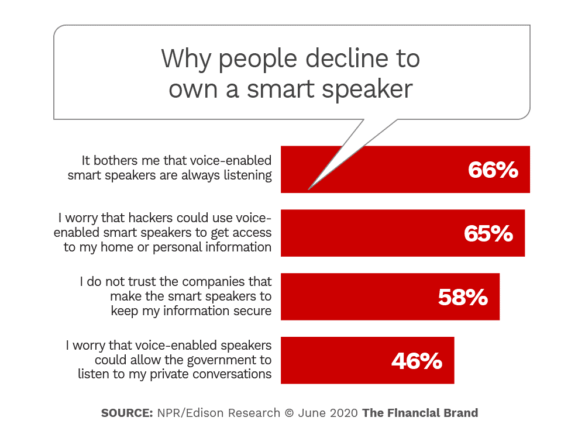

Not everyone is enamored with the whole voice assistant concept. The NPR Edison Research found there were four main concerns of consumers that do not own a smart speaker.

U.S. Bank, which offers voice banking, addresses the privacy issue head-on in a blog. “Even if you’re using an Amazon, Apple, or Google voice device, these companies don’t have access to your secure financial information,” the article states. And the assistants do not store your data. Bank customers need to set up a four-digit security code, he adds, which they speak into the device. This ensures that only they can ask the assistant for their balance.

The Case for Implementing Voice Banking Now

Despite a longer-than-expected gestation period, voice banking still looks promising to many financial institutions. Whether it begins to gain ground on text-based chatbots remains to be seen.

“The primary benefit of using voice-assistant technology to bank is convenience,” says by David Marrese, Senior Product Manager, Innovation Design for U.S. Bank. “Rather than logging into your bank account online or through a mobile app, you can simply ask a question, all without stopping what you’re doing.” It’s also a useful tool for the visually impaired, he notes.

Further down the size range, three credit unions got talking about the potential for voice banking at a trade show where they met. They agreed to work with digital banking vendor Alkami, which they all used, and Abe.ai to implement an AI voice assistant.

The Financial Brand spoke with Paul Kurth, Digital Branch Manager for one of the three, Connexus Credit Union, along with Abe.ai CEO Rob Guilfoyle. Connexus currently is offering digital assistant service by voice through Amazon’s Alexa, according to Kurth, as well as by text message. Next steps will be to add voice capability through Google Assistant (in process) and later in 2020 via Facebook Messenger.

At present the assistant can respond to balance requests and carry out money transfers and loan payments. The other two credit unions participating are Illinois-based BCU, and STCU, based in Washington state.

Why the Institution Went for Voice Banking First

Connexus has been using a staggered rollout of its voice assistant to small groups of members, and using their feedback to make improvements as they move forward. Kurth says the credit union specifically wanted to add voice capabilities first versus rolling out a chatbot capability.

Normally Abe.ai, which handles both types of service, recommends that new clients begin with “owned” channels — web, mobile, SMS — because they’re easier to implement, according to Guilfoyle. Later, “unowned” channels — Alexa, Google Assistant, Facebook — can be added.

“The most active [voice banking] user segment has been 35-44 year olds. I thought it would skew younger.”

— Paul Kurth, Connexus Credit Union

Kurth says that differentiation was the reason Connexus decided to focus first on developing the Alexa voice capability, even though it is harder to do. Many financial institutions offer digital assistant capabilities through text, he says, compared with voice, which is much less common.

Having the rollout begin in the middle of a pandemic brought complications, but also pluses, Kurth states. One challenge was to quickly incorporate responses to COVID-related questions that people had.

“The Abe.ai team was able to spin up responses quickly,” he notes, which enabled the voice capability to help reduce the load on the credit union’s call center. Another plus was that “a bunch of people were staying at home looking for an opportunity to engage with Alexa,” says Kurth.

Connexus hasn’t actively marketed the new capability beyond targeted emails and push notifications to its mobile app users. After the consumers’ initial use of the voice assistant for banking, Kurth says the outreach shifts to introducing consumers to the next best capability to try out, such as internal credit card payments.

Although it’s early in Connexus’ experience with voice banking, Kurth says he was surprised that the most active user segment has been 35-44 year olds, with the next largest being 45-54 year olds. “I thought it would skew younger,” Kurth says. Guilfoyle says across his company’s user base, voice channels attract older consumers, although he suspects that younger family members are doing the setup.

Read More: Artificial Intelligence, Algorithms, Big Data & The Future of Banking

Benefits of AI Banking Now and Going Forward

A key benefit from any type of AI-powered conversational banking is the data it gathers. At Bank of America, Erica gathers details on what requests customers make. That data is used to identify features customers want that aren’t currently offered.

It’s much the same at Connexus. Kurth says what they’ve already learned on the reporting side of voice banking has helped them from a member experience perspective. Consumer requests tend to be very straightforward through the voice channel, he states, which is not always the case when somebody is calling over the phone or sending an email. “We’ve been able to gather information from the voice channel and apply it to other channels,” he states.

Further ahead, Kurth says the credit union plans to integrate voice banking into its mobile chat capabilities within digital banking. Adding billpay capability is also coming up shortly. More broadly the institution is working with both Alkami and Yodlee to provide spending insights to digital banking customers.