No two customers are alike, and each consumer expects you to know them, understand them and reward them with a level of contextual experiences that extend from product creation to service delivery… across the entire customer journey. Effectively executed, this level of personalization will support proactive engagement at the time and in the channel where the customer benefits the most.

Organizations in every industry are making major investments to improve customer experiences. An estimated $6.8 trillion of direct investments in the digital experience is expected through the next two years, according to IDC, with 75% of organizations pursuing comprehensive digital transformation. Differentiating an organization requires customized solutions that can deliver contextual experiences.

“Good customers will abandon bad processes. Bad ones won’t,” said Darryl Knopp, senior director of portfolio marketing at FICO. “Banks need to recognize how to keep customers engaged through their banking experience. Personalized tools to proactively build consumer portfolios is vital for keeping the customer feeling seen and understood.”

States the FICO eBook, Accelerating Customer Decisions with Applied Intelligence: “It’s about ditching siloed, departmental frameworks and, instead, connecting people + processes + technology across your business with a single, collaborative approach that operationalizes these important decision assets so you can put them into action.” The power of this concept is in the value transfer that is created when empathy is shown for the customer’s desired outcome.

CFPB 1033 and Open Banking: Opportunities and Challenges

This webinar will help you understand the challenges and opportunities presented by the rule and develop strategies to capitalize on this evolving landscape.

Read More about CFPB 1033 and Open Banking: Opportunities and Challenges

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of a Decision Intelligence Platform

A decision intelligence platform allows financial institutions to understand customers and their needs across the entire customer lifecycle, deploying AI-based recommendations instantaneously for engagement that benefits both the customer and financial institution. With a centralized customer profile, that is updated in real-time and shared across the organization, banking institutions can interact with customers as a “financial concierge” for sales, service and security solution optimization.

At a time when financial institutions are challenged by legacy data and product silos, a decision intelligence platform allows organizations to deploy insights internally and externally at a speed and scale that was previously impossible. IDC predicts that by 2025, 75% of business leaders will leverage digital decisioning platforms and ecosystem capabilities to become more agile and adaptive.

The democratization of data within an organization improves collaboration between business units and allows all employees to support the customer experience. Equally important, insights can be delivered securely.

“Enterprises waste time and money on unactionable analytics and rigid applications. Digital decisioning can stop this insanity. It is the highest-value next step for firms that wish to complete the insight-to-action cycle necessary for a successful digital transformation.”

— Forrester (The Dawn of Digital Decisioning)

In making a decision intelligence platform more valuable, first-party insights can be enhanced with third-party data for highly contextual recommendations delivered across both internal and external communication channels. Imagine doing a test drive as part of buying a new car and receiving a personalized financing offer based on an instant credit score before leaving the auto dealership. Or a financial institution could provide reviews and ratings for vehicles like the one just test driven. This level of real-time engagement can increase the lifetime value of the customer by instilling trust in the use of data on the customer’s behalf.

Finally, a decision intelligence platform allows for the instant simulation of business outcomes based on “digital twins” of the existing customer database, using AI to drive hundreds or thousands of alternative scenarios and impacts. Simulation allows for the safe testing of products, pricing, processes and other ideas across the organization… without impacting daily business.

The Importance of Speed and Scale to CX Improvement

Banking organizations need to respond to marketplace changes and opportunities faster than ever. So legacy processes for rethinking business models must be adjusted. In the past, a “waterfall” project management approach was often used, with a clearly defined sequence of execution phases that required approval at each stage before proceeding. This worked well for predictable, recurring processes, but it lacked the speed required as the pace of change accelerated.

Moving to an agile approach can be challenging, especially when a financial institution has had success with more traditional project management approaches. The move to an agile approach requires instant access to the reliable data offered by a decision intelligence platform. As referenced in the FICO eBook, the combination of real-time data and an agile project framework allows organizations to “think big, start small and act quickly.”

Read More:

- The Power of Data Democratization in Banking

- Better Banking Experiences Require Real-Time Data Insights

The Foundation of Decision Intelligence Platforms

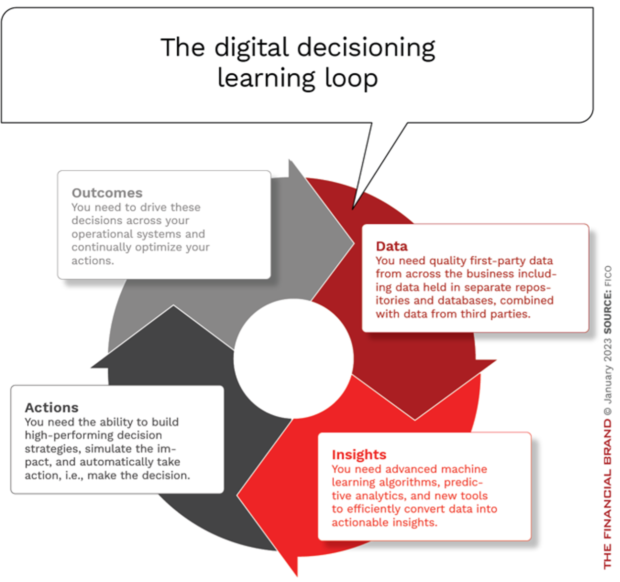

The foundation of decision intelligence platforms allows financial institutions to optimize and monetize their people, data and analytics for more intelligent decisions at the speed and scale that will make organizations more future-ready. The underlying flow includes leveraging data to create instant insights, which enables smart actions to achieve the desired outcomes.

“Digital decisioning provides the end-to-end connectivity that unifies the four stages (data>insights>actions>outcomes) with a single platform to deliver enterprise-wide visibility, scalability, and decisioning transparency,” states FICO’s eBook. Bottom line, a uniform 360-degree view of the customer is created, allowing an entire bank or credit union to support a seamless customer experience at every touchpoint across the entire customer journey.

- Data. The combination of first-party data, shared decision assets (attributes, models, segmentation, etc.), and third-party data for an accurate picture of the customer. Decision intelligence platforms streamline and simplify data aggregation and management, allowing for speed and scalability.

- Insights. Successful creation of insights requires a systems-thinking approach that works in alignment with existing systems, processes, people and even culture. The goal is to find customer patterns, models, events and recommendations that exhibit empathy towards the customer’s needs.

- Actions. Many organizations know a great deal about their customers. The challenge is deploying recommendations that create engagement and a positive customer experience. Done well, these engagements are a combination of automated and human interactions at scale.

- Outcomes. The final outcomes of the communication to the customer creates new data and insights, beginning a new high speed learning loop. This flywheel effect continually adapts and calibrates decisions in real time – improving innovation, efficiency, internal collaboration and financial results.

Leveraging data, advanced analytics, automated communication and a continuous learning loop, banking organizations can empower both internal business users and customers. By deploying smarter, faster, more contextual engagement, banks and credit unions will increase trust and generate higher lifetime value by decreasing relationship attrition.

Read More:

- Power of Digital Insights Determines Fate of Today’s Banking Providers

- How Data, AI & Machine Learning Supercharge Personalization for Banks

Getting Started to Improve Banking CX

Far too many financial institutions find excuses not to move forward as opposed to taking steps towards creating an improved learning loop and differentiated decision intelligence platform. Define what area of your business requires the most attention and determine what is needed from a data and analytics perspective to achieve your goal.

Most banks and credit unions find an area that has the potential to drive the greatest positive impact at scale and speed. Instead of years to achieve results, many organizations focus on what can be done in months. “Projects that have good alignment to your strategic vision and are fast time to value are often great candidates to start with,” states FICO.

Potential obstacles could include:

- Legacy mindsets around new technology and processes

- Compliance requirements

- Accessing “clean” data

- Lack of support for AI and automation

- Lack of internal skills and talent

The best solution to the above obstacles is to engage a third-party solution provider that can leverage case studies from across the industry to generate results. Financial institutions of almost any size can vet the experience and expertise of potential collaboration, finding a partner that meets the needs of an organization and can deliver results quickly.