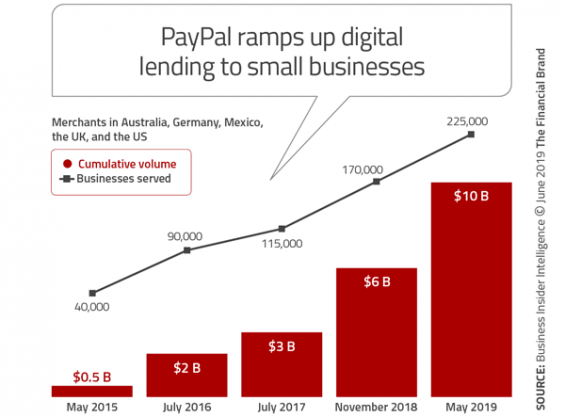

Most traditional financial institutions associate PayPal with being a significant player in the competition for consumer payments. Their growth, along with the growth of Venmo, Square and other digital payment alternatives, is well documented. What is less well known is the rapid growth of PayPal as a digital lending alternative. It may be time for banks and credit unions to wake up, however, as the company announced that they had crossed $10 billion in small business lending in only 5 years.

“It took PayPal twenty-three months to get to the first $1 billion in lending,” said Darrell Esch, Vice President of global credit at PayPal. “Demand has never been in shortage.” According to research from deBanked, it took PayPal only five years to reach the $10 billion milestone.

The loan originations were spread out across 225,000 small businesses globally according to PayPal, including the US, UK, Australia, and Germany as well as Mexico through a partnership with another online lending platform. Currently, however, PayPal is originating $1 billion per quarter … making this digital player a very formidable competitor.

Read More:

- 12-Step Digital Lending Action Plan

- Banking Providers Must Overhaul Lending for Digital Millennials

- Digital Lending Must Go Beyond Eliminating Paper

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Amazon Joins PayPal as Top 5 Small Business Digital Lender

While the growth of PayPal as a digital loan alternative is impressive, they are far from the only digital lender impacting the lucrative small business lending marketplace. Amazon has joined PayPal, OnDeck, Kabbage, and Square as a top 5 digital small business lender. In fact, Amazon revealed that it had made more than $1 billion in small business loans to US-based merchants in 2018.

In total, there are more than 1.9 million businesses, content creators, and developers in the U.S. using Amazon to deliver their products and services. According to Amazon, small and medium sized businesses now account for 58% of Amazon sales – up from 30% ten years ago.

The peer-to-peer business lender, Funding Circle, also revealed its first-quarter trading update, showing that loans under management rose by 44% compared to the first quarter of 2018, while originations grew by 23% (they have originated $9.5 billion in loans). This indicates that there is greater competition between alternative and traditional lenders, as well as increased competition within the alternative lending marketplace.

Digital Lenders Leverage Data for Improved Experiences

As with most digital banking alternatives, the top small business digital lenders use vast customer insights and competitive terms to deliver personalized offers and experiences to small businesses. Most of this is done in conjunction with small businesses still having banking relationships for holding funds and making disbursements at traditional banks and credit unions.

Alternative digital lending firms often provide small businesses more favorable terms on loans than can be received from traditional financial institutions. They also provide more financing options and faster approval than traditional banks. Alternative lenders like PayPal also approve small business loans at higher rates — 56% compared to 26% approval rates by big banks, according to data from Biz2Credit.

Because PayPal, Amazon, Square and other alternative lenders have access to transaction history of sellers on their platform – and often use that merchant’s sales data instead of a credit score – they can quickly determine the credit worthiness of a small business borrower. Comparably, banks and credit unions usually only have access to a small business’s deposits and bank accounts, unable to see the entire picture of a company’s sales.

“PayPal business financing programs can provide funding from $1,000 – $500,000 for small businesses looking for both quick decision-making and immediate usage as an application decision that usually occurs within minutes or hours, if approved, allows the business to start using the funds almost immediately,” said Esch. This availability of funds comes at a time when many traditional organizations have pulled back from offering small business credit. According to the Federal Reserve’s Small Business Credit Survey, as many as 70% of merchants didn’t receive the funding they wanted in 2018.

“If you look at the great recession what you’ve seen is a bounce back of commercial lending, but lending to small businesses really hasn’t come back,” states Esch. A lot of the hesitancy is attributed to the cost of underwriting. Banks are usually not in a position to lend small amounts of money on a frequent basis. Digital alternative lenders are built for this type of lending.

Risk of New Credit Models

In the past, many of these digital lenders were thought to be in a position of undue risk, especially if consumer confidence and/or retail sales falter. Many believe the risk of these lending operations has decreased significantly over time, however, since the models used to determine credit worthiness have improved significantly.

Instead of charging a fixed interest rate like traditional financial organizations, PayPal and Square automatically take a pre-determined percentage of each transaction without requiring additional paperwork. Collecting loan repayments as sales come through, instead of setting monthly payment dates, alleviates a burden for merchants and can make the loans less risky. Clarity of terms may be more easily understood by the merchant as well.

Small Business Data Provides Marketing Advantage

Access to transactional data also allows a provider such as PayPal, Amazon or Square to know when a small business may need funds … sometimes even before the small business knows their need. This is a competitive advantage not available to a traditional bank. Since all sales receipts go through their payment software, the digital lenders also know the rough amount of collateral available. This allows for highly personalized, real-time offers.

The benefits of these loans are reflected in the growth and profitability of the firms receiving the funds. According to PayPal, small businesses tend to use working capital loans and business loans to purchase inventory and equipment, support marketing efforts, and to manage cash flow.

These loans help small businesses grow and definitely help word-of-mouth marketing by the small business community. When digital lenders are proactively offering credit, at the right times, and traditional financial institutions aren’t, loyalty can shift.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Traditional Financial Institutions Can’t Sit on the Sidelines

As mentioned, banks and credit unions have lost an historic advantage in many traditional and new business lines to digital fintech providers. Can the industry continue to play ‘catch up’ or completely sit out as more agile digital solutions steal business and customers?

With regard to small business lending, many tech companies are partnering with banks since they don’t have licenses to take deposits on their own. That could certainly change in the future. That said, most small and mid-sized banks have a hard time competing against the largest banks and big digital lending players for small business digital lending.

While there is still a large number of trusted relationships built through the years, consumers and small businesses want financing solutions that are easy to apply for and quick to access. They want proactive recommendations based on their individual business situation and appreciate partnering with organizations that compete on price and service.

The only response available for traditional banks and credit unions is to build more digital processes from the ground up that are able to analyze requests for funds in minutes and not weeks or months. This can be achieved by either building solutions internally or by partnering with solution providers that have already created and deployed a digital lending platform.