Whether buying a new set of sheets, ordering takeout, or searching for a car loan, consumers often use their phones.

That means a bank’s mobile marketing strategy — or lack thereof — can have an outsize influence on its ability to get noticed by potential new customers who are shopping for what it offers.

This starting point in the customer journey is also where community banks can flex their marketing muscle in a way that puts them on equal footing with competitors like Bank of America, according to experts from marketing communications company Podium who spoke during a webinar hosted by The Financial Brand.

Even better it can be done as easily and cheaply as sending an automated text. Mobile searches for “bank near me” have increased by more than 60%, according to data from Podium.

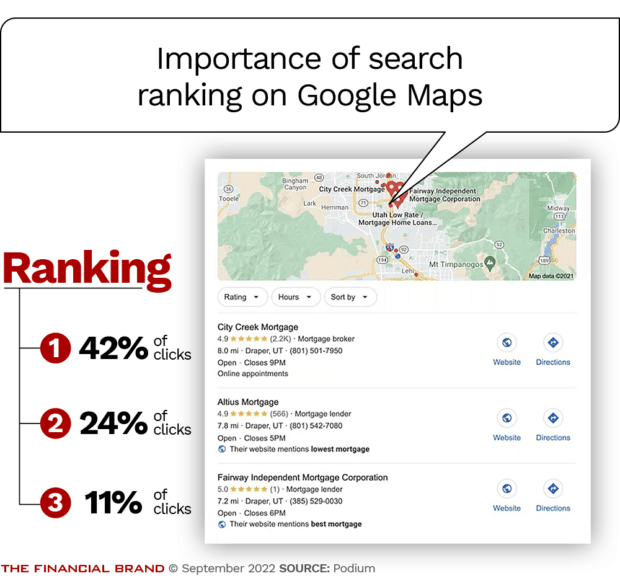

Even consumers who do a general search for “auto loans” will often find a map with recommendations on the first page. And while major players like Capital One or Bank of America may dominate top results if they have a branch in the community, local banks and credit unions have an equal opportunity to land on page one results in a mobile map display.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Getting on Google Maps

One of the most important factors in a Google Maps search is the star rating. While banks want to ensure they are in the top results, these ratings are impacted by several factors, including the number of reviews, relevancy, quality of reviews, length of reviews and how recent they are.

“Banks need to understand what impacts search rankings, and that is really focusing on reviews,” said Pat Johnson, manager of product marketing at Podium during the webinar. “Your marketing team needs to be thinking about how to grow those reviews.”

The most important thing banks can do to optimize their Google rankings is to simply start asking customers for reviews. While many consumers will take to social media to rant about a negative experience, few will take the time to leave a positive review unless the bank asks for it, said Johnson.

One of the best places to ask is via text immediately after a customer makes a purchase, opens a new account, or gets a loan, said Johnson. Be sure to include a link that makes it easy for the customer to follow through.

Key to Collecting Reviews:

Automate review requests via text messages linked directly to Google reviews.

When it comes to increasing the number of online reviews for your bank, text is one of the most powerful and underutilized tools, according to Johnson. Unlike email, which often lingers in inboxes or ends up in spam filters, 98% of text messages are opened and read, Podium’s data shows. Additionally, 76% of consumers say they will complete a review request if it is made through the right channel.

In one example, Ogden, Utah-based Tab Bank increased reviews by 12x in three months and raised its Google star rating from 2.4 to 4.7 by adopting a text-based system.

Automating the request for reviews helps bank and credit union marketers avoid missed opportunities. “It’s important to have a mechanism that streamlines that ask. Having that and the right channel is very important. You want to automate the request,” said Johnson.

Read More: 62 Digital Marketing Statistics Every Financial Marketer Should Know

Use Text Messaging to Start a Conversation

Text is a useful option for delivering the automated request. Text messaging removes the friction from collecting and giving reviews, making it easy not only for customers, but for bank staff, said Marc Hansen, senior director of Americas revenue marketing at Podium.

Sending review requests via text can also open the door for a conversation, he said. While many banks are finding success through web chat capabilities, moving those conversations to text can result in even better performance due to its higher open rate and faster response.

“Once you open up text messaging as a feed for your customers, there are a variety of things you can do through marketing,” said Hansen. Examples include: collecting Google reviews, scheduling appointments, capturing internal net-promoter-score feedback and even outbound campaigns targeting small business owners.

Though many banks and credit unions have shied away from text in the past, consumers have become more open to using that channel for communication with all types of businesses. Three-quarters of consumers say they want to receive marketing messages via text, and 95% of those texts are read within three minutes, according to data from Podium.

Go Easy on the Texting:

Be selective in choosing what message is worthy of a text. It's essential these messages are personalized, relevant and from trusted parties.

Nobody wants to receive three texts a week about specials on pepperoni pizza, but they do welcome the occasional relevant text from their bank, Hansen said. “Text messages are personal and intimate, and you want to treat it as such,” he said. “That’s not to say you don’t leverage phone or email, but you may want to consider adding text as an option to see what it does for your customer base.”

Another critical component is to ensure that the text message offers an option to communicate directly with a human. With complex products like a home or business loan, consider it essential, Johnson said. “I want to talk to a human because my question and the process is more complex,” he said. The handoff should be seamless and ideally should pass along the relevant messaging so that the customer doesn’t have to repeat the details.

Read More:

- Strong Growth in Bank Digital Marketing Comes Under a CFPB Cloud

- How Banks Can Improve Digital Marketing by Using Their Own Data

- 4 Ways Banks Can Use Google Alerts & Social Monitoring to Drive Growth

Prioritizing Customer — Not Bank — Convenience

Johnson suggested bankers think of the customer journey as a “series of conversations.” Today, most of these conversations start online — and often on mobile devices — but they may continue in a mix of other channels.

Johnson cited a survey in which 46% of the respondents reported that they actively seek out companies that provide alternatives to the phone, such as text and chat. Banks and credit unions that can seamlessly transition a conversation to any channel a customer prefers will have a competitive advantage.

Like many businesses, financial institutions tend to do what is best for themselves, not necessarily what’s most convenient for their customers, Hansen said. But to deliver great customer experiences, what matters most is the channel.

“Even if the service is great,” he said, “it could be a terrible experience for the customer if it’s inconvenient for them.”