It’s hard to deny that the pandemic era has proven to be the debit card’s big moment in the sun.

Debit card usage skyrocketed to unforeseen heights over the year and a half since the start of the Covid pandemic. Whether this is a permanent shift or merely a passing phased remains to be seen. Credit cards have been written off many times, but remain highly popular. Yet there are some clear signs that the balance has shifted, including rapid growth of mobile wallet use and person-to-person payment apps, both involving debit cards to a certain extent.

According to the 2021 Debit Issuer Study from PULSE, total debit card spending outstripped credit card spending for the first time ever in 2020. While debit card transactions went down slightly, total dollar volume was up. According to the report, based on research conducted by Oliver Wyman, this was most likely due to consumer habits during the lockdowns of the early pandemic, when people made less trips to stores but stocked up when they did go.

Key Takeaway:

A typical debit card is now used for $13,550 in annual spend by the average U.S. consumer.

Debit transactions totaled 76.1 billion, compared to 78.1 billion in 2019 — a decline of 2.5% year-over-year. At the same time, total debit spending grew by 8% year-over-year, thanks to a significant jump in ticket sizes. Average ticket size rose from $40.50 in 2019 to $44.80 in 2020, an increase of more than 10% — the largest upswing in the study’s history.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Debit spending volume could continue to run ahead of credit cards for the rest of this year as well.

“With the pandemic lingering, we could see debit spend outpace credit spend in 2021,” says Steve Sievert, Executive Vice President of Marketing and Brand Management with PULSE. “Debit has long been a top choice for consumers in terms of transaction count but not in total spend. A key factor that helped push debit spend ahead of credit in 2020 was decreased spending in merchant categories like travel due to pandemic-related restrictions.

“Consumers have traditionally reached for their credit cards when making travel related purchases,” Sievert continues. “It’s worth noting that debit has historically been a go-to in times of economic uncertainty as consumers look to avoid increasing debt.”

Read More: The Future of Payments is Fast, Seamless, Safe and Embedded

A Shift in Card Preferences

Credit cards have always been much more glamorous than their humble debit counterparts. An entire industry was founded on helping people maximize points and rewards from credit card loyalty programs. Unboxing videos of high-end, luxury credit cards would get hundreds of thousands of views on YouTube.

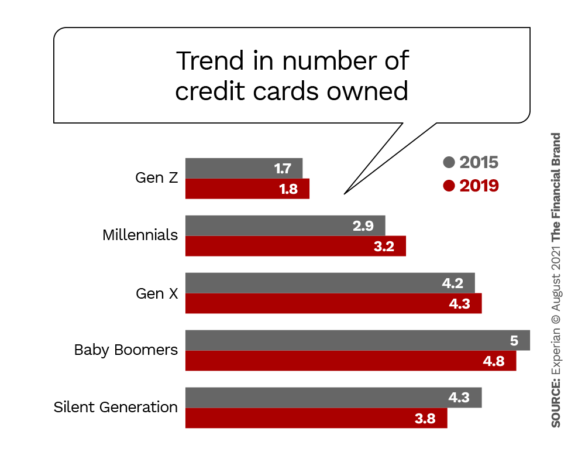

However, studies have shown that younger generations are embracing credit cards in smaller numbers than older generations. The average Millennial holds about three credit cards, while the average Gen Zer has only 1.8. This compares to 4.3 for Gen X and nearly five for Baby Boomers.

So, this could mean the rise of debit cards may have some staying power. In general, the younger generations tend to take a more dim view of debt than older ones. Gen Z, for example, has a tendency to only want to spend money they have in hand and grow savings, after seeing how many older Millennials have been crushed by debt.

Sievert notes that the study did not break down card usage by age, but that “it’s reasonable to conclude based on other research that Gen Z’s heavy use of debit contributed to its resiliency. Yet, reduced spend in travel and other merchant categories where credit cards have historically been consumers’ preferred payment method also is a major factor.”

Turning Point:

The number of debit transactions has exceeded credit card transactions for some time, but 2020 was the first year in which the value of debit spending (including prepaid) exceeded credit cards.

The report further notes that while spending on debit was up 8% in 2020 compared with the previous year, spending on credit cards in fact declined by 9%, reflecting the different spending patterns of debit versus credit.

Read More:

- Millennials and Credit Cards: Separating Fact from Myth

- Trends Signal an Ominous Future for Credit Cards

Debit Powers Digital Wallet Usage

For over a decade we have heard and read about the rise of the digital (or mobile, if you prefer) wallet and its soon-to-be ubiquitousness. While that has mostly not yet come to be, 2020 did see a marked increase in digital wallet usage, powered by debit.

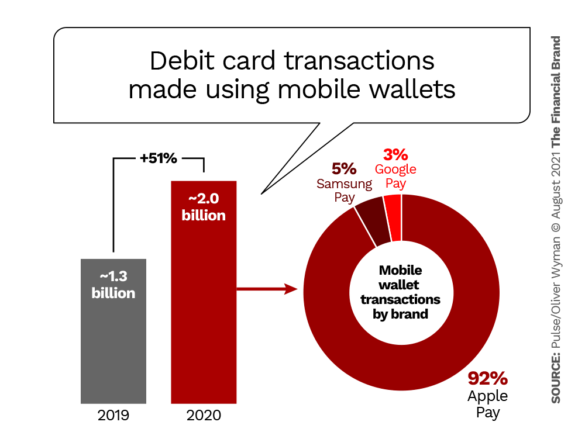

Approximately two billion digital wallet transactions were made in 2020 across the three major players in that space: Apple Pay, Google Pay and Samsung Pay, according to the report. This represented a whopping 51% increase in transactions compared with 2019. This space was overwhelmingly dominated by Apple Pay, which accounted for 92% of these transactions. The average ticket size also increased 55% year-over-year, from $15 in 2019 to $23 in 2020.

Overall, “issuers generally have a positive outlook on mobile wallets,” the report states. “Merchant acceptance of contactless in general is increasing, with 74 of the top 100 U.S. merchants now accepting Apple Pay and 65% of all U.S. retail locations supporting it. [Apple claims a U.S. merchant acceptance rate of 85% for its mobile wallet.]

“In addition to in-store avenues, in-app purchases using mobile wallets are growing rapidly, with 57% of mobile wallet transactions now being made in app,” says the PULSE report. “Cardholder enrollment in wallets is also rising, as is their familiarity with contactless payments.”

ATM Use Goes Down As Digital Overall Goes Up

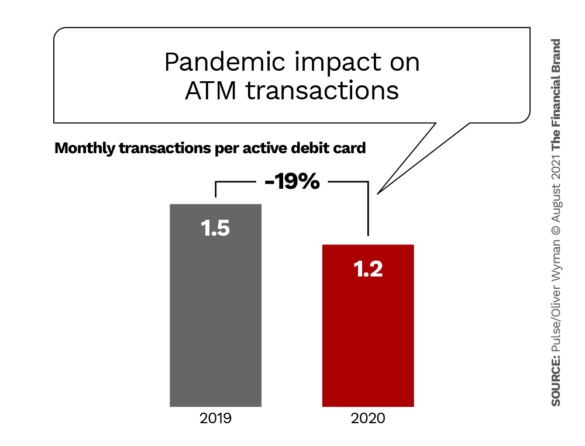

Not surprisingly during a year where people were told keep apart and wash their hands thoroughly, ATM use was down as less cash was exchanged. Active cardholders reduced their ATM activity by 19% in 2020 compared to the prior year.

Cardholders shifted a portion of their spending from in-store to online, and used grocery and restaurant delivery services more often, services that don’t usually accept cash payments, the PULSE report notes. Additionally, many traditionally cash-heavy venues, such as bars and sporting venues, were closed for long periods of time.

The report also explores digital priorities, and reports that debit card issuers are looking to ramp up digital offerings even more. Top strategic priorities cited for the next year include real-time fraud alerts, digital-first card issuance, self-serve card replacements and one-time-use cards.

Sievert believes that the increased use of digital wallets, funds-transfer apps such as Zelle, Square Cash and Venmo and other contactless and digital transactions will continue as many consumers have embraced the benefits.

“We may not see the same levels of acceleration post-pandemic, but we believe the behaviors will stick.” he predicts. “The decline in ATM use is a result of the increasing digitization of cash. This long-term transformation has gathered speed over the past 18 months.