With bank and credit union branches reopening across the country, we are entering a period where all processes need to evolve to reflect consumer demand for digital options that are fast and easy. It has become clear that, in the future, branches will be used less for routine transactions that can be handled digitally, and used more for engagements that are more complicated. With this as the “new normal,” organizations need to support multiple channel options better than they do currently.

Recent research indicates that unless a financial institution can open a new account or complete a new loan application in less than five minutes, the potential for the consumer to abandon the account opening increases to as much as 60% or more. Alternatively, faster account openings reduce abandonment rates down to 25% or less. In other words, if organizations can eliminate unnecessary steps and streamline account opening, they can double or triple the number of new relationships.

Simply enabling a consumer to open an account, apply for a loan, make a bill payment or transfer funds is not adequate. Instead, this process must be reimagined to reflect the simplicity consumers have encountered when they have ordered from Amazon, joined a Zoom call, watched a movie on Netflix, or had groceries delivered by Instacart.

Hoping consumers will return to branches to open a new account or apply for a loan is not a winning strategy. Unless processes are improved, potential new customers will be lost and costs of operations will remain elevated. This requires a customer-first, data-driven strategy that will make digital engagement the primary mission.

Read More:

- True Digital Account Opening Totally Eliminates Need for Branches

- How Bank of America and Chase Get Mobile Account Opening Right

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Digital Options Increasing, But Slowly

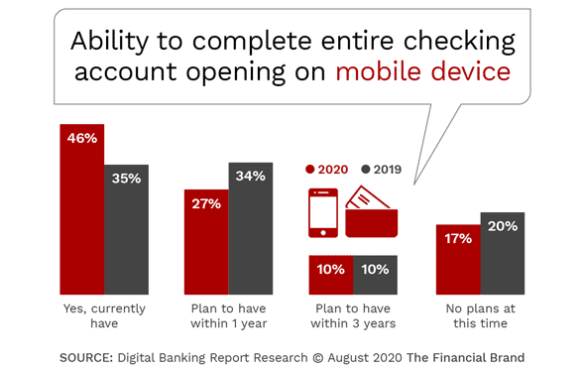

The Digital Banking Report found that the number of financial institutions that provided end-to-end checking account opening with a mobile device in August 2020 (46%) was far lower than those who could provide an online/website account opening opening (77%). This was modestly greater than the number of organizations that stated they could provide end-to-end mobile opening in 2019 (35%), but far short of what consumers desire.

While the number of organizations that provide digital account opening and loan applications has increased since last August, the simplicity of the process at most traditional financial institutions remains stuck in the past. Often, the steps the consumer needs to take are exactly the same steps that the branch employee has done in the past. When processes take an extended period of time to complete, and more digital banking alternatives become available, the potential for a consumer to abandon a process and move to a competitor increases.

Speed and Simplicity is the New Definition of ‘Convenience’

As consumers are embracing a world more available than ever on their computer or their phone, speed and simplicity is the new definition of convenience. The longer a process takes, the more likely a consumer will abandon the process and try elsewhere. In the Digital Banking Report, State of the Digital Customer Journey, it was found that abandonment rates increased significantly as the time to open an account or complete an application increased. If the process took over ten minutes for an online/website process, or five minutes for a mobile process, the abandonment rate impacted the account openings by as much as 40%.

The digital consumer expects simplicity, an intuitive design and speed of completion. Research indicates that, while the number of organizations offering digital account opening continues to increase, the ability to complete an account opening continues to be extremely slow. In fact, many consumers will notice that the digital process could actually be slower than an account opening in a branch.

Reality Check:

Most ‘digital’ account opening processes and loan applications include the same steps required if a relationship was initiated in a branch. These steps originated decades ago … and are unacceptable to a digital consumer.

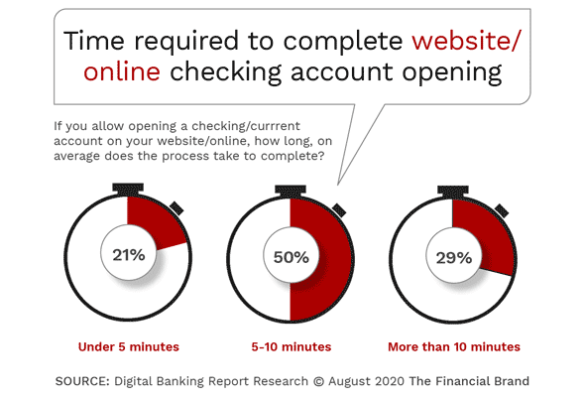

The research from the Digital Banking Report found that almost 80% of online/website account openings took longer than five minutes in 2020, with close to 30% taking longer than ten minutes. The change in time to open a new account online has changed very little since 2017, indicating that most organizations have focused on enabling digital account opening as opposed to optimizing the process for the consumer.

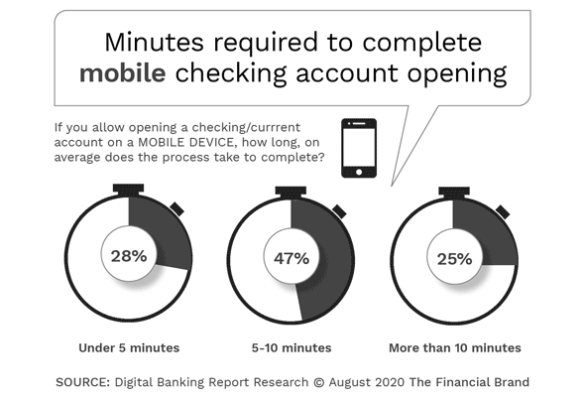

The time required to complete a new account opening using a mobile device was only slightly better than what was found for online opening, with only 28% indicating a process of less than five minutes, but 25% taking longer than ten minutes.

Most Financial Institutions Lose More Potential Business Than They Generate

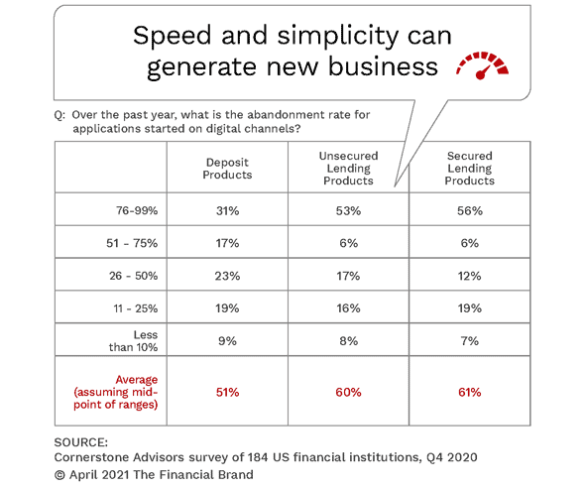

In most cases, banks and credit unions are losing far more business than they generate because prospective customers and members abandon the account opening and loan application process before they complete what they wanted to do. In research done by Cornerstone Advisors, the average abandonment rate for new deposit account openings is just over 50%. For lending products, the abandonment rate is even higher.

Bottom Line:

The cost of not simplifying account opening and loan applications is lost business.

What is astounding is that close to one-third of financial institutions surveyed lost more than 75% of the deposit accounts that consumers wanted to open, while more than half of the organizations lost more than 75% of the potential loan business. Put another way, for these banks and credit unions, they lose two accounts (or loans) for every account (or loan) opened. This is not sustainable for organizations hoping to grow their customer base in the future.

Account Opening Reimagined

Many financial institutions realized that minor modifications to current account opening and loan application processes were not enough. They decided to start with a blank sheet of paper and to only add a request for information from the consumer if it wasn’t available anywhere else. So, if a consumer already had an account with the bank or credit union, the majority of the information that was normally requested was already filled in.

One organization that found success with this strategy was U.S. Bank. According to Dominic Venturo, Senior Executive Vice President and Chief Digital Officer at U.S. Bank, “We reduced the number of fields of information requested by more than half, because if the person was already a customer [or we could find the information elsewhere] very little incremental information was needed. In some cases, we may only need income to be updated, and everything else was a ‘review and approve’ … which is awesome.”

For organizations that may struggle with letting go of legacy processes, there are many firms that can help to improve the digital account opening process. These firms can help remove friction, increase engagement, and improve customer satisfaction using time-tested tools and strategies.

Digital banking transformation is not simply enabling a consumer to transact using a digital device. It requires a rethinking of all processes and operations for a digital experience that compares to the best in all industries. This process begins in the back-office and impacts all components of digital engagement.