According to the results of ‘Expectations & Experiences’ quarterly research conducted by Fiserv, most consumers are satisfied with their primary financial organization, but are less satisfied with their own financial health. The survey found that consumers continue to manage their finances and make payments using multiple channels, with Millennials using mobile banking nearly three times more than other generations.

“The latest Expectations & Experiences survey underscores the day-to-day concerns about money that still loom large for consumers, even as there are more options available than ever before in how they can manage their finances,” said Mark Ernst, chief operating officer, Fiserv. “For banks, credits unions and billers, this is an opportunity to go beyond offering products to creating experiences that are essential to people’s lives, anticipating their needs and giving customers control and confidence in their financial futures.”

Financial Anxiety Remains

Despite an economy that is significantly better than a decade ago, the survey found consumers were less content with their financial health compared to other areas of life. This is especially true with Millennials and lower income households. Only 20% of early Millennials and 21% of low-income respondents said they were satisfied (8 or higher on a 10 point scale), compared to 36% of the population as a whole. Larger percentages of consumers were satisfied with their emotional health (52%), social life (44%) and even their physical health (43%).

When questioned further, the level of financial anxiety became more clear across all demographics:

- 39% would have trouble or would not be able to pay back a $500 loan

- If they received $1,000 unexpectedly, 47% would use it to repay a debt

- 44% have needed immediate access to funds from a check in the last year

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Satisfaction with Financial Institutions High

The satisfaction with primary financial providers remains high, with a 76% satisfaction level. This helps to explain the stability of use of traditional financial providers over the past several years (85% use a large national bank, credit union or community bank as their primary institution).

The research did find the use of virtual or online-only banks increased to 8% among late Millennials, with 15% of high net worth households using digital providers. These demographic segments tend to provide a leading indicator for financial services utilization and these trends should not be taken lightly.

Cost and convenience remain the key drivers of financial institution choice according to the research. Interestingly, while customer service remained an important factor in the decision, the importance dropped compared to the 2015 study. The top five factors for selecting a financial institution were:

- Physical location (this differs from a similar study by Novantas in 2016)

- Customer service

- Online banking/bill pay

- Fees/service charges

- Ability to conduct all banking digitally

Millennials Love Mobile Banking

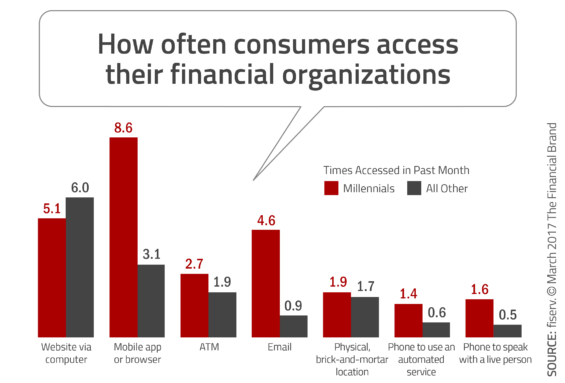

With better online and mobile banking services being introduced and improvements being made in design, ease of use and engagement tools, the shift towards these digital channel options continue. According to the Fiserv study, online banking websites accessed via a computer remain the most frequent way consumers access their primary financial organization. Consumers accessed their accounts six times on average in the past month.

Alternatively, Millennials preferred the mobile channel over online banking by a significant margin. During a typical month, Millennials accessed their financial institution 8.5 times via a mobile app or browser versus 3.1 times for the non-Millennial segment. Surprisingly, they also were more than 4 times more likely to connect with their banking organization via email (4.6 times vs. .9 times), while also using ATMs, the phone, and even branches more frequently than their non-Millennial counterparts.

Digital engagement increases were also found with the new account opening processes. Online account opening was up, with 28% of new savings accounts and 39% of new investment accounts opened online.

Despite a desire by many consumers to use digital tools for managing their finances, many still revert to traditional methods of banking. For instance, while just 6% of consumers cited checks as their most preferred method of payment, 58% of consumers said they cashed a check within the last three months. In addition, faster access to funds was identified as a need by consumers, with 44% needing immediate access to funds from a check within the last year. Common needs cited for immediate check funds include daily expenses (26%), covering bills (20%) or to avoid late fees on payments due (10%), reflecting the financial stress many consumers continue to face.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

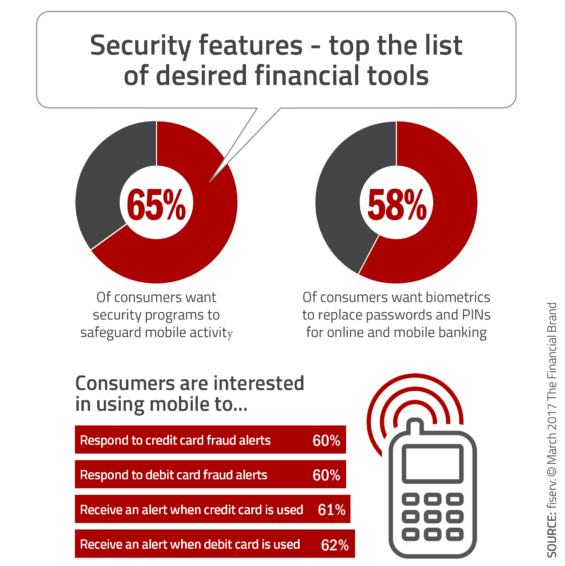

Security Remains Top of Mind

Security of financial data and transactions were an underlying concern throughout the quarterly Expectations & Experiences survey. Consumers were extremely interested in mobile tools that enhance security. From smartphone alerts to biometrics, consumers are looking for leading-edge solutions to aleviate their security concerns.

When given a choice of digital features, the tools receiving the most interest were security-related. The survey found that 65% wanted% security programs to safeguard mobile activity, while 58% wanted biometric options to replace PINs and passwords (voice, fingerprint, palm scan, etc.).

People also showed interest in services that enabled them to secure their physical debit and credit cards via mobile devices. “Among smartphone users with debit and/or credit cards, 60% indicated interest in using their smartphone to respond to credit or debit card fraud alerts, and an almost equal number indicated interest in receiving card transaction alerts for credit cards (61%) or debit cards (62 percent) to quickly identify fraudulent transactions,” stated the report.