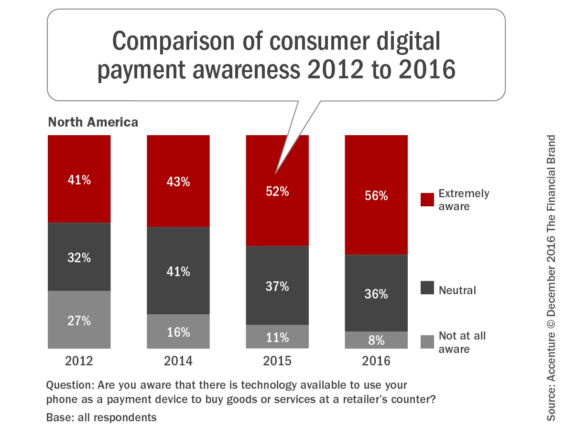

Despite an increase in awareness of mobile payments, usage continues to remain flat, illustrating the challenges in changing consumer behavior when merchants and issuers can’t deliver a strong value proposition. According to Accenture, 56% of North American consumers are now aware of mobile payment services — a 4% increase from 2015. However, the regular use of mobile payments remains flat at 19%, with 60% of consumers using cash at least weekly to make purchases at a merchant location (a drop of 7% from last year).

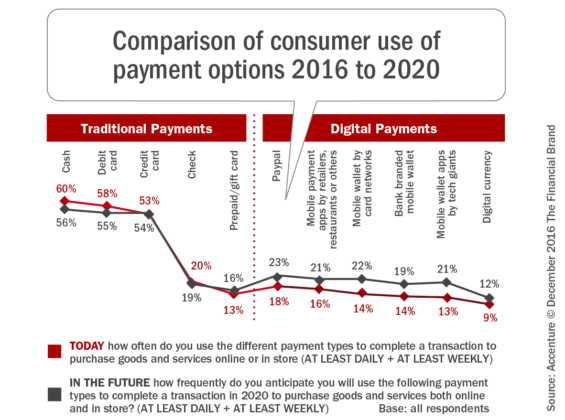

The 2016 North America Consumer Digital Payments Survey, based on a survey of more than 4,000 smartphone users in the US and Canada, shows that consumers are expressing optimism about mobile wallet adoption in the future. anticipating a nearly 60% increase in the use of mobile wallets from card networks (from 14% in 2016 to 22% in 2020) and from technology companies (from 13% in 2016 to 21% in 2020). The usage of bank-branded mobile wallets is also expected to increase from 14% to 19%.

At the same time that digital payments options are expected to increase, traditional payment alternatives are in the decline. However, even with the expected decline in cash and debit card use, cash and plastic will continue to dominate the payments landscape for years to come. In fact, credit card usage was actually up three percentage points from 2015 and expected tyo increase another 1% by 2020.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

“We are seeing a gradual increase in consumer awareness of mobile phone payments options; however, adoption has remained flat over the past few years,” said Robert Flynn, managing director of Accenture Payments in North America and co-author of the report. “Consumers are content to use cash and plastic for their everyday transactions, and while the use of cash is declining overall, it is the most commonly used form of payment – and consumers expect it to remain so in 2020. To shift consumers’ payment behaviors will take more than just providing another ‘me too’ mobile payments option – leading merchants will need to identify and provide next-generation, value-added services.”

Barriers to Mobile Payment Adoption

For financial institutions to achieve a first-mover advantage, barriers to consumer adoption of mobile payments must be addressed. Of the nearly two-thirds (64%) of consumers who have never used their mobile phone for in-store payments at a merchant location:

- 37 % said they have not done so because they believe cash and plastic are fine for their payments needs

- 21% prefer not to register payments credentials into their mobile phone

- 19% are concerned that unauthorized transactions may occur

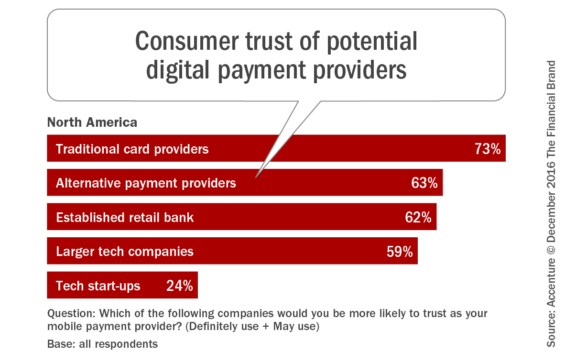

Alternatively, of those consumers who have used mobile payment apps in-store, consumers most frequently used their bank’s mobile app (26%), with 76% expressing satisfaction with the experience. In addition, 73% of the respondents said they trust traditional card providers the most as their mobile payments provider, followed by alternative payment providers like PayPal (63%), traditional retail banks (62%), and large technology companies (59%).

Tech start-ups trail all other providers in consumer trust at just 24%. This significant gap in trust signals that speculation in recent years that fintech firms might dominate the digital payments market is unfounded.

“The existing payments system isn’t broken, which is why consumers are not making a mass-move to mobile phone payments adoption – the incentives are not there yet,” said Michael Abbott, managing director of Accenture Digital, Financial Services, North America lead. “Consumers expect more in today’s fast-paced digital environment – just the ability to tap-and-pay is not enough. Payments providers need to bring the traditional card to life and create a real-time interactive experience for consumers.”

The Need for a Strong Value Proposition

As with any commerce decision, consumers are looking for value. This includes what is being purchased as well as the way it is being bought. To this end, the Accenture survey found that that consumers value tangibles like deals, discounts and rewards and intangibles like convenience and relevance. In fact, 45% of retail bank consumers say the top reason that they would stay loyal is if their bank offers discounts on purchases of interest.

There is a need to move from mobile payment transactions to digital commerce, where activity, behaviors, devices, location and offers all come together for an enhanced consumer experience. Open banking is one way for payments providers to improve their value proposition. Application programming interfaces (APIs) provide the technical backbone for organizations to partner with third parties to enable contextual engagement.

The Importance of Millennials and Mass Affluent Consumers

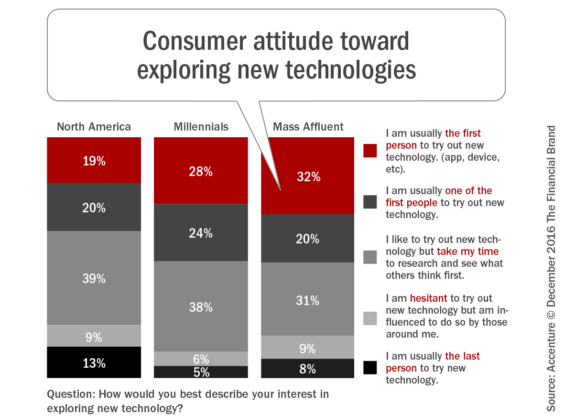

The Millennial and mass affluent segment (earning $100,000 annually) provide a strong foundation for the growth of digital payments. These segments lead adoption trends in digital and mobile payments and are the early adopters for most new technology.

When asked how they would best describe their interest in new technologies, 52% of both groups say they are the very first or one of the first to try it, compared to just 39% of all other survey respondents. The mass affluent segment is the most likely to pay in the store using their mobile phone (35%) followed by Millennials (28%), compared to the 19% average.

Finally, In Millennials and mass affluents are more likely than most consumers to use mobile apps from retailers, restaurants or others (23%, 30% and 16% respectively).

Millennials and mass affluent consumers are also the most likely target for connected commerce:

- 30% of Millennials and 35% of mass affluent consumers are interested in using wearables (compared to 21% overall)

- 26% of Millennials and 34% of mass affluent consumers are comfortable providing personal data to third parties. (compared to less than 20% overall)

“Millennials and higher income individuals may be low-hanging fruit for payments providers looking to increase adoption, but there is also a vast amount of untapped opportunity with consumers who are becoming more familiar with digital technologies and the rewards and convenience it affords,” stated Flynn. “As open banking becomes more prevalent, driven by APIs, consolidated customer data will provide a full picture of the customer, giving payments providers the information they need to create unique and differentiated offerings. Winning in mobile payments is anyone’s game at this point.”

Being Proactive in the Payments Marketplace

To be a market maker in the payments marketplace, providers will need to commit to increasing the level of personalization, leveraging insight not commonly used today. This includes not only payment data, but locational, behavioral and even social insights.

“Leaders in payments set themselves apart not by mastering the transaction – that’s been done – but by mastering value delivery, always on customers’ terms<” says the Accenture study.