The argument has often been made that the “checking account” is over-the-hill. Maybe if one day the majority of consumers transact in cryptocurrency the checking account will disappear. But even that’s debatable. The rapid adoption of mobile apps and contactless payments has not significantly diminished the importance of a core, insured transaction account.

Checking accounts remain a critical financial anchor for most consumers, serving as the central hub to receive and make payments. And through debit cards, direct deposits, retirement savings withdrawals, fintech applications and P2P platforms, most consumers have multiple daily interactions with this account.

Even as fintech players enter the market, many consumers opt for a plain vanilla free checking account at one of the top four U.S. banks: Bank of America, Chase, Citi, and Wells Fargo. According to the latest Federal Reserve data, these four banks account for approximately 35% of the U.S. deposit market share.

Regional banks, community banks and credit unions (and digital banks) don’t approach this kind of scale, yet they can learn how to improve their own offerings — as well as what consumers are looking for in free checking — by studying the offerings of the big four.

Below are the key features and related elements of the primary checking accounts for Bank of America, Wells Fargo, Chase and Citibank, compiled by The Financial Brand.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Bank of America Advantage Checking Account

Bank of America’s flagship Advantage Checking account comes in three settings: SafeBalance, Advantage Plus and Advantage Relationship. Advantage Plus banking offers multiple ways to waive the monthly fee, enables a balance connection for overdraft protection, and the option to buy paper checks. Customers also get access to Bank of America’s award-winning mobile banking app, which offers robust planning and budgeting tools. These include the bank’s virtual assistant Erica and its Life Plan financial planning and insight tool.

Bank of America basic free checking account

Additional Bank of America checking account information.

2. Wells Fargo Everyday Checking Account

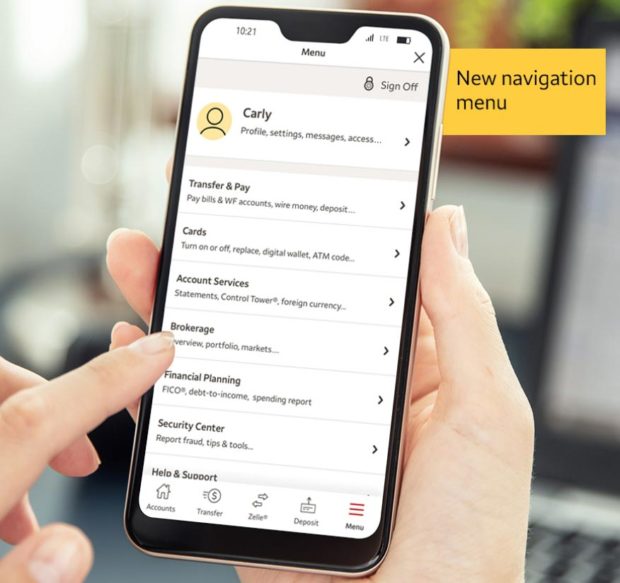

The Wells Fargo Everyday Checking account offers essential banking features in an easy-to-open account with as little as $25. It offers paper check writing, mobile deposit, bill pay, contactless debit card, and integration with Zelle. It’s also designed with mobile in mind and features optional overdraft protection. The account works in conjunction with Wells Fargo’s digital Control Tower tool that allows consumers and businesses to track key financial matters including subscriptions and turning cards on and off.

Wells Fargo basic free checking account

Additional Wells Fargo checking account information.

3. Chase Total Checking Account

Chase offers three flavors of its basic personal checking accounts: Chase Total Checking, Chase Secure Banking, and Chase Premiere Plus Checking. Total Checking, the most popular, covers all the basic needs with online banking, mobile banking, bill pay, Zelle integration and access to 16,000 ATMs. The country’s largest bank offers a half dozen other checking options for high school students, college students, and other segments.

Chase basic free checking account

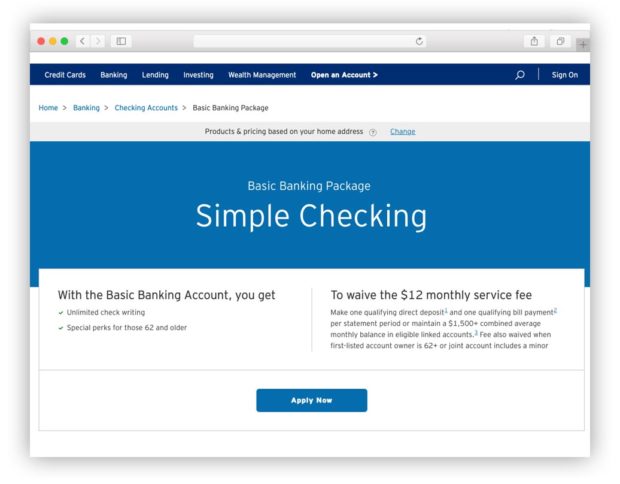

4. Citibank Basic Banking Checking Account

Citi offers seven different types of basic and premium checking accounts, all with various fee structures, benefits, and services. The Basic Banking Package account offers regular checking with unlimited access to checks and digital tools. The number four bank announced a very aggressive overdraft/NSF fee policy change to take place in the summer of 2022. Basically the bank will cover overdrafts but not charge a fee for doing so. Details are described in a separate section below.

Citi basic free checking account

Additional Citibank checking account information.

Read More:

- Rethinking Checking Account Strategy in a Digital Banking World

- Square Plunges Deeper Into Banking With Plans for Checking & Savings

- Growth Is Impossible Without Faster Digital Checking Account Opening

Comparing Checking Account Fee Structures

Most consumers now expect low-cost or free checking. 80% of adults have a checking account at a bank or credit union, and approximately half of non-interest-bearing checking accounts are free, according to Bankrate.com. Consumers who maintain a minimum balance to avoid fees, use basic checking services, and don’t bounce checks or overdraft their account shouldn’t incur any fees.

As “free checking” becomes a commodity, differentiation is less about the cost of the fees but how they are triggered by account minimums, rules, and overdrafts.

Basic checking accounts at Wells Fargo, Chase, Citi, and Bank of America all offer:

- No monthly fee for account holders who meet certain criteria (typically a regular direct deposit or a minimum balance).

- Free check writing.

- Free ATM use at bank-owned ATMs (typically $2.50 at non-bank ATMs).

- Free basic services online and through the mobile app.

However, there are slight differences in fee structures for monthly fees, overdraft fees and other fees. Consumers who tend to carry low balances or are at greater risk of overdrafting their account should pay close attention to the fine print and how fees are structured. To avoid fees, the account holder typically needs to have a monthly direct deposit or maintain a minimum balance of $1,500. Some of the big four banks also offer fee waivers for older groups or students.

Comparing Checking Account Overdraft Programs

For some account holders, overdraft fees remain the biggest impediment to “free checking.” According to the Consumer Financial Protection Bureau, overdraft and NSF fees cost consumers an estimated $15.5 billion in 2019. Currently, most banks, including some of the four listed here, charge customers a $35 fee for each overdraft.

However, the biggest banks, as well as others, are changing overdraft fee structures to be less punitive, more forgiving, more transparent, and with more options. As these changes roll out into the industry more broadly, the new competitive factors will be about timeliness and options.

While consumers will still face penalties for overdrawing an account or bouncing a check in most cases, they will have more advanced warnings about low balances and more opportunities to address them. Some banks now offer greater grace periods, enabling a consumer to avoid overdraft fees by refunding the account within 24 hours. Additionally, new short-term loan programs allow the account holder to borrow up to $500 for a small fee.

Here are some details about the overdraft policy changes at the top four banks:

Starting in May 2022, overdraft fees at Bank of America will fall from $35 to $10. Additionally, the company will eliminate transfer fees associated with its Balance Connect option that automatically draws from connected accounts.

Bank of America also now offers several options for overdrafts, including Balance Assist, which offers the opportunity to borrow up to $500 for only $5. Additionally, the bank’s Safe Balance account doesn’t charge for an overdraft but declines transactions when there’s not enough money in the account.

To help customers reduce overdrafts, Wells Fargo announced in January 2022 that it would offer earlier access to direct deposits, offer a 24-hour grace period before instituting overdraft fees, and will offer a new short-term loan option by the end of 2022.

Wells Fargo also introduced its Clear Access Banking option, which charges no overdraft fees. Introduced earlier, the Overdraft Rewind service rolls back overdraft fees when the consumer covers a direct deposit the following morning.

While Chase is retaining its $34 overdraft fee, it eliminated its NSF fee and introduced a bigger buffer for financial shortfalls. This includes a next-day grace period that gives customers until the end of the next business day to make a transfer to cover the difference. Additionally, Chase also offers the ability to set up enhanced account alerts to notify people when their balance is low.

In the most dramatic move of all the top four banks, Citi said it will eliminate overdraft fees, returned item fees, and overdraft protection fees by the summer of 2022. There are two new options to cover negative balances. Safety Check transfers available funds from a linked account to cover an overdraft plus any fees (there is a $10 transfer fee). Additionally, the Checking Plus line of credit automatically transfers money to the checking account. Citi has also enhanced low balance alerts and will not authorize ATM or point-of-sale debit transactions in cases where funds are not available.

Read More: Trends in Overdraft Fees: Which Banks Ditched Them (and Which Didn’t)

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Checking Account Interest Rates

Few free checking accounts at traditional banks pay interest, and when they do, it’s a usually a paltry amount. Consider that enhanced options on some of these accounts, such as Portfolio by Wells Fargo and Chase’s Premier Plus Checking, pay an APY of .01%. On a $5,000 average balance over the course of a year, that return adds up to a whopping $5 interest.

As a result, consumers typically don’t factor in APY when deciding where to open a checking account. However, that may change as the Federal Reserve raises interest rates throughout 2022 at a quick pace. Banks as a whole may not raise rates immediately because many are still awash in deposits. However, should digital banks start raising rates to attract new deposits, traditional banks may begin to follow.

As of April 2022, for example, SoFi offered one of the highest yield checking accounts in the nation, with an APY of 1.25%, more than 30 times the national average rate on checking balances.

Read More: How Banks & Credit Unions Should Prepare for Rising Interest Rates

Checking Account Mobile Banking App Comparison

Due to the proliferation of smartphones and the dominance of ACH, cards and contactless payments in today’s economy, mobile apps are far more important than checkbooks.

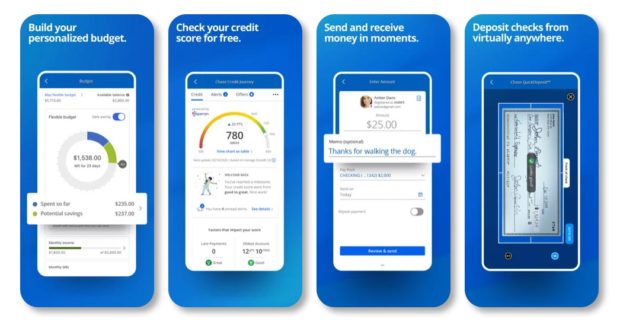

The mobile banking apps of Bank of America, Chase, Wells Fargo and Citi all have solid ratings in the App Store and Google Play. Each app offers all the essential mobile banking functions such as remote deposit and the ability to move funds and make P2P payments. The real value has now become the spending and budgeting tools incorporated into these apps.

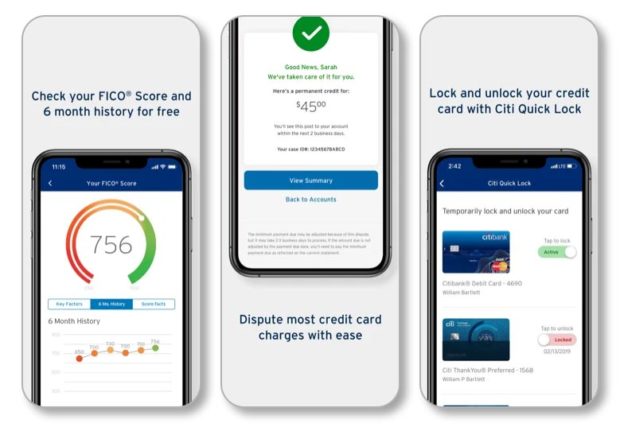

Citi Mobile leads the pack with slightly better star ratings in both places, even with a smaller rating base (star ratings based on five stars max).

Citi Mobile

App Store: 4.9 stars/2.9 million ratings

Google Play: 4.7 stars/825,000 ratings

In addition to basic mobile banking essentials, the Citi app offers some features that make it more helpful and easier to use. For example, the Citi Mobile Snapshot provides a quick review of key account information without signing in. It also links all bank and credit card accounts in one place to offer a holistic view. In addition, customizable alerts and spending insights help customers manage their finances as they need to.

Bank of America

App Store: 4.8 stars/3.5 million ratings

Google Play: 4.6 stars/941,000 ratings

Bank of America’s app offers the basics like balance check, remote check deposits, and the ability to view statements and pay bills. It also provides cash-back deals through BankAmeriDeals and a spending and budgeting tool that enables users to easily monitor spending in their accounts. Customers can also add a digital wallet to pay with their phones.

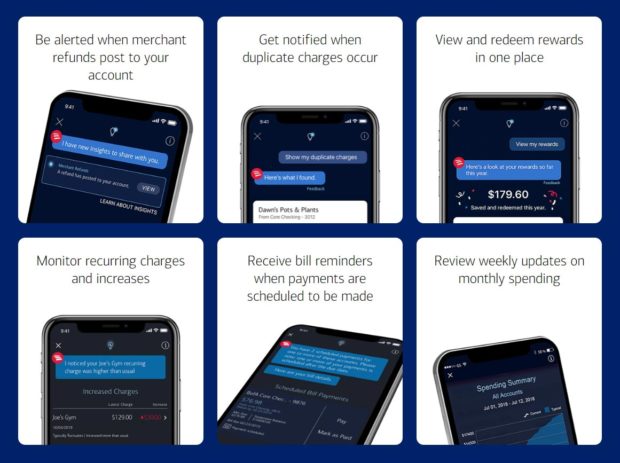

Through custom alerts and the Erica virtual assistant, users can also be notified of duplicate charges, recurring charges, bill reminders, and weekly updates on monthly spending.

Wells Fargo

App Store: 4.8 stars/6.8 million ratings

Google Play: 4.6 stars/1.5 million ratings

The bank began releasing a rebuilt mobile experience in 2022 and is set to release its new virtual assistant “Fargo” in late-2022. The Wells Fargo app also offers My Money Map, a money management tool.

The My Spending Report with Budget Watch automatically tracks and sorts transactions into familiar categories to provide a complete financial overview in one location. All the charts and graphs allow customers to visualize their spending.

JPMorgan Chase

App Store: 4.8 stars/4.1 million ratings

Google Play: 4.3 stars/1.7 million ratings

Chase’s mobile app offers all the basic features one would expect but with a couple of extras. Incorporated with the Zelle payment network, the QuickPay function enables Chase cardholders to make P2P transfers in real-time. There are also autosave features, a budget planner with “daily pacing” to help consumers stay in line with their goals. The “Today’s Snapshot” feature lets the account holder view their daily spending habits broken down into categories like food, entertainment and gas.

Read More: What’s the Future for Checking Accounts?

How Banks Can Compete with Major Checking Account Providers

Checking accounts clearly remain relevant as a cornerstone account for transactions and daily banking, but many banks and credit unions are rethinking their checking account strategies. The expectation of free checking means financial institutions now need to compete by building value in these accounts.

There are several things banks and credit unions can do to better compete with the big players in the checking account market:

Make checking accounts mobile first. Nowadays, a checking account is only as good as the mobile functionality and the mobile app it is tied to. Research by Phoenix Synergistics found that nearly two-thirds of consumers agree that being able to use their phones to manage their checking accounts is essential. Consumers across the board also have no patience for lag times and poorly performing apps.

Adopt different fee structures. Relying on hefty overdraft fees as a primary source of revenue is on the way out. As many major banks reduce or eliminate fees, most other banks and credit unions will likely follow suit making the terms more flexible and consumer-friendly. This means these institutions now have to look to other sources of revenue, such as short-term loans.

Deliver value with new tools. Banks and credit unions need to offer more value than simply using checking as an account o receive funds and make payments. All of the big banks covered in this article incrementally introduce new account and app features to enhance budgeting and spending analysis. The most effective banks are now using bill pay, budgeting, credit score and other tools to help their customers continually improve their financial well-being.