Millennials are no longer the youngest banking customers anymore. Even the oldest of Gen Z — nicknamed the “Zoomers” — are entering the job force. Most of the financial industry is still catering to Millennials and only just now targeting the oldest Zoomers. It’s easy to justify that focus as Millennials continue to be a highly important market.

On the other hand neobanks, whose customers generally skew younger already, are quietly nurturing adolescents and the generations following them — specifically Gen Alpha, which comprises any child born since 2010 — many of whom are still years out from banking traditionally.

How? With unique bank accounts and mobile services.

It’s not a splinter trend. There are some fast-growing fintech players publicizing these unique solutions for younger consumers. Revolut and GoHenry are two prominent ones, but others that specialize in teenage and kid banking accounts include Copper, Greenlight, Jassby, Osper, RoosterMoney, Current, FamPay, Monzo and Step.

Race to the Cradle:

Financial institution leaders may be very confident they are taking care of Gen Z and Millennial customers. But the competition is betting big on the generations still on the horizon.

Some megabanks have created products similar to those that neobanks offer, including Chase — with its Chase First Banking service and its high-school checking account — Capital One, Wells Fargo and PNC, along with direct bank Axos.

However, many of the legacy provider children account promotion is not nearly as flashy or creative as with the neobank products. While there’s no data to substantiate traditional banks and credit unions are more or less successful with these younger audiences, it’s critical they keep an eye on the competition who are centering their strategies on the coming generations.

Read More: The World’s Biggest List of Digital Banks

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Gamechanger: Phones in Kid’s Pockets

Granted, traditional financial institutions have always made it possible for teenagers to open checking and savings accounts, usually under the purview of their parents. And it has worked — that’s how many current customers were first introduced to banking.

“A lot of what we had seen previously toward customer acquisition — especially younger consumers — was based on where their parents bank,” Stephen Greer, a senior analyst at Celent, tells The Financial Brand. The bells and whistles ten years ago weren’t extravagant. They were simple incentives like free account openings for your kid.

But, the game has since changed. And it isn’t because teenagers have more needs or even different needs. It’s because they now have a phone in their pocket with a deluge of intriguing apps.

“A teenager doesn’t need a lot of those extra, additional products,” Greer explains. “But they might find it really compelling to be able to integrate social media into some of these to be able to have something that looks cool and they can use to pay their friends.” That explains why Venmo, with its social media component, is so popular among young people.

Regardless of where kids’ needs are at, Covid-19 spurred money concerns across all ages. In a GoHenry survey based on data from January to December 2020, almost three out of every four kids between the ages of 6 and 18 said they were more worried about money since the start of the pandemic (broken down, that’s 78% of 6- to 10-year-olds, 72% of 11- to 15-year-olds and 70% of 16- to 18-year-olds). GoHenry is a mobile app specializing in child and teen banking accounts.

Challenger banks have recognized there’s a gap in what kids used to need and what they want now. Advanced technology helps. While a wad of legacy institutions still operate on “decades old-core technology,” Greer thinks the key is finding the elements of the banking experience that resonate with the younger consumers.

Greer goes on to explain neobanks are betting big, building a simple experience now for the youngest banked — in hopes they don’t go to the big players, like Wells Fargo, Chase and Bank of America. Then, once the challengers understand the kids, they can roll out suites of banking products that fit the needs of these consumers to create what Greer calls a “sticky relationship that persists.”

Colorful, Interactive and Personalized

The tried-and-true method for teaching kids is to make it fun. Even Verizon is jumping on the youth banking trend, after announcing the launch of its new program “Family Money.”

Dig Deeper: Verizon Infiltrates Banking with Neobank-Like Strategy

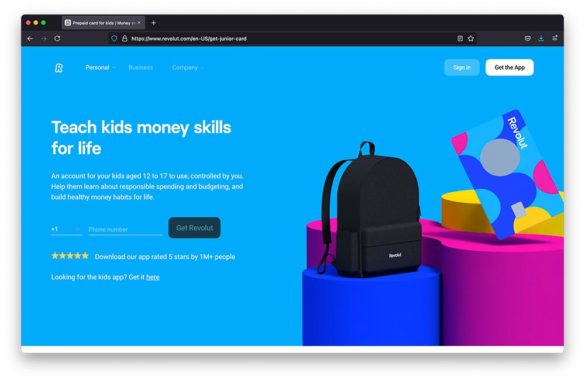

Take a look at the difference between Chase First Banking’s homepage in comparison to Revolut’s, which offers a kid banking software in addition to its complete suite of products. Which looks more fun?

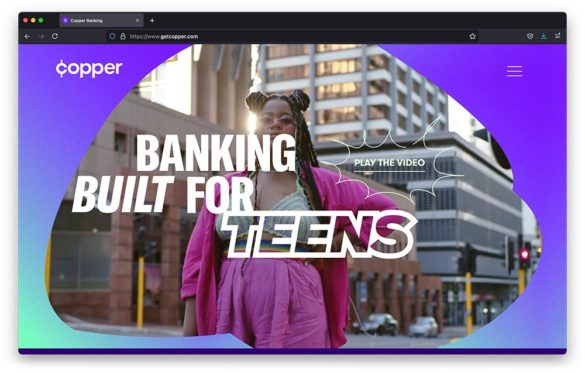

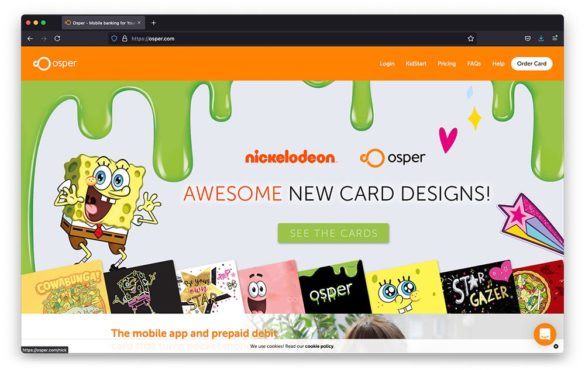

Or look at the website (still under development) of Copper, a neobank that specializes in teenage banking. Or at Osper’s homepage, which advertises Nickolodeon-themed debit cards.

And the features aren’t conventional either. A decade ago, parents paid their kids’ chore allowances in cash. Maybe the cash got lost, or it was sent through a cycle in the washer. It wouldn’t be until the kids understood the value of money in their early teens that both child and parent went to the bank to open an account.

Now, as more children get cellphones, it makes sense that parents would be able to “send” their kids money after they mark chores completed on a digital to-do list. Easy, fast and no more worrying if there are stranded dollar bills under the bed.

And there is plenty of money flowing between parents and kids. GoHenry found in their report U.S. children collectively earned $27.2 billion over the course of 2020. The bulk of it — $25.5 billion worth — came from allowances.

Neobanks are getting crafty with the mobile children bank accounts. As kids shop online, parents can monitor and set spending limits to teach them healthy spending and saving habits.

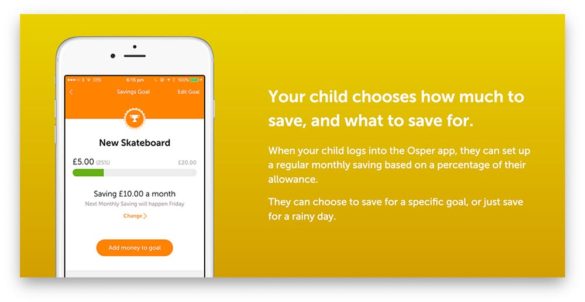

Osper, for one, has a budgeting wealth management system built right into their app so kids can save up for what they want over time — and see the best ways to do it. GoHenry features a debit card with parental controls.

That’s not to say traditional financial institutions aren’t staying ahead of the curve. Chase First Banking says parents can set spending limits for certain locations as well — maybe $10 on Amazon, $10 at restaurants and $20 everywhere else.

Read More: Gen Z Says They’re Eager to Use Big Techs for Banking – But Will They?

There’s Still Plenty Of Time…Right?

Banks and credit unions are by no means in a rush to get rid of their old models. While the no-fee account is the priority for younger consumers, Greer says, traditional financial institutions are wary of abandoning their profitable models.

However, there’s a sense — and acceptance — “that certain revenue sources are not going to be the cash cows they once were,” he adds. “Margins are being compressed all over the place.”

Although banks and credit unions want to up their digital game, it’s easier said than done, and costly. It will most likely start with fintech partnerships, Greer believes, to create an ecosystem that works for the younger generations.