The onset of the pandemic put all components of your customer relationship strategy on center stage. The stay-at-home nature of the crisis forced most people to engage with their bank and credit union without visiting a branch or transacting any part of their life as they had in the past. This forced organizations to encourage consumers to using digital options or interact with their financial institution remotely.

Organizations that did not have an end-to-end digital engagement capability (without branch support) were caught off-guard, forced to take initiatives that may have been further down the priority list and move them to the top. The almost instantaneous shift to digital and remote engagement had most organizations dealing with unforeseen challenges as digital use and call volumes skyrocketed. In many instances, customer experiences suffered.

The ‘good news’ is that consumers were dealing with unforeseen challenges as well, with the entire family in a lock-down mode, becoming accustomed to new challenges. While they were frustrated with long waits for customer service assistance or the inability to do the transactions on their mobile device without friction, they were tolerant of the challenges … initially.

Read More:

- Customer Journey Mapping Provides Path to Digital Banking Loyalty

- Mobile Banking Drives Satisfaction and Growth

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Consumers Growing Impatient

At some point in the future – maybe at different times for different areas of the world – the coronavirus crisis will be mostly only a bad memory. But, the changes in the way consumers and businesses engage with with each other, and with all parts of their life, will be changed forever. One thing is abundantly clear, the new normal will not be a specific stopping point, but an environment that will change faster than ever before.

In other words, the change we are experiencing today will only move faster … and will never be this slow again.

As a result, consumers and businesses expect their financial institution to not only keep up with the way big tech firms and digital-only alternatives are delivering digital and online experiences, but to offer new and better ways to do banking … now.

Here are a few banking experiences that are no longer acceptable:

- Long call center hold times. Too many financial institutions start their call center message with, “Because of unusual circumstances, you may experience extended wait times”. It’s been months since the ‘unusual circumstances’ began. Customers expect you to have figured this out already.

- Fractured digital account opening. Consumers can order their groceries, select entertainment and buy a new car digitally from home and can have a video call with dozens of people internationally. They expect their bank or credit union to be able to help them open a new account without leaving their house.

- Impersonal communication. Gone are the days when large segments of consumers are communicated to with very impersonal messaging. Consumers expect to be treated as a segment of one, where their behavior and preferences are taken into account with advice provided in real time.

- Lack of channel integration. Consumers are used to working with providers where they can start online, move to a phone and even use a physical facility without needing to start a transaction over. Banks and credit unions must provide the same level of channel integration.

- Poor mobile design. How easy is your online or mobile platform to navigate and use on a daily basis. It may be easy to check balances on an account, but how about tracking a transaction or learning how to perform an unfamiliar digital function? The new definition of convenience is the ease of use of mobile and online tools.

Read More:

- Becoming a ‘Digital Bank’ Requires More Than Technology

- How Bank of America and Chase Get Mobile Account Opening Right

From Digital Technology to Human Experiences

While there will certainly be a lot of pressure on earnings for the foreseeable future, the focus of all efforts must be on the consumer and small business experience. Consumers and small businesses are feeling more pressure than many have ever felt in the past. They are craving understanding, empathy and connection from their financial institution.

These customers will quickly be able to ascertain whether initiatives from their financial institution have their best interests in mind or if they are lacking authenticity. As a result, this is not a time to cross-sell, but a time to reach out on a personalized basis with recommendations that will help them through this difficult financial period.

The move to digital should not be to minimize transaction costs, but to maximize the engagement potential of digital and online platforms. Even before the pandemic, consumers were starting to feel like the digitalization of banking had a negative impact on the human element of customer experience. They were not ready to sacrifice humanized engagement for digital convenience. At the very least, they wanted a choice.

Research from the Digital Banking Report shows that consumers and small businesses value innovation and product advancement, but not without the emotional intelligence and personalized communication functionality that is the foundation of building trust.

Consumers and small businesses want their financial institution to know them, understand them and reward them for their business. And they want this more now than ever before. ‘Business as usual’ (or less) is no longer acceptable.

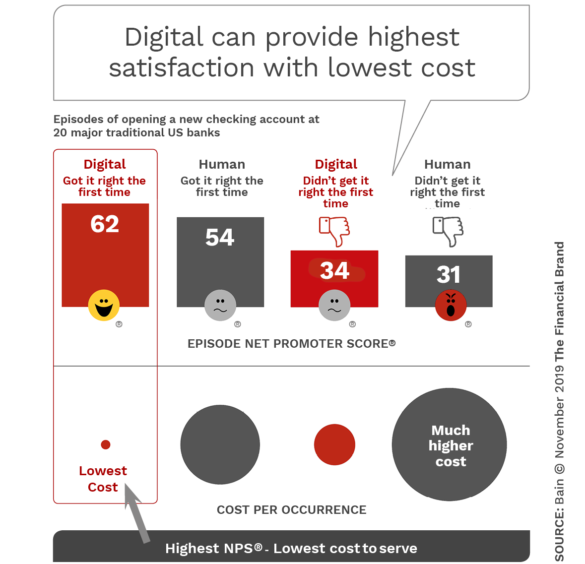

Focusing on a humanized experience does not have to increase cost. In fact, building a digital experience that includes a human, when done right, can be less expensive than missing the mark with a human-only experience, according to a Bain & Company study.

Customers Will Accept Imperfection

Just because consumers and small business will no longer accept their financial institution not getting the basics right doesn’t mean they expect perfection. In fact, this time of rapid change may be the best time to exhibit agility and a ‘fail fast’ positioning … if there is clarity of purpose and transparency.

This philosophy was best exhibited during the early days of the small business PPP loan program. Some financial institutions stumbled out of the starting gate, but made it very clear that they would do anything for their customers. These organizations did far better than those they waited until everything was buttoned down before they even offered loans to small businesses in need.

By illustrating that your organization is working hard to meet their needs, even when mistakes are made, you can actually help to build trust, satisfaction and a loyalty far beyond what was possible in the past.

But remember to get the digital and customer care basics right first.

COVID-19 has taught all organizations how quickly change can happen. It has also taught many financial institutions how legacy technology, processes and leadership can put an organization in a negative light quickly. The key is to avoid using the pandemic as an excuse, but as an unequaled opportunity to create an organization that can compete better in the future.

This period has taught organizations that digital does not mean the absence of humans, but the integration of technological efficiency and personal experiences only possible with focus and collaboration.

By genuinely putting the consumer first, leveraging data and advanced analytics to build better solutions, COVID-19 may be seen as the stimulus needed to compete more effectively in the future.