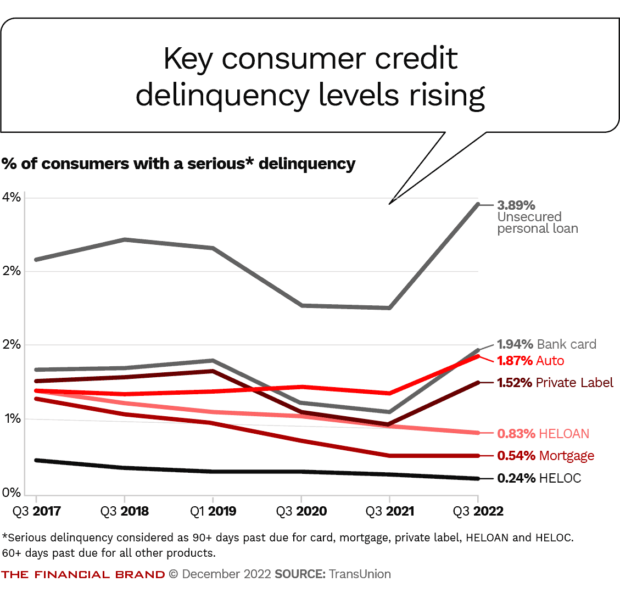

Serious delinquencies are rising in several key lending categories even as demand continues to be high, according to TransUnion’s consumer credit forecast for 2023.

Delinquencies are up for credit cards and unsecured personal loans, and will continue rising in 2023, hitting levels not seen in over a decade, according to TransUnion. Credit quality is also deteriorating on auto loans.

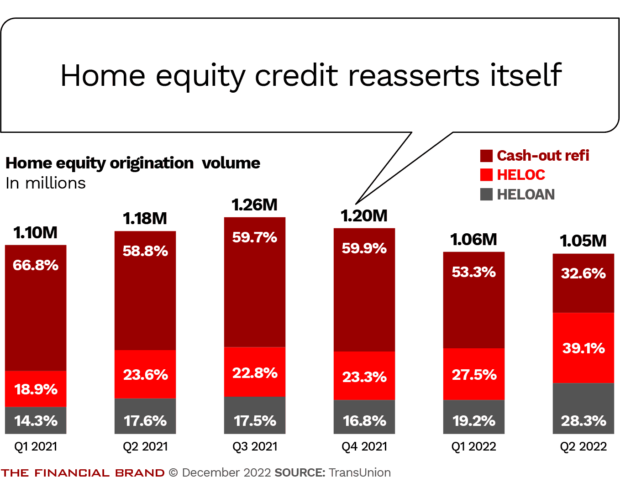

But mortgages are an exception to that trend, as are home-equity loans and lines of credit, in part, TransUnion says, because they tend to go to prime and prime-plus borrowers. Though home equity lending has not seen a lot of activity for an extended period, volume will increase in 2023, the credit bureau predicts. It appears to be a particularly attractive loan sector, as it promises the rare combination of solid demand and solid performance.

Executives from the biggest banks in the country acknowledge the trend of deteriorating credit quality, but strike a tone of cautious optimism. Their take is that consumer credit conditions have begun to “normalize,” after being artificially buoyed by the government’s pandemic stimulus.

At the same time, they are bracing for a recession, albeit not a severe one.

“The probability of a recession has gone up. We’re actually looking for that right now. We think it could be like a lower case ‘v,’ mild and short.”

— Marianne Lake, JPMorgan Chase

Consumer Lending Landscape Gets Rougher

Asked in an interview to put the consumer credit trends in perspective, Michele Raneri, head of U.S. research and consulting at TransUnion, says that some categories are flashing yellow lights, suggesting lender caution. However, she adds, the situation is less worrisome than in the Great Recession of 2007-2009, because broader market conditions today differ significantly from back then.

“Something that’s different between where we’re at now and the Great Recession is that we don’t have the housing crisis that we had before,” Raneri tells The Financial Brand. “The housing crisis really overextended people because they were so leveraged beyond what their income could support. We’re not seeing evidence of that in this economy yet and our forecast isn’t showing that either.”

The rampant unemployment of the Great Recession hasn’t surfaced either. Though a recession in 2023 would be a wild card in terms of the consequences, Raneri says, even the bleakest scenario in TransUnion’s projections doesn’t suggest unemployment at the levels of the Great Recession.

A TransUnion poll of more than 2,800 consumers indicates that four out of five people think the country is either in a recession now or will be before 2023 is over.

Despite that, the majority of people have a positive outlook.

The same poll shows 52% of Americans are optimistic about their financial future in 2023, with the Millennial (64%) and Gen Z (61%) segments being the most upbeat. Ranieri notes that the extra optimism likely arises from their expectation of rising wages as their careers progress.

Even so, TransUnion expects delinquencies to rise in 2023 across all types of lending categories, as insufficient growth in wages and potential job cuts to control expenses begin to bite.

It also expects loan growth to slow in general — but there are at least two categories where activity is likely to be robust. Consumer demand for home equity credit is forecast to rise. Auto lending is expected to pick up as well, with the production of new cars starting to recover from pandemic setbacks like supply chain disruptions.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Pursuing Loans, But Credit Scores Already Slipping

In the TransUnion survey, 26% of respondents said they plan to seek new credit or to refinance in 2023.

The products these consumers cited as the ones they’ll be seeking are: credit cards, 53%; auto loans/leases, 23%; unsecured personal loans, 22%; mortgages, 17%; new home equity lines of credit, 14%; and refi mortgages, 14%. (Some plan to apply for more than one type of credit.)

But the consumer optimism, and the plans to apply for credit aside, the economic environment is having an impact on credit scores. In a TransUnion webinar where Chris Huszar, senior manager, financial services research and consulting, shared the credit bureau’s forecast, he said that credit scores have been “slipping” as consumers contend with inflation and rising rates. Huszar also said that lenders in multiple categories have been reaching further down the credit tiers, and accepting more subprime and near-prime borrowers than before, to improve loan growth.

The average household debt burden remains near a 40-year low, according to a December semiannual report on banking risk from the Office of the Comptroller of the Currency. While consumers’ overall cash reserves remain higher than normal, median deposit balances have fallen in all income groups for the first time since the second quarter of 2020, the report said.

The OCC urged caution, saying “bank management needs to closely guard against complacency in underwriting practices.”

Weighing the Impact of Inflation and Recession

The potential for a recession, and the likely increase in unemployment it would cause, is an obvious concern for major credit card lenders like Capital One. Inflation, though, is the bigger worry right now.

During a “fireside chat” at a December 2022 Goldman Sachs analyst conference, Richard Fairbank, chief executive at Capital One, said he has found that unemployment has the dominant effect on consumers’ ability to handle debt. But the impact is “specific” to the people who lose their jobs.

“Inflation has a smaller effect” on a borrower’s ability to repay than job status, Fairbank said, “but it happens to everybody.” Because of inflation, real wage growth is actually negative, for example.

That has Capital One concerned, and the company is monitoring it, Fairbank said.

An important backdrop to understand about the current credit picture comes from TransUnion’s Huszar. Even though home prices have been declining broadly in recent months, the level of tappable equity available to homeowners remains high and market mortgage rates are much higher than what homeowners with outstanding mortgages are paying.

“Given those high equity levels consumers are willing to protect their homes now more than ever,” says Huszar. This strengthens the typical trend TransUnion has seen in most cycles for consumers to prioritize housing debt.

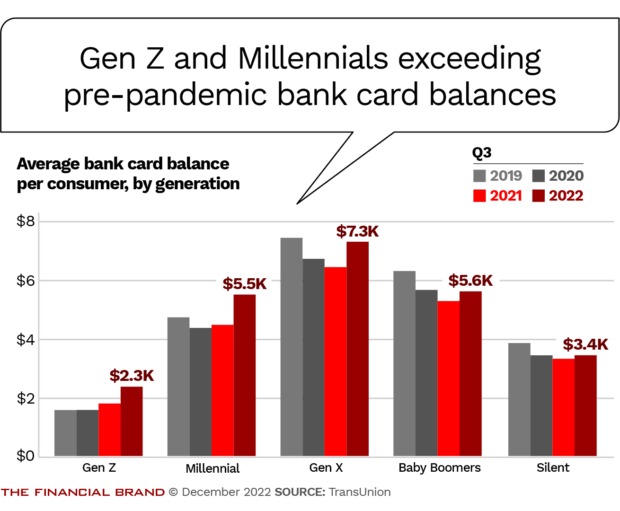

But other loan segments will take a hit, as inflation and rising rates put pressure on consumers. One indicator of this growing pressure is that credit card balances among the Millennial and Gen Z segments now exceed pre-pandemic levels, according to TransUnion.

TransUnion is forecasting serious delinquency rates of 2.6% on credit cards, up from 2.1% at the end of 2022, and 4.3% on unsecured personal loans, up from 4.1%. The credit bureau expects serious delinquencies on auto loans to peak in the fourth quarter of 2022 at 1.95%, then edge down just slightly in subsequent quarters to finish 2023 at 1.9%.

It defines serious delinquencies as greater than 90 days past due for credit cards and 60 days past due for unsecured personal loans and auto loans.

Read on for a recap of what TransUnion forecasts for 2023 in key lending areas and what some of the largest banks in the country have to say about consumer loan trends.

See more about credit strategies:

- 2023 Forecast: Auto Lending Will Rev Up — But at a Price

- Why Banks Need Real-Time Loan Data to Survive a ‘Credit Recession’

Credit Card Originations Will Remain Strong

“The credit card industry has seen strong growth in originations since the second quarter of 2021,” TransUnion says in its report. Going forward, it expects tighter lender underwriting standards in anticipation of a likely recession. But the speed bump effect that will have on origination growth comes with an asterisk.

TransUnion forecasts that 2023 originations — new credit cards issued — will trend down by 7.6%, but that is against 2022, a year that set records for new card volume. New cards are projected to hit 80.9 million over the coming year, up from a pre-pandemic level of 66.8 million in 2019. (Originations had been 87.5 million in 2022.)

Credit card balances grew by 19% in the third quarter, compared with a year earlier, according to TransUnion data. Growth was expected to continue for the fourth quarter, though at a much lower rate.

In the coming year, TransUnion expects increasingly cash-strapped consumers to use their cards more.

Besides the usual spending, consumers will turn to credit cards for another reason: to help them manage cash flows, TransUnion predicts.

These dynamics will fuel delinquencies in coming quarters.

“We expect card delinquency to increase in 2023 as consumers face liquidity shortages from the prolonged high inflation environment, slowing wage growth, and expected increases in unemployment,” says Paul Siegfried, senior vice president and credit card business leader at TransUnion.

Capital One, for its part, is still adding credit card accounts, but is “dialing back around the edges,” according to Fairbank.

He said its credit card delinquencies continue to “normalize” as the effect of the pandemic stimulus fades — which is another way to say that performance has been deteriorating. The deterioration has been faster among newer accounts — which Fairbank said is typical — as well as among lower-income, lower-credit-score cardholders.

“New originations are always the part of the business where you are going to see the earliest indicators of how the economy is working.”

— Richard Fairbank, Capital One

With seasoned accounts, the behavior is established, “and there are not too many surprises,” he said. In contrast, the performance of new accounts is subject to major swings, based on market conditions.

“From what we see right now, we still see growth opportunities,” Fairbank said.

Read more:

- How Banks Can Help Customers Tame Credit Card Debt

- Stressed Consumers Are Seeking Out Alternatives to Credit Cards

What Other Big Banks Say About Credit Cards

Like Fairbank, other CEOs at the Goldman Sachs conference were generally optimistic about the outlook for credit cards in 2023.

Andy Cecere, U.S. Bank’s chairman, president and CEO, said that cards continue to be a major focus. “Spend levels are good and the rate of paydown continues to be higher than normal, but it’s starting to moderate,” Cecere said. Delinquencies are below what the bank considers to be normal levels.

Wells Fargo President and CEO Charlie Scharf said some new credit card products at his bank are attracting “extremely strong credit prospects because of the value propositions we’re offering.”

Though consumers overall continue to show strength, Wells Fargo is getting more cautious, Scharf added. “You can’t sit here and say that you expect the slowdown to occur and not take that into account as you think about what to underwrite,” he said.

Asked about tighter underwriting, PNC’s chairman, president and CEO, Bill Demchak, said his bank generally sticks with the same lending parameters.

“We don’t really change our credit box,” he said. As economic conditions shift, “it will be harder for clients to fit within the box.”

A Handy Early Indicator on Cards:

JPMorgan Chase monitors changes in the number of consumers making minimum payments on their credit card outstandings. A rise suggests worsening credit.

Marianne Lake, co-CEO for consumer and community banking at JPMorgan Chase, said she anticipates delinquencies for cardholders who earn less than $50,000 will increase to pre-pandemic levels by midyear.

These lower-income consumers “are normalizing faster” than other segments, but continue to fare surprisingly well for now, Lake said. “Even with inflationary pressures, there still is excess liquidity when you look at how capable people are at paying their bills.”

Repayment rates on cards remain elevated, she said, noting that Chase tracks the number of cardholders who are paying just the minimum amount due each month, or “min pays,” as she called them.

“That’s usually a leading indicator — when people start migrating to making min pays,” she said. “Haven’t really seen much movement in that space yet.”

She also described Chase as being in continual tweaking mode on its card portfolio. “We’re always tightening and we’re always also expanding. We’re always trying to swap in goods and swap out bads based upon improved modeling and data and expectations.”

The big banks typically spoke of conservatism in their card marketing. But TransUnion’s report notes that originations among subprime and near-prime borrowers are on the rise. Of new credit cards issued, 45% went to these borrowers in the second quarter of 2022, up from 42.6% in the first quarter.

Fractional Marketing for Financial Brands

Services that scale with you.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Home Equity Credit to Boom in 2023

During the Great Recession many people had “upside down” mortgages — meaning they owed more than their home was worth. Often they turned in their keys and let their lenders figure out what to do.

But homeowners have more equity now. Even going into a potential recession with inflation continuing, the high level of tappable equity many homeowners currently enjoy gives them options for dealing with a troubled economy that other consumers lack, TransUnion’s Huszar says.

That cushion effect is not lost on Fifth Third President and CEO Tim Spence, who views homeownership as an indicator of credit performance. In remarks at the Goldman Sachs conference in December, Spence said that 85% of his bank’s consumer borrowers and 75% of both auto and credit card customers are homeowners.

Consumers are already tapping into their home equity in greater numbers. TransUnion found that home equity lines of credit are growing as a percentage of equity-based borrowing.

TransUnion predicts that home equity lending overall will increase by 24% in 2023, compared with 2022. Delinquencies, defined as 60+ days past due or more, will rise to 1.4% by yearend 2023, a rate that is still below pre-pandemic levels.

Read more:

- Marketing HELOCs Shows the Way to Intelligent Cross-Selling

- Timely Advice Beats a Rate-Only Mortgage Lending Strategy

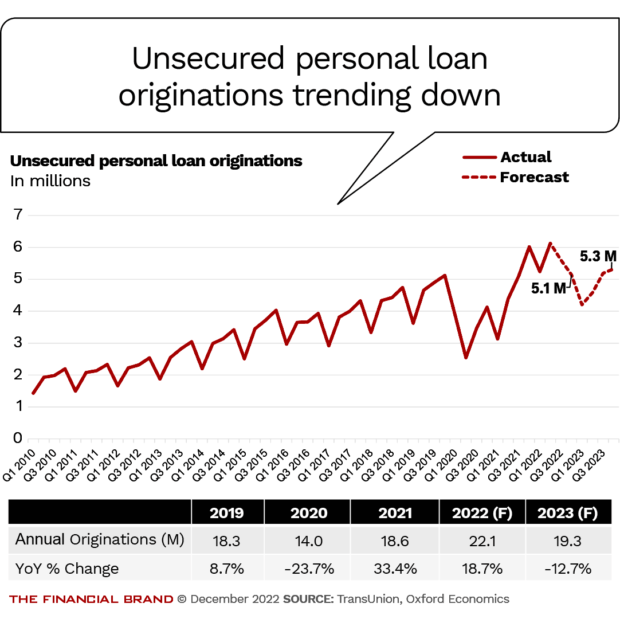

Banks and Fintechs Pushing Hard on Unsecured Personal Loans

After experiencing record growth in the first half of 2022, unsecured personal loans slowed to a more normal pace of growth in the second half. TransUnion expects this same normalized level of lending to continue next year.

Total unsecured personal loans in 2023 will be down 12.7%, compared with 2022. (Chalk it up to the major spike in volume in 2022’s first half.)

Both banks and fintechs upped their volume of personal loans in 2022, compared with the previous year. TransUnion’s Huszar indicated that this is another area where banks, eager to fuel growth, pushed deeper into subprime and near-prime segments than in the past. The credit bureau found that delinquencies of 60+ days past due neared 4% in the fourth quarter of 2022, which is the highest point for that measure since 2013.

Delinquency growth is highest among Gen Z and Millennial borrowers, TransUnion says in its report, citing data from the third quarter of 2022.

Lenders are starting to pull back now. Liz Pagel, senior vice president and consumer lending business leader at TransUnion, says they generally seem to be reevaluating their risk appetites in this loan category.

“As delinquencies rise, lenders will continue to tighten their ‘buy’ boxes,” shrinking unsecured personal loan originations in 2023, says Pagel. But consumer demand for these loans will be strong, she adds.