It’s imperative that banking gets to know Gen Z (born between about 1996 and 2010) much better than they do now. Student Beans, a student loyalty network, estimates that this upcoming generation has a spending power of at least $44 billion. Furthermore, there’s a long runway; the spending power for members of Gen Z has a potential horizon of $60 trillion once they and Millennials inherit parental wealth, estimates Niamh Cunningham, COO at Rival Technologies. Cunningham spoke during a webinar on Gen Z hosted by MX.

By now, everyone knows that Gen Z are digital natives with an affinity for socially aware brands. They depend on their social media presence unlike any previous generation. The banking industry first recognized — and sought out — the oldest members of Gen Z in 2018 and 2019 as they began to peek around the corner of adulthood.

But banking can’t assume that Gen Z is going to be the same as it did pre-COVID. Covid-19 did help this generation establish their financial independence, but it also permanently rocked their boat as the first real financial challenge of their lifetimes.

The discussion was anchored by a generational survey conducted by MX highlighting what the banking industry needs to acknowledge about Gen Z — and how to respond. Less than half of Gen Z admit to having an account with a traditional bank, credit union, neobank or fintech. This compares to three-quarters of Baby Boomers and seven out of ten Millennials. Although the youngest Gen Zers are still about 12 years old, the MX data concentrated on the members of the cohort ranging in age from 15 to 24.

“They’re just in a very different spot financially than their parents were in the previous generations. Their view of the world is a lot different,” senior director of engineering at Q2 Ryan Hollister explains in the webinar. “Simply offering them checking accounts and loan products is not necessarily meeting their needs.”

Read More:

- How Neobanks Are Catering to the Youngest Generation of Consumers

- Bank of America Grabbing 1 in 3 Gen Zs and Millennials with Mobile

- How One Neobank Targets a Huge Gen Z Segment Overlooked by Banks

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Unique Style of Gen Z

Some of the variances in Gen Z from even the generation that came before (Millennials) can indeed be credited to how its members connect with the rest of the world. Nearly almost all of Gen Zers in the United States shop online and — because almost four out of five of them (78%) are TikTok users — over half (55%) say they have bought something they first saw on TikTok, according to Student Beans. Another 65% say they get ideas of things to buy from all social media platforms.

They are also credited with being devoted to brands they identify with. This characteristic is a potential tool that the financial institutions who win over their hearts can use to their advantage.

“Millennials and Gen Z are very, very brand loyal and appreciate a strong brand. Some of these are super strong brands that are out there. And so sitting side by side with them should not be something that you’re afraid of,” Hollister says. Student Beans foresees these brand loyalties persisting long after Gen Zers graduate from college.

Although they have been characterized as impulsive by many generational experts, Gen Z has also been coined as ‘generation sensible’, according to Student Beans. “The most mature members of the cohort — students and young professionals — have just inherited their spending power, and these consumers show time and time again how important it is for brands to balance quality with affordability,” the Student Beans report reads.

Read More: Why Strong Visual Branding and Communication Are Vital in Banking

Gen Z and Millennials are similar in many ways, but what will likely distinguish them the most moving forward is the influence of the pandemic. Millennials lived their adulthood through the lens of the 2008 financial crisis, while for Gen Z the lens is Covid. This has led to Gen Z being labeled as the ‘most stressed-out generation’, according to risk management consultancy firm Hays Companies. This experience has shaped their perceptions of financial health.

“One of the things that really stood out was that Gen Z in particular has a very different banking style to Millennials,” Cunningham. She adds that members of Gen Z are extremely worried about their savings, although they haven’t yet learned how to effectively set aside money. Those surveyed say that they “earn it, spend it, spending more than they earn”, but that’s something they would like to change.

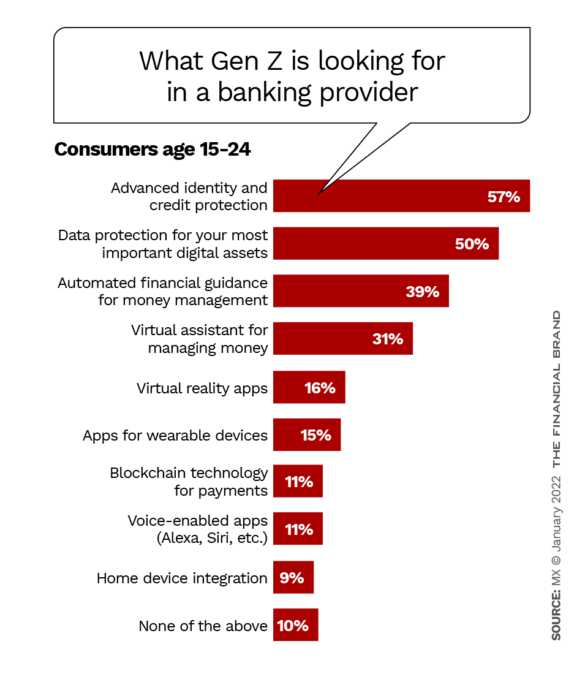

In light of their renewed concerns and fears, the banking industry could reap the rewards of adapting business practices to adhere to the Gen Z lifestyle. Here’s what MX found this generation wants — and needs — the most from banking providers.

Trust and Security

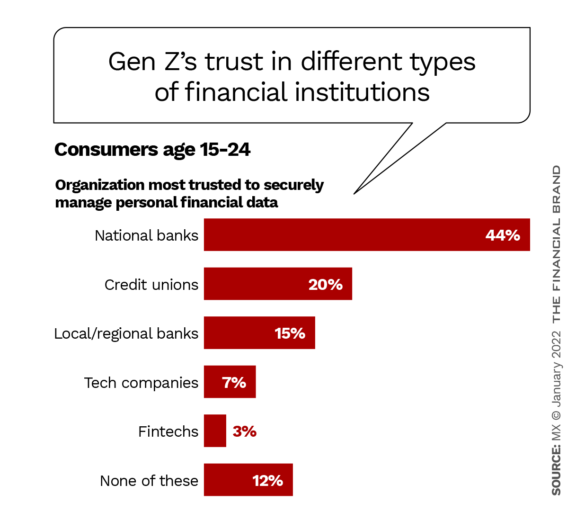

Many banking experts have pegged the deep-set fears of Gen Z with their finances on the generation’s unyielding desire for trust and security from their banking provider — whether it be with a traditional or digital-only player. It may be why these younger consumers are more likely to trust larger megabanks while older subsets — such as Baby Boomers — rely more heavily on smaller, regional banks and credit unions.

It might surprise most bankers to learn that at the end of the day, Gen Z does still turn more often to legacy banks and credit unions than they do the new neobank players in the space. This is due to a fundamental trust that still seems weaved into the traditional banking industry.

Hold On Tight…Then Even Tighter:

The traditional banking industry still holds the key to Gen Z’s trust — but that isn’t guaranteed to last. Banks and credit unions must learn how to keep that trust.

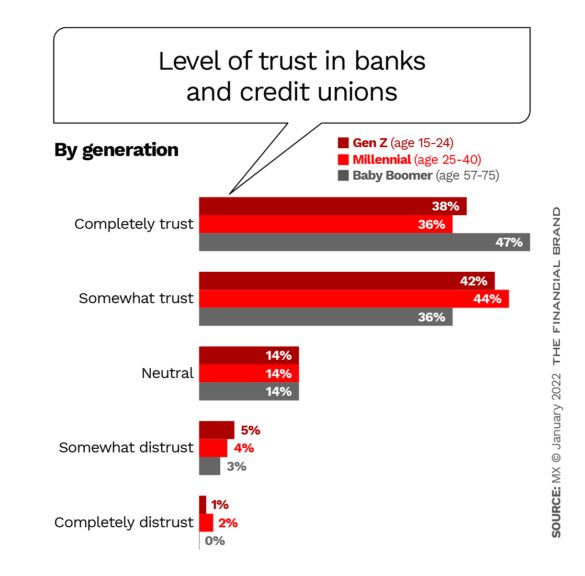

MX also found that “while most respondents from each group indicated that they at least somewhat trust their primary financial institution regarding their personal financial data, Gen Z and Millennials were less likely than Baby Boomers to completely trust their financial institutions.”

MX points out that, moving forward, financial institutions have a particular opportunity to cash in on the inherent trust that Gen Z still has in the traditional banking industry over new, digital-only banks. It may not last forever, so it’s important to make the right moves now.

They Want More Personalized Financial Help

Financial health is just as important — if not more important in most cases — to Gen Z than their physical health. In a 2021 survey, Goldman Sachs’ digital bank Marcus found that two thirds of Gen Zers say they prioritize their financial fitness over their physical fitness. And seven out of ten of them (68%) would rather hire a financial advisor over a personal trainer at the gym if the cost was the same.

Only 16% of Gen Zers (in comparison to about a quarter of Gen X, Millennials and Baby Boomers) described their current finances as “out-of-shape”. Additionally, 63% of Gen Z surveyed say they want to focus on improving their savings in the New Year, 47% say they are looking to improve their credit score and another 46% say they are looking to focus on sticking to a budget, according to Marcus.

Be Aware:

In the New Year, Gen Zers are prioritizing their finances. Almost half (47%) want to improve their credit scores and 46% say they want to establish and keep to a budget. Banks and credit unions can help these consumers with that.

This leads into what MX notes the banking industry should be most highly aware of when it comes to Gen Z. In addition to security and trust, members of this younger generation value financial guidance with products and services and personalized experiences. For instance, a Chase survey found that 44% of Gen Z say they are utilizing a credit monitoring service so they can improve their credit scores and another 76% say they use a credit service to check their scores.

Just because it’s a more financially aware generation doesn’t mean it’ll be easier to take care of. In the webinar with Cunningham, Civista Bank’s CTO Carl Kessler points out personalizing and designing services that cater to Gen Z’s desires can be costly.

“One of the things I want to share with folks is having worked in big regional banks —getting the information available to us so that you can create a personalized experience has been complex — it’s been very expensive,” Kessler says, and it’s difficult. “I’ve been on the on the side of desperately trying to get the marketing folks and the sales folks the information they need to help the customer for the past seven or eight years.”

But, just because it’s hard doesn’t mean it isn’t crucial, he adds, pointing out that it will take analyzing Gen Z’s behavior to understand how to best personalize the experience for them.

A lot of this could very well come down to giving the generation the tools they need to feel comfortable. As mentioned above, Cunningham points out that in the MX report, large portions of Gen Z say not only savings concern them, but so do loans and retirement.

“For a lot of people, a very common theme was that they just don’t feel they have enough financial education to make the right financial decisions in their life. And, because of this, the financial institutions that are going to be successful are the ones providing tools and services to educate their base and improve their financial literacy,” Cunningham says.

P2P, BNPL, Crypto or Money Transfers? Or All of Them?

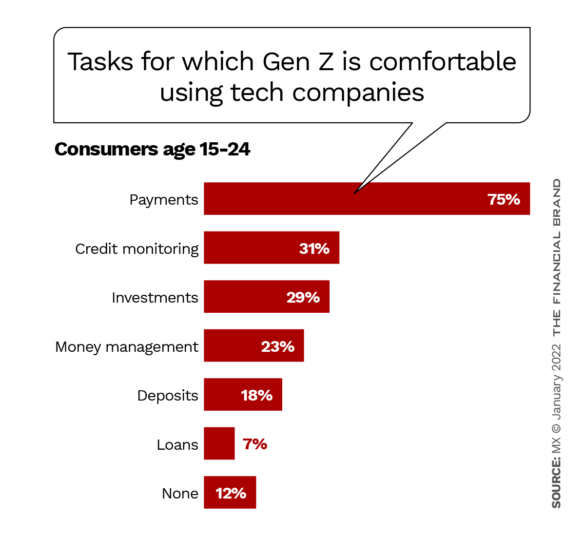

There is an inherent contradiction within Gen Z. They say they value security and trust as a top priority in their banking experience, and that legacy institutions have earned more of their trust than fintech players. Yet, they’re also opening more and more digital-only bank accounts, and more of this generation than any other have quickly adapted to the payment and money movement services offered by many fintech companies, MX points out.

Gen Z enjoys fashioning a quilt-like medley of banking apps. More than four out of five Gen Zers utilize a money transfer fintech app, compared to half of Baby Boomers. Another one out of five used a BNPL service at least once during 2021. MX attributes this to the convenience factor.

“This implies that the experience offered by these companies is so convenient that it overrides customers’ trust concerns,” MX states. “Banks and credit unions have an opportunity to capitalize on their greater levels of trust among consumers by providing convenient payment experiences that are comparable to those offered by tech companies.”

Doing that is not a simple task.

Learn What They Like:

Gen Zers are a major fan of convenience that BNPL and money movement apps offer. If your institution can master these, it will be an easy way to earn their longterm loyalty.

CityBank of Texas, with just over $3 billion in assets, has struggled with this. Figuring out what the next generation wants has been a million-dollar question, Justin Knowles said in the webinar, who is strategic innovation officer at CityBank of Texas. He adds that the culture of an institution plays a major role in this and suggests that banks ask themselves “what is the executive team willing to bite off?” His team, for one, built a committee that is designed to take on projects like BNPL and crypto.

“We serve as a gatekeeper in that role. While projects are trying to come in, we slot them based on a lot of different things: Revenue driving efficiency, resource availability, regulation. He says four or five of the bank’s executive team sits on that committee, as well as other strategic folks across the organization.

Finally, more than half of Gen Z expects their answers are going to be accessible online, the report adds. Live chat, for one, is going to be a key way that Gen Z is going to look to its banking provider for connection and answers to questions. MX points out the investment in chat will be fruitful in attracting and retaining Millennials and Baby Boomers as well.

“Among the support channels financial institutions or fintechs could offer their customers, live chat is the most likely channel to meet the preferences of the largest number of possible customers across younger and older generations,” the report reads.