While many traditional economic indicators, such as employment and consumer spending data, suggest that consumers are doing better financially, insights from the Center for Financial Services Innovation (CFSI) on individual financial behaviors and household-level data depict a significantly less positive story. When the interconnection between spending, saving, borrowing and planning are analyzed, many consumers turn out to be struggling.

Some of the findings in the study:

- Only 28% of Americans are considered financially healthy.

- 47% of consumers spent more than or equal to their income in the last 12 months.

- More than a third of all consumers (36%) are unable to pay all of their bills on time.

- Nearly a quarter (22%) of all Americans say they worried that their food would run out over the last 12 months.

- Nearly a third of Americans (30%) say they have more debt than they can manage.

“The headlines about high employment and steady stock market returns only tell part of the story, and fail to highlight the financial reality for the millions of families in America that cannot afford medical care or are worried about putting food on the table,” said Jennifer Tescher, founder and CEO of CFSI.

Making matters worse, the more vulnerable people in America pay roughly $175 billion annually in fees and interest for financial products and services. The good news is that there are both traditional and non-traditional financial organizations working to leverage technology and market opportunities to provide economic benefits to those households that are in greatest need. The key is to find revenue models that can offset many of the fees and hidden charges that negatively impact trust in financial services organizations.

A study from Omidyar Network and Oliver Wyman investigates how financial institutions can create a sustainable revenue model that will build trust and value at the same time as improving the financial health of middle market consumers. The research includes a review of 350 fintech firms, interviews with more than 50 industry leaders, and insights drawn from consumers across demographic and geographic spectrums. While no all-in-one solution has surfaced yet, the study finds that the potential exists for a sustainable model in the expanding banking ecosystem.

Read More: Where’s the Marketing ROI on Financial Literacy Programs?

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

A Time for Action

With more than 7 in 10 households being considered financially unhealthy by CFSI, the time is now for building financial stability options by both traditional and non-traditional financial services organizations. “An emerging cohort of fintech startups is taking advantage of lower-cost digital operations and distribution, nimble innovation cultures, user-friendly tech build outs, and the lack of legacy profit margins to help consumers manage their finances more effectively,” states the Omidyar Network and Oliver Wyman research.

“It’s 2018. We have big data, AI, machine learning and mobile ubiquity.,” says Ron Shevlin, Director of Research at Cornerstone Advisors and a contributor to the repor. “What consumers and financial services providers need is a finhealth services ecosystem – a connected and integrated set of financial health products and services that consumers or third parties are willing to pay for.”

Adds Shevlin: “If we’re willing to pay $5 for a flavored latte, it’s not inconceivable that we would pay $5 for a finhealth product or service.”

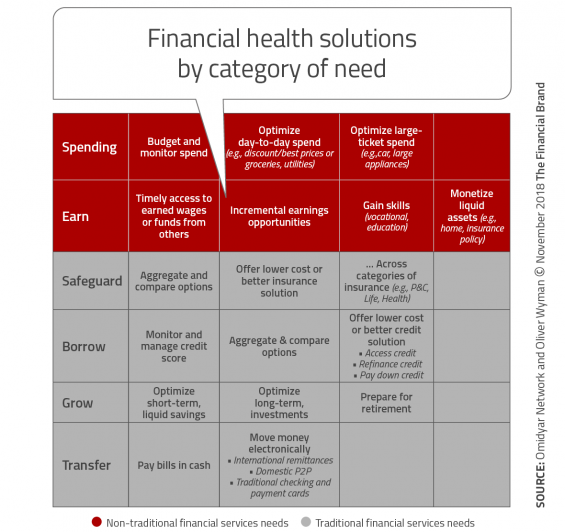

Interestingly, across the spectrum of consumer financial needs, the study found more than 15 tools that could be integrated to create as much as $2,000 to $3,500 in economic benefit for consumers who have a median of about $45,000 in annual post-tax household income.

Unfortunately, the deployment of these possible solutions is hampered by the lack of public awareness of fintech providers, the lack of trust in all financial organizations, and current regulatory hurdles. On top of these challenges, the monetization of these solutions needs to take into account the reality that most consumers believe there is a lack of fee transparency and that financial firms only look out for themselves.

Bottom line, building a sustainable revenue model is of paramount importance when looking to improve financial health of consumers. The study found the following challenges with monetization strategies:

- Low levels of consumer engagement

- Data security concerns

- Delayed gratification (financial wellness is a long-term journey)

- Regulation and compliance scrutiny

Consumers Have Several Unmet Needs

In focus groups, the research found that there was no single goal mentioned related to financial wellness. Some consumers wanted to spend less, others to improve their credit, buy a home, and/or switch jobs. The less-wealthy households were more likely to want to avoid situations that caused financial stress. This group was also more likely to mention shorter-term financial solutions, such as saving money or finding a second job.

As income rose, so did the horizon of solutions desired. These consumers wanted more wealth opportunities and were more concerned about insurance or buying a house. These participants also wanted solutions that provided financial advice or investing tools.

The less financially stable households were more likely to have a positive impression of solutions that were less expensive to use, easiest to use, and that had the least amount of associated risk. Data privacy proved an overarching concern.

Finally, any solution had to provide complete pricing transparency with those solutions that clearly communicated the value of the solution being best received. Transparency included simplicity of fee structure.

Read More: 6 Steps to Build a Marketing Strategy Around Financial Education

Alternative Revenue Models Are Available

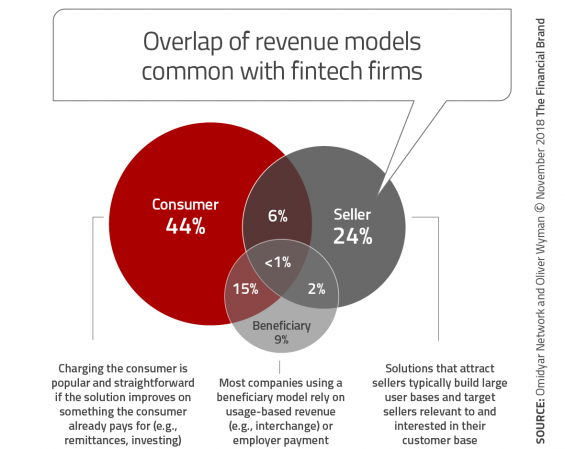

The foundation of a sustainable monetization strategy is determining how value can be created and who should pay for this model. Three basic payer options can be set up:

- Consumers can pay directly to solution providers.

- Third-party solution providers can pay for access to consumer and their insights (lenders, insurers, merchants, etc.).

- Third-party beneficiaries of a better-served consumer (merchants, employers, etc.)

Just as important as the revenue model is determining how the revenue can be structured and applied in the new banking ecosystem, where multiple partners are integrated on behalf of the consumer. Currently, most financial health fintech options fall into one of eight high-level categories.

Consumer Pay

- Subscription or use fee (Digit)

- ‘Freemium’ cross-sell to paid solution (MoneyLion)

- Benefit sharing (Truebill)

Third-party seller

- Compensated referral (Credit Karma)

- Advertising fee (Mint)

Third-party beneficiary

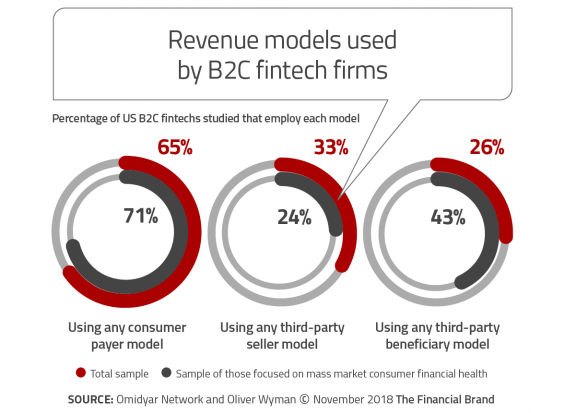

The research finds that there is no universal solution. However, 65% of the companies studied currently use the direct consumer payment approach. The study also found that the startups that have received the most funding have used technology to reduce costs on traditional financial services (as opposed to working from a revenue perspective).

While roughly three-quarters of financial health solutions today rely on a single type of revenue, firms with multiple sources of revenue have raised twice as much funding from investors as those with just one revenue source, says the research. The firms discovered that as organizations mature, a wider array of revenue options is often considered.

Bradley Leimer, co-founder of Unconventional Ventures and contributor to the report states, “What is most critical about this analysis is that there are revenue models beyond credit that have proven to be not only profitable, but also act in the best interest of the consumer.”

Leimer continues: “The study shows that there are many paths toward doing well by doing something good for the customer, and that these opportunities should resonate not just with fintech startups, but also with teams throughout traditional banking.”

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Mass Market Financial Health Options

Today, the majority of mass market-focused financial health firms charge the consumer directly for their offerings. Alternatively, fintech organizations not only are less likely to charge directly, but they are also moving away from an emphasis on “fee transparency” to one that better positions the “value” of the new solution.

Mass market solutions also tend to rely on referral networks for customers as compared to traditional marketing. By depending on referrals, mass market solution providers can select the right mix of alternative solutions for their customers, avoiding conflicts of interests associated with single product delivery.

Mass market solution providers are also more likely to develop new revenue options from beneficiaries (such as employers) who are likely to derive financial benefit from the improved financial health of financially strapped employees. In many cases, this means a repositioning of the new revenue model as being good for everyone as opposed to just being good for the individual consumer.

Cultural Shifts Needed to Increase Trust

There is momentum building across the financial services industry to look at guiding principles within both traditional and non-traditional institutions. With a focus on a commitment to financial health, this involves a cultural, strategic and process shift within organizations.

It also involves a reevaluation of how services are delivered to the underserved consumer, with an eye on both risk and revenue. Finally, the metrics for success must be reconsidered given the alternative revenue models possible. Ultimately, the consumer, financial services organizations and investors should all benefit.

The research stopped short of landing on a single, all-in-one solution. Instead, it provided several strategies that could create sustainable revenues and also improve the financial health of consumers. In doing so, there is a halo effect that improves the overall economy while increasing the trust in the financial services industry.