Executives at financial institutions of all sizes ranked their progress with digital transformation as only a 58 on a scale of 0-100, according to research by Alkami Technology.

When asked about their strategic priorities for digital banking transformation, these same executives stated their top three strategic priorities as optimizing processes and operations (41%), gaining a competitive advantage (31%), and increasing top-line growth (29%).

The question becomes, do these priorities positively impact the consumer, who is making their choice of financial institutions based on the ease of relationship initiation and engagement, the integration of payments, and the commitment to financial wellness across the customer journey? Despite a continued focus on efficiency, organizations must double down on customer experience differentiation.

“For many financial institutions, back-office processes can hamper the ability to digitize the customer experience,” states Allison Cerra, Chief Marketing Officer at Alkami Technology. “Banks and credit unions need to refine the goal of their transformation, and identify what that means across the organization.” Services that scale with you. Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance. Read More about The Power of Localized Marketing in Financial Services

Fractional Marketing for Financial Brands

The Power of Localized Marketing in Financial Services

Customer Expectations Driving Digital Change

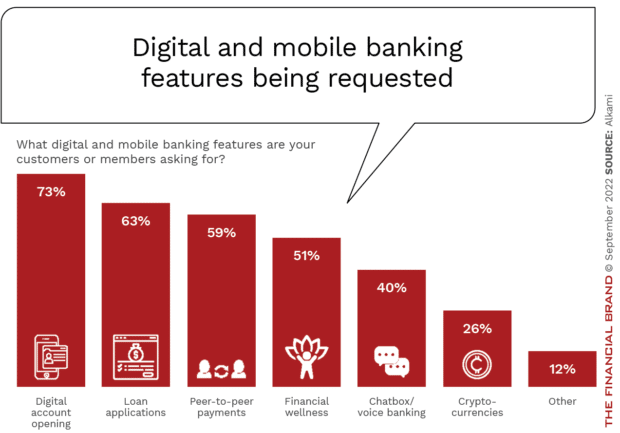

Banks and credit unions are trying to keep pace with the expectations of consumers, who have significantly altered the way they conduct banking. From the opening of new deposit and loan relationships, to the way payments are made, financial institutions need to transform from the inside out to remain competitive. Innovation at both speed and scale beyond iterative product development is more important than ever, as non-bank organizations are educating consumers on what is possible in a digital world.

While consumers are less likely to set foot in a branch since the pandemic and before, device-based banking has led them to engage with banks and credit unions significantly more often — usually on a daily basis and often several times per day. This opens the door for greater engagement and time-based recommendations.

The Alkami research notes four major trends as banking seeks to adjust to a significantly more digital ecosystem. These are:

- Support digital payments

- Collaborate with fintechs

- Focus on hyper-personalization

- Uncover data and AI opportunities

Each trend is covered below.

1. Support Digital Payments

The fastest area of change in banking is around the way people pay. While cash is still used for many transactions, the skyrocketing use of cashless and contactless payments is occurring with all segments of consumers and within all industries.

According to McKinsey, more than 80% of Americans use digital payments, including browser-based or in-app online purchases, in-store checkout using a mobile phone and/or QR code, and person-to-person (P2P) payments.

Avoid Fragmented Transformation:

A unified redesign of payment architecture is required as opposed to piecemeal tweaks driven by compliance necessities.

Accenture found that seven out of ten banking executives believe that transforming the payment industry is at the core of their larger digital banking transformation programs. Unfortunately, while financial institutions recognize the need for innovative thinking and redesigning their payment programs, few have yet taken the steps necessary to measurably benefit from this changing landscape. To succeed, financial institutions will need to invest in both the development of new technologies and the talent to keep those products current and seamless.

Read More: 7 Major Payment Trends that Will Shake Up Banking

2. Collaborate with Fintechs

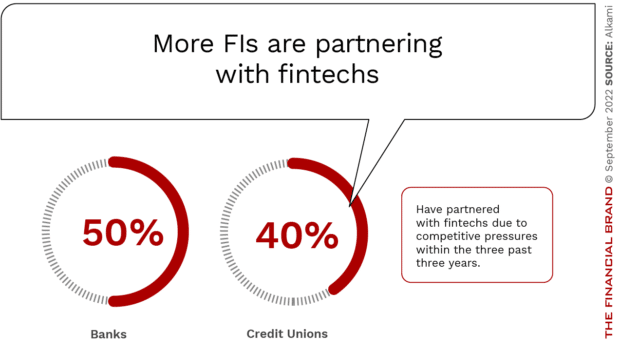

Many executives within traditional banking organizations still consider fintech companies as an enormous competitive threat due to their digital technology, agility and ability to transform data into highly personalized engagements. However, more bankers than ever now see fintechs as a gateway to innovation. Partnering with fintech firms has jump-started many innovation initiatives at banks and credit unions of all sizes.

That is not to say that alternative financial providers are not impacting the competitive balance within banking. While very few consumers are leaving their existing financial providers, people increasingly are diversifying their financial relationships by adding accounts from non-traditional players. The good news is that traditional banks and credit unions have a level of trust and familiarity with account holders that most non-traditional financial institutions have not attained.

According to the Alkami research, “Some financial institutions are profitably white labeling fintech products on their application program interfaces (APIs) to let third-party developers build their own financial products with existing architecture. Others are skipping that process altogether, allowing fintech apps like PayPal or Venmo to establish digital wallets on their site.” As an alternative, some banks and credit unions are buying fintech properties outright.

3. Focus on Hyper-personalization

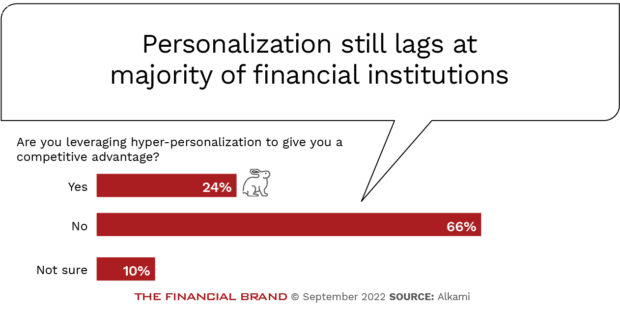

Consumers have come to expect highly personalized digital interactions across all industries. The benefit for the consumer is a highly relevant level of service that creates loyalty by recognizing past interactions and predicting future needs. This level of personalization often increases sales and engagement, which increases revenue.

The Alkami research found that only about a quarter of survey respondents reported using hyper-personalization to attain a competitive advantage, while two-thirds said they did not. Often, the inability to deliver contextual communication is due to the lack of data and analytic capabilities to drive strategies. “As banks strive to take advantage of hyper-personalization, concepts like user interface (UI) and user experience (UX) must remain at the forefront,” states Alkami.

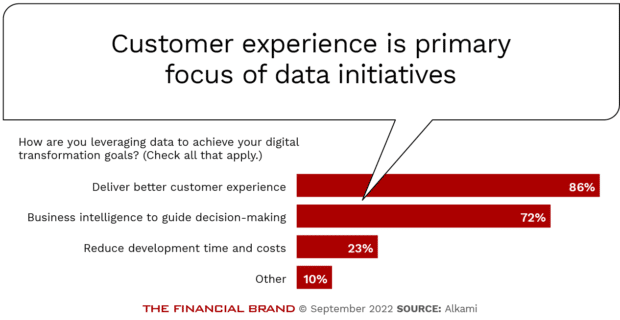

4. Uncover Data and AI Opportunities

Most banks and credit unions already are using some form of data analysis to optimize performance or tap new markets. Many institutions are also using data to deliver a better member and customer experience (86%), guide decision-making (72%), and reduce development time and costs (23%) according to Alkami. The challenge is that most efforts are in their infancy, due to infrastructure, data, and talent shortcomings.

The key to success is to unlock the information embedded within internal and external data to get a clearer picture of clients’ future needs in order to prepare real-time contextual recommendations. This will drive engagement and loyalty. It is also imperative to try to democratize the distribution and use of insights across the organization.

Finally, AI technologies should also be used to lower the bank or credit union’s costs through increased automation.

Prioritize for Success

During periods of economic uncertainty, financial institutions can’t afford to halt their investment in digital banking transformation. Instead, banks and credit unions must prioritize strategies for the greatest return on investment in the shortest period of time. This should not ignore longer-term, foundational investments, but should balance short- and long-term strategies.

These strategies must include the modernization of existing payments infrastructure, enhancement of innovation strategies (including the collaboration with third parties), the use of data and AI to improve customer experiences, and increased deployment of personalized engagement that reflects the needs of the consumer in real-time.