One of the major impacts of the pandemic is the increased comfort level consumers have with digital interactions and the decreased reliance on bank branches. This has significantly impacted the array of financial institutions a consumer will consider when they want a financial solution, and where they are opening new accounts. The result is a dramatic increase in the number of consumers who have their primary banking account at a fintech and/or big tech organization.

To respond to this shift in banking loyalties, traditional financial institutions must decrease their reliance on branch footprint, and consider a much broader digital account acquisition strategy to generate new deposit, loan and payments growth. For organizations smaller than the largest megabanks, there will also be the need to target specific customer segments at scale, building differentiated offerings.

Wake-Up Call for Traditional Banks

Financial institutions are realizing that the increase in digital banking use is not a temporary phenomenon caused by the pandemic, but a seismic and permanent shift in the way consumers and businesses conduct daily banking. This shift is impacting the way customer experiences must be enhanced and relationship engagement increased.

According to research from PwC, there’s a large and growing segment of the population that can be considered ‘digital natives‘, with a preference for avoiding branches and conducting all of their business on digital channels (32%). At the same time, there is a shrinking segment of consumers who prefer digital channels but also like having a local branch. The reduction in this segment was caused by some consumers shifting to a digital-only behavior, while others reverted to their pre-pandemic branch-based behavior.

The decrease in physical branch usage began way before the pandemic, with consumers in all age categories embracing digital alternatives to save time. What is different today is that this flight to digital is also beginning to impact the organizations consumers are choosing to conduct business with. More than ever, existing customer loyalty is being challenged by channel agnostic options where data and applied analytics allow a customer to get more personalized solutions when and where they desire.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Fractional Marketing for Financial Brands

Services that scale with you.

Consumers Moving to Alternative Providers

Over the past decade, non-traditional financial institutions have entered the banking ecosystem, offering digital-only specialized solutions. The pandemic served to accelerate the shift away from traditional branch-based banks to digital banks, suggesting an increased level of trust and overall comfort with big tech and fintech alternatives.

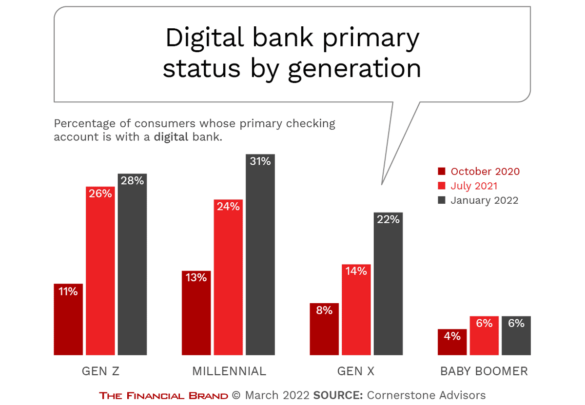

A study from Cornerstone Advisors found that the percentage of Americans whose primary checking account is with a digital bank has skyrocketed since 2020. According to the research, more than a quarter of consumers aged 21 to 26 (Gen Z) and nearly a third of Millennials (age 27 to 41) now call a digital bank their primary checking account provider. For those who think that only younger consumers are making the switch, the percentage of Gen X consumers (age 42-56) who have their primary account with a digital bank grew from 8% to 22% since 2020.

“Digital banks aren’t the ‘challenger’ banks, anymore,” states Ron Shevlin from Cornerstone Advisors. “They won. More Gen Zers and Millennials call a digital bank their primary checking account provider than those that consider a community bank or a credit union to be their primary checking account provider – combined.” The research from Cornerstone found that six in ten Gen Z consumers and Millennials whose primary checking account is with a digital bank has that account with Chime, PayPal or Cash App.

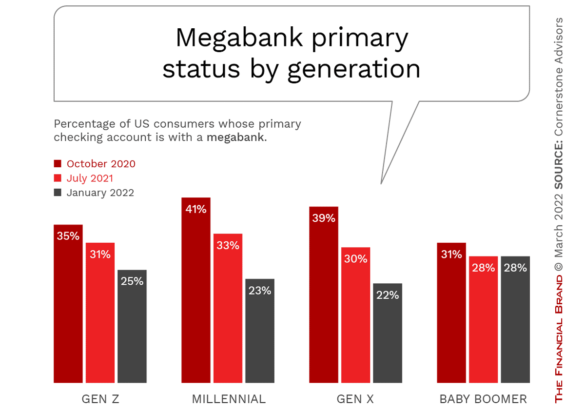

The impact of this shift is not equal across all types of financial institutions. Interestingly, the most significant negative impact is being felt by the largest traditional banks. While the top megabanks dominated consumers’ primary checking account assignments as recently as 2020, the percentage of Gen Z consumers whose primary checking account is with a top five bank has dropped from 35% to 25%. Among Millennials and Gen X consumers, the percentages declined by almost half.

Beyond the changes in primary account growth at megabanks, credit unions have also been negatively impacted, with the percentage of Gen Z, Millennial, and Gen X consumers calling a credit union their primary checking account provider declining by roughly 30% between 2020 and early 2022. Interestingly, community banks actually gained share in primary checking account status across four generational segments during this same period, with regional banks being somewhat unaffected.

Read More:

- Do People Want to Visit Branches? Not When Digital Channels Work

- Future of Branches Debated in a Transformed Digital Ecosystem

- Are Consumers Ready for a World Without Bank Branches?

Definition of Primary Bank Being Redefined

There was a time when the definition of the primary banking relationship was easy. A consumer had a checking account, a savings account, and a lending relationship. While some consumers held all of these relationships at a single financial institution, the checking account was usually considered the primary financial account if multiple organizations served the financial needs of the consumer.

Over the years, the definition of a primary financial account has evolved, as consumers opened multiple checking, savings, lending and investment accounts and as competition for loyalty increased. Today, it is not uncommon for a consumer to have close to a dozen financial relationships serving multiple purposes.

Primary Financial Institution:

“With many consumers having multiple checking accounts, multiple payment accounts, multiple investment accounts, and using various tools to help them manage all their accounts and relationships, the idea of a ‘primary financial institution’ has become outdated.” – Ron Shevlin

As a result, we are seeing a significant shift in the definition of a primary bank, with the checking account relationship becoming less dominant, and the level of financial support and daily engagement growing in importance. According to the research by PwC, while 60% of consumers over 55 define their primary bank as where they hold their primary checking account, only 34% of Gen Z consumers use the same criteria. For this segment, they consider their primary financial institution as the organization they trust to give the best advice or work in their best interest. This loyalty is often reflected, as in the past, by where the greatest level of engagement occurs.

The research also found that there’s a small – but growing – share of consumers who define their primary bank as the one that acts in the best interest for the environmental and societal issues. 14% of Gen Z consumers and 12% of Millennials used this definition, with only 2% of Baby Boomers using this criteria.

As Shevlin states, “With many consumers having multiple checking accounts, multiple payment accounts, multiple investment accounts, and using various tools to help them manage all their accounts and relationships, the idea of a ‘primary financial institution’ has become outdated.” Engagement and emotional attachment to a financial organization is increasingly framing the definition of a primary financial relationship.

Growth in an Increasingly Competitive Marketplace

Your bank or credit union may not been seeing a wave of account closures. This should not provide comfort in a digitally connected marketplace. Consumers and businesses no longer need to close existing accounts to put longstanding relationships at risk. Opening a new digital banking relationship has never been faster or easier. In addition, the appeal of highly specialized financial solutions that make financial wellness easier has never been greater.

Consumers are moving business to alternative digital banks that don’t have branches, but meet specialized transaction, savings, investing, payments and borrowing needs. The growth of these non-traditional relationships have come at the expense traditional banking organizations.

More than ever, the potential to target a narrower segment of the population across a much broader national footprint is a viable growth strategy. This requires a shift from a product to a packaged solutions strategy that meets the specific needs of a specific segment.

Chris Gorman, the CEO of KeyBank refers to this as a ‘targeted scale‘ strategy for growth. KeyBank has used this strategy to serve the medical and technology communities extremely well through new products and services, focused content, and the building of third-party partnerships.

Chime also uses a similar strategy to reach consumers who aren’t being served well by traditional banks, offering a secured credit card for those looking to build a credit history, and a transaction account without fees.

Building a national digital relationship strategy will require a modern digital banking infrastructure that can support banking the way a digital consumer expects. There will be a need for an API-enabled platform that is both flexible and agile to respond to marketplace opportunities. There is also the need to leverage a robust data and analytics platform that is cloud-based.