First the TCF Financial and Chemical Bank merger. Then BB&T and SunTrust. These developments throw a glaring reality about the banking industry into sharp focus. The biggest U.S. banks have budgets so large, staffing so deep, and brands so well recognized that the competitive picture in U.S. banking has sharply tilted in their favor. This state of affairs has been aided to no small degree by changes in consumer habits and expectations.

“There’s a technology and analytics arms race in play now where the big guys are betting they can outspend and outdo the competition,” says Pradip Patiath, senior partner and co-lead of McKinsey’s consumer and small business banking practice in North America. “When you’ve got banks like Chase and BofA spending over $7 billion a year on technology and yours is much less, how do you compete?” The consultant says the two mergers mentioned above are a reflection, in part, of this growing dilemma.

“When you’ve got banks like Chase and BofA spending over $7 billion a year on technology and your budget is much less, how do you compete?”

— Pradip Patiath, McKinsey

McKinsey analysts and researchers have been tracking a tectonic shift in U.S. retail banking for some time. “Until a few year ago, U.S. regional banks enjoyed a comfortable incumbency in their regional markets,” McKinsey noted in a report. “In the last few years, however, the balance, in which regional banks and megabanks could succeed on their own terms, has started to shift under the pressure of changing customer preferences.”

In the old days, if a bank or credit union built more branches it ended up with a greater share of new accounts, at least up to a certain point. After that, results would begin to flatten. The equation was so predictable that it formed a familiar S-curve chart used for years by banks, according to Patiath, a 22-year banking industry veteran.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

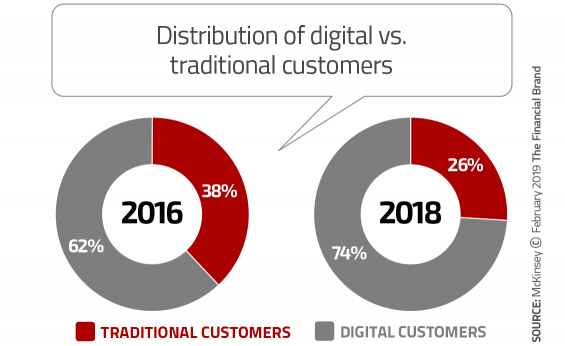

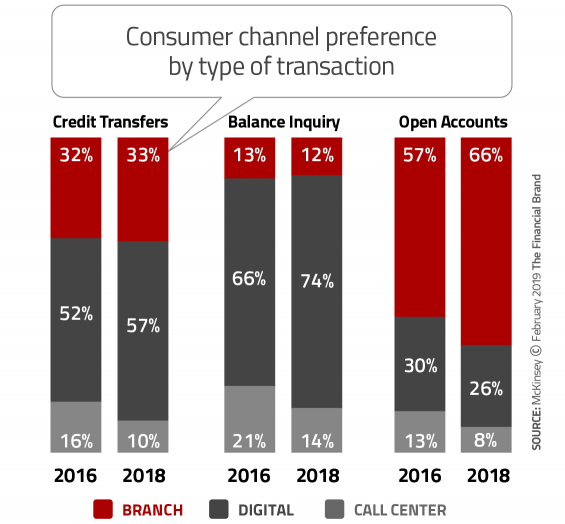

Patiath says McKinsey’s research shows that the once-reliable branch/account equation is now broken. The S-curve flattens out much earlier than it did previously. This means that the next branch added in a market does not give institutions the lift it used to. And the one after that, even less. One factor contributing to this shift is that transactions are flowing out of branches and into digital channels.

However, even though a majority of consumers want options and features that match what they have become accustomed to from digital-first companies such as Amazon and Netflix, a significant portion of consumers continue to value face-to-face interaction for more complicated needs, McKinsey’s report states. Compounding the complexities of the modern retail banking model, consumers expect all the channels to work together seamlessly.

Financial institutions need to rethink and redesign their distribution strategies, says McKinsey. Their analysts argue that to have a better shot at succeeding, retail banking providers need a different way to measure the effectiveness of their customer acquisition and retention strategies, since the old branch-based S-curve measure has broken.

Read More:

- Getting Branch Design Right in the Digital Age

- Rethinking Branch Networks And The Retail Experience in a Mobile-First World

- Branches vs. Digital: Hitting The Retail Delivery Sweet Spot in Banking

The Four Components of Customer Mindshare

In an effort to produce a better predictor of deposit market share, McKinsey plugged every kind of variable into various algorithms. The exercise revealed four variables that were more important than others:

- Physical footprint — A financial institution’s branches, ATMs and other physical points of presence. “Physical density still matters,” says Patiath, “just less so than before.”

- Digital maturity — The extent and sophistication of a institution’s web and mobile capabilities. Are you as good as Apple and other digital leaders? Or are you just kind of middling?

- Share of voice — An institution’s advertising and marketing representation in specific markets relative to other financial brands.

- Customer experience — A banking provider’s ability to fulfill consumers’ expectations across all channels. What are people saying online? What is an institution’s rating for its mobile app?

These four variables, taken together, yield a new equation that McKinsey dubs “customer mindshare” — the combination of products, services, functions and access that encourages greater engagement between a financial institution and its target audience. The firm believes this concept will help financial institutions better quantify their position in the marketplace and identify more effective ways to improve it.

How Financial Brands Can Dominate Without Branches

Patiath points out that the relative weight of these four variables will vary by market; the coefficients of all four may be different in Chicago, New York or elsewhere.

Speaking with The Financial Brand, Patiath gave an example of how these variables can play out. In one market, he explains, a traditional bank without branches in that area had top market share because it scored strongly along the other three parameters. It did this by putting ads everywhere — especially in digital media channels — and by spending heavily on customer experience elements such as a top-notch digital contact center.

“When we surveyed consumers in that location to see who was the top dog, people named the bank with no branches by a two-thirds margin.” It’s a clear example of how overplaying other variables can help a bank or credit union neutralize physical branch density as a factor in consumers’ decisions.

It’s important to note, however, that in some markets physical density does still matter — a lot — such as in large, high-growth markets. In Chicago, for example, it might be more appropriate to emphasize marketing and customer experience versus branches, elsewhere it might be just the opposite.

The largest banks with the deepest pockets can do it all if they choose, but even so they are investing selectively. Chase, for example, has been adding branches in certain key markets, even while massively investing in digital. But Patiath staunchly believes that this level of competition isn’t the end of the story for regional and community banking institutions. By careful analysis of the relative importance of the four variables, he believe, they can use their more limited resources effectively.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

It Takes a Scalpel, Not a Sledgehammer

“If you’re one of the 5,500 banks in the U.S. that aren’t spending as much as Chase is, you have to find a more targeted formula,” says Patiath. “You need to resort to a scalpel versus a sledgehammer because you will never outspend a large bank.” To assume you just have to do everything they do — match them in all four variables — is an impractical and losing strategy now, he adds.

And yet Patiath says the typical practice is to take the budget and slather it like peanut-butter equally across all four variables equally. Or, worse, they “just keep doing what the institution’s been doing for decades.” Patiath calls that using a sledgehammer. “It isn’t going to work anymore.”

Instead Patiath recommends banks and credit unions look at each of the four variables market by market to see which will give them the most lift. A small regional bank operating in three major markets, for example, should separately model each market by the four variables of customer mindshare. The equation might show that deposit accounts equal X-times branch density, plus 2X times share of voice, and so forth. Each variable would have a weighting depending on the market.

“You’re basically saying, ‘For every $100 I have to spend next year, I should spend this much on branches, this much on digital, this much on market share, and so on. It would be a different recipe for each market,” Patiath explains. That could mean $0 for one or more of the variables in a particular market. He describes this as “using a scalpel.”

He acknowledges that for financial institutions below about $5 billion in assets the formula might be a little different. “They may want to double down on the relationship model that sets them apart from the large institutions.”

Three Strategies to Compete With the Big Banks

For many banks and credit unions, “digital maturity” is the variable that will cause them the most angst, if for no other reason than it’s a fast moving area demanding continual upgrades. McKinsey shared the following recommendations for the financial institutions in this situation:

1. Understand and build on your advantage. “The sharpness of your value proposition is critical,” says Patiath. There are many niche opportunities in banking that pass under the radar of the largest banks — hundreds of them. Smaller banks and credit unions should “understand the niche markets; understand where you have advantage and go after it.

2. Spend your marginal dollars wisely. “If you’re a midsize or smaller institution, those investment dollars need to go much further than the same dollar goes for a very large bank. Spend it based on empirical evidence built around the four variables.”

3. Build your digital marketing capabilities. Use of digital marketing and analytics to drive marketing ROI will allow regional banks to better compete for share of voice in their selected markets.