Do you ever feel like you are pushing products to customers just to meet unit goals?

All bankers start out with a sincere desire to help consumers positively progress along their financial lives, but as financial institutions have moved further into the digital space, those connection points become more challenging. But, with financial literacy remaining a huge issue in the U.S., consumers need support from their bank or credit union more than ever.

Financial institutions can still connect with customers at pivotal times in their financial lives. Doing so requires three things:

- Knowing customers holistically to better understand their needs.

- Anticipating customer needs earlier.

- Developing “always on” campaigns focused on sensing and responding to the emerging needs of consumers.

Let’s dive a bit into each one of these core competencies.

1. Getting a Holistic View of Customers

Even financial institutions with world-class databases only know a small sliver about their customers, and that knowledge is based on direct interactions. In order to round out their view of the customer they need rich and diverse third-party data.

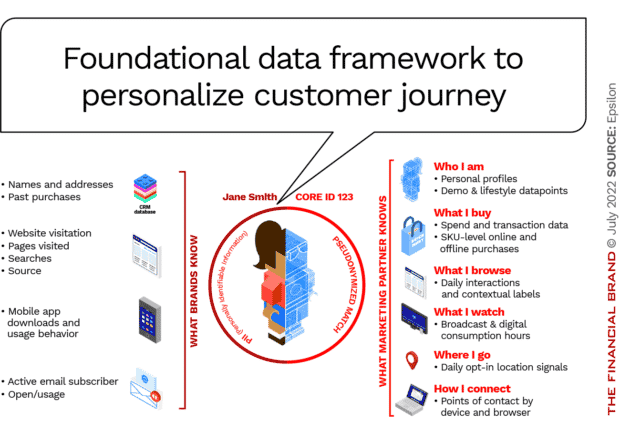

One of the challenges in doing so is the ability to align the various third-party data sets to your customer data, and that can be solved through strong identity resolution. Identity enables bank marketers to get a comprehensive view of customers, and if done with a reliable partner, can be done in a privacy-safe way that personalizes each person’s journey, driving better outcomes for your customers and your brand.

The power of identity resolution provides a clearer view into who your customers are across channels — online and offline — and does so with a privacy-first framework. Much like the graphic below:

In the graphic you can see the data from a brand can be matched with a myriad of signals from consumers, all of which help bank marketers formulate the right messages at the right time for each customer.

2. Anticipating Banking Customer Needs Earlier

This holistic view of the customer not only helps marketers understand what life stage the person is in today, but also where they’ll be tomorrow and beyond. Consumers are constantly evolving, and it is during these changes where they are most in need of guidance.

To anticipate consumers’ needs requires two things:

- Low latency data.

- Well-developed signals that provide early indication of an emerging life-stage change.

A great example is a college senior who is graduating in a few months, relocating to a new city, renting an apartment and starting their first full-time job. You can reasonably break down this person’s life-stage chain as follows:

While the early indicators listed in the table above are fairly intuitive, financial institutions can let the data “speak for itself.” Working with a marketing partner they can take conversion files and look at the low-latency data for the previous year or more before the conversion events to identify customer behaviors that are predictive.

Using this method, one financial institution we work with uncovered a pattern where a customer’s interest in interior decorating — followed by home theater, home repair and DIY projects — spiked three months before they opened a mortgage. Imagine if your current checking and savings customers displayed this predictive behavior and you were able to begin driving awareness of your mortgage options three to six months before they were going to open a mortgage with someone. What impact would that have on your cross-sell performance?

3. The Value of Always-On Campaigns

Sensing and responding to these life-stage shifts means you need to align your marketing efforts to the timing of the customer and not your annual campaign calendar.

Quarterly campaigns are still important but adding a series of always-on campaigns allows for stronger proactive marketing. Each of these campaigns should sense and respond to a specific life-stage change where the audience selection process is refreshed frequently in order to react to the low-latency signals.

For those institutions testing or implementing journey orchestration, think of these life-stage triggers as kicking off a well-constructed journey that takes advantage of the lead time provided by the early sensing to nurture awareness, and to educate and aid the customer along the path to purchase.

Too often, banks and credit unions only learn an existing customer is interested in refinancing their mortgage after that person asks for their payout amount. By then their sights are already set on an alternative provider who offered a better rate. If the institution had understood their customer’s needs and intent, they could have kept them, often with an offer even better than the competition.

No More ‘Fractured Identities’

This three-pronged approach can be applied across the full spectrum of bank marketing use cases: Acquiring prospective customers as well as cross-selling and mitigating attrition for existing customers. Mentioned above was the key role that identity plays in establishing a more complete view of consumers. The same concept applies to all three elements and the entirety of the marketing process, including activation paths and measurement.

A financial institution with fractured customer identities across these functions is like a person with many watches — they never seem to know what time it is. We see the symptoms of a fractured identity layer crop up in data management, activation, attribution, optimization and journey orchestration.

Financial brands that adopt a strong, consistent identity layer make all of these processes more effective, and in turn, provide better holistic marketing for customers at scale.

Learn more about how you can use marketing enabled by identity with a low latency holistic view of customers and signals-driven always-on campaigns to drive better results for both your institution and its customer.