The status quo in retail banking is tottering. It’s under siege from new technologies, new consumer expectations, new competitors and new regulations. This has forced banks and credit unions to modify their business models, re-prioritize investments, change products and services offered and ramp up innovation efforts. There has also been a rethinking of distribution options, with digital channels significantly increasing in importance.

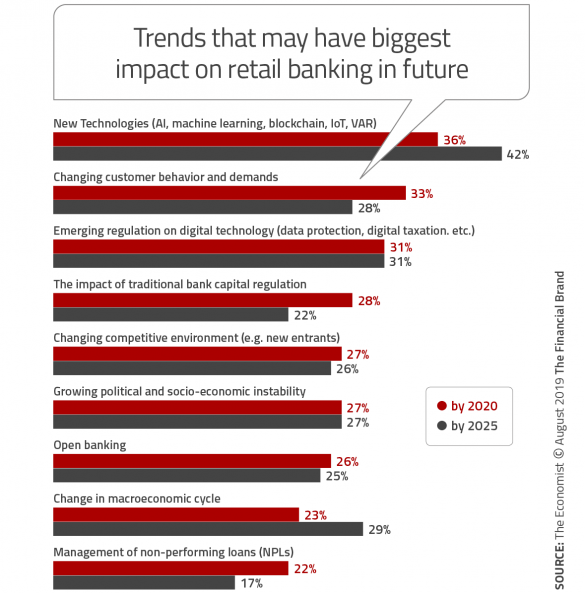

These shifts are reflected in the sixth iteration of a study of the future of retail banking conducted by The Economist Intelligence Unit, on behalf of Temenos. Until recently, the changes in consumer behavior were believed to be the primary impetus for changes in retail banking strategies. For the first time, the key driver for change is considered to be new technologies, such as artificial intelligence, machine learning, blockchain, the Internet of Things and other technologies underpinned by data and advanced analytics. And the forecast from those surveyed is that the importance of new technologies will only get greater in the future (2020 to 2025). This is reinforced by the importance of regulations on data technology – which is also projected to increase in the longer view.

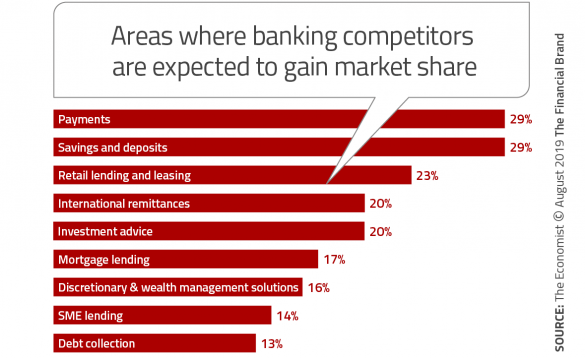

When financial institutions were asked about the impact of areas of banking that are the most vulnerable to outside competition, it was not surprising that payments was ranked at the top, followed by savings/deposits and lending/leasing. We are already seeing the impact of targeted solutions on the foundation of traditional banking in these areas. Aligned with these findings, the non-traditional competitors thought to be the biggest threats in the short-term (2020) were payment players (39%), big tech firms (29%) and peer-to-peer lenders (23%). In the longer term, the biggest threats were considered to be the big tech firms (27%), partnerships between big tech and fintech (26%) and payments players (25%).

Interestingly, neobanks (Starling, N26, Monzo, etc.) were seen as an increasing threat in the longer term, indicating that many bankers are noticing the increase in scale these firms are achieving. The increase in competitive presence of neobanks was not seen as being as much of a threat in North America as in the rest of the world, possibly reflecting the more difficult regulatory environment in the U.S.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Read More:

- Financial Services Entering New Era of Customer Engagement

- 9 Secrets to Building Customer Engagement in Banking

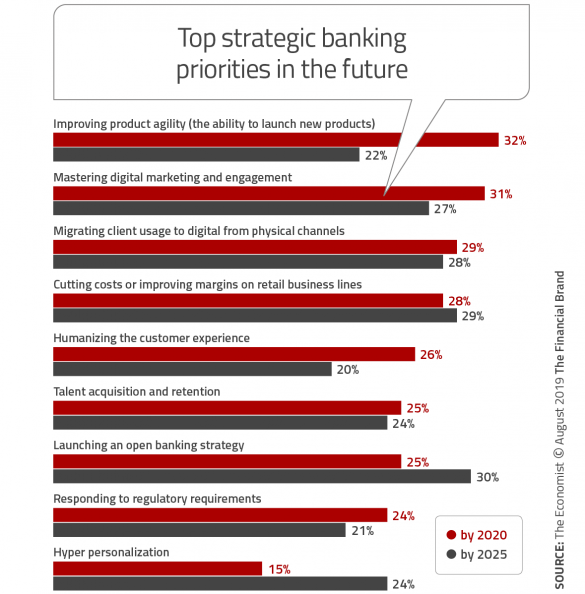

Strategic Priorities Expected to Shift

Similar to the changes expected in the drivers of change and the competitive landscape, financial institutions also see the strategic priorities changing over the next five years. In 2020, banks and credit unions expect the key strategic priorities to be product agility (32%), digital marketing (31%), digital channel migration (29%) and cutting costs (28%), while the priorities in 2025 are expected to be open banking (30%), cutting costs (29%), digital channel migration (28%) and digital marketing (27%). Aligned with the focus on data and advanced analytics, ‘hyper personalization’ increases from 19% to 24% during the five-year span.

In both time periods reviewed, while regulatory strategies were important, they were never as important as the consumer-facing strategies or cutting costs. Obviously, the strategies will adjust if there are privacy issues or a major change in regulatory or compliance emphasis. It is also clear that the focus on talent acquisition and retraining will not decrease in the foreseeable future. The EIU/Temenos report emphasizes that to achieve the desired strategic objectives, there will need to be partnerships between banks and solution providers as well as collaboration between traditional banking organizations. Only with these alignments will organizations be able to be as agile and flexible as the marketplace requires.

Delivering on the Open Banking Promise

Of high awareness within the banking industry, but not yet understood by consumers is the evolving nature of open banking, which has proceeding in stages in Europe and elsewhere, but not yet in the U.S. From the consumer perspective, people want easier ways to manage their money and make their daily life easier. Many financial institutions, on the other hand, are somewhat overwhelmed by the prospects of delivering on the open banking promise. The paradox exists between the desire to deliver more integrated solutions while being transparent around the sharing of data between multiple organizations.

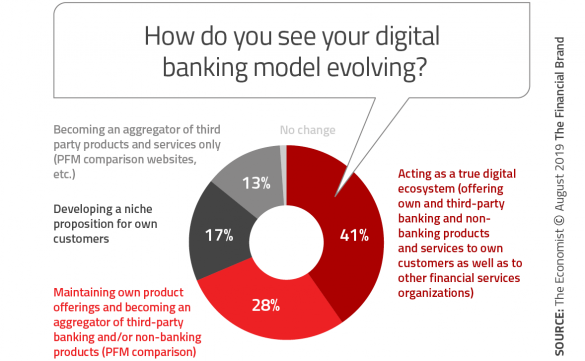

Most of the concerns around open banking revolve around the collection and sharing of data with third parties and the inherent risks around such sharing. There is also the need to educate both the consumer and the employee on data security. The end result is less than clear regulations around open banking, and very few organizations actually being prepared to deliver on what has been promised consumers. That said, it is interesting that more than four in ten financial institutions (41%) are looking beyond just offering banking products in the future.

Building the ‘Bank of the Future’

Each bank and credit union must decide the path they prefer to take in the future. Will they be a multi-service integrated provider of both financial and non-financial services, leveraging the potential power of open banking, or will they retreat to become a specialized niche organization for a specific segment of the banking community? Or, will they seek a partnership with one or more non-traditional providers, aggregating multiple products under one roof. It seems clear that status quo is not a viable option for the long term if an organization is hoping to avoid disintermediation.

“Five years from now, when describing intelligent banking, it will be a bank that is using cloud, AI and other emerging technologies, and will be capable of offering a whole range of innovative services to their customers.”

— Max Chuard, Chief Executive Officer at Temenos

Whatever path is determined to be the best, organizations must make a strategic determination quickly – since the rest of the world is not sitting still. Change is tough when revenues are strong and the risk of change could be great. Historically, traditional banks and credit unions are risk averse and are headed by legacy bankers. But, the need to innovate is evident and many financial institutions are becoming more aggressive with their innovation strategies.

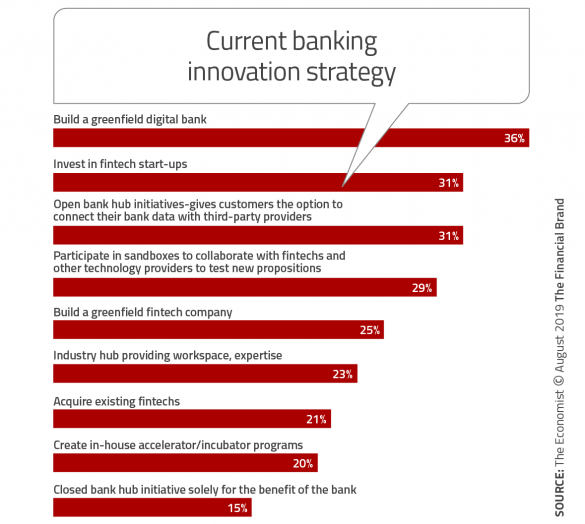

The desire to build ‘greenfield digital banks’ was mentioned by 36% of the survey respondents, illustrating the desire to ‘build something new’. While this strategy allows organizations to build on a strong foundation, this foundation can also hold organizations back from truly innovating and building from the ground up. We have recently seen the closing of some digital banking initiatives (Finn by Chase), where the digital bank was never given the ‘freedom’ to succeed away from the legacy organization.

Other financial institutions also are innovating by collaborating with fintech firms, investing in fintech or building innovation units internally. Whatever strategy is decided upon, it is clear that innovation has become more than just window dressing at many organizations.

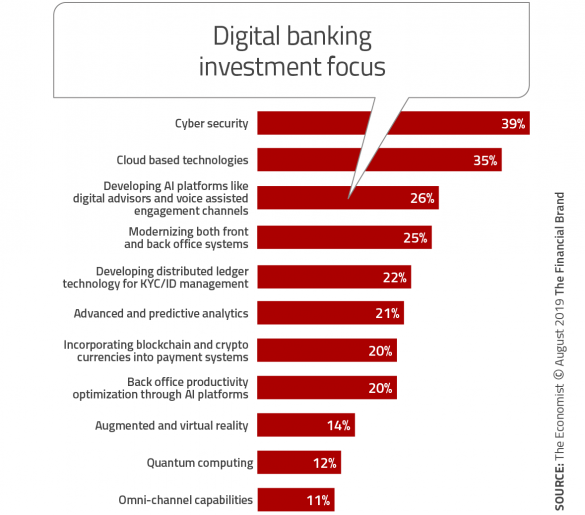

When it comes to digital investment, much of the focus remains on trying to stay ahead of cyber criminals that are becoming increasingly troublesome. Cloud technology, however, is increasingly becoming a priority, illustrating the continued importance of cost cutting at legacy institutions. Thirdly, the increasing importance of using data, advanced analytics and digital technologies for improved experiences cannot be overstated. Part of this deployment of AI and advanced analytics will be to humanize the experience as opposed to automating all components of banking.

More About the Research

In January-March 2019 The Economist Intelligence Unit, on behalf of Temenos, surveyed 405 global banking executives on the changes they see taking place in their industry to 2020 and 2025, their organizational response, and the longer-term impact on their strategic development. This, the sixth iteration of the retail banking survey, focuses on how these retail banks are incorporating and advancing technology delivery for their current and future customers.

The survey respondents were geographically diverse: 25% were drawn from Europe, 25% from Asia-Pacific, 18% from North America, 16% from Africa and the Middle East, and 16% from Latin America.