Here’s a good indicator of what the American consumer now expects from financial institutions:

“If I ever have a question or concern about an order that I just placed, I can just text Apple. They’ll send a message right to my phone and someone will log on in seconds, and text me back the answer to my question … I think Chase, and any major bank, should implement that.”

That quote came from the latest Future of Money survey conducted by Logica. It was said by an anonymous participant interviewed by the researchers, and reveals what financial institution customers have come to demand — which is everything.

“Americans continue to look to financial brands to provide great value and financial advice on how to invest, make the most of their money and manage to a budget,” the study report states. “Financial institutions need to meet these needs with both digital tools and people.”

This, the 10th iteration of the twice-yearly study, was conducted in April 2021. 1,000 U.S. adults completed the online survey.

Shifting Tides:

Compared to a year earlier, the number of consumers ‘not at all stressed’ about their financial situation jumped 12 percentage points to 44%.

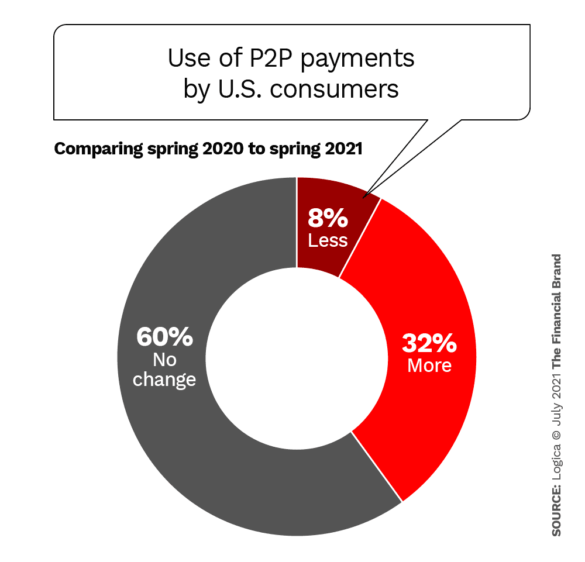

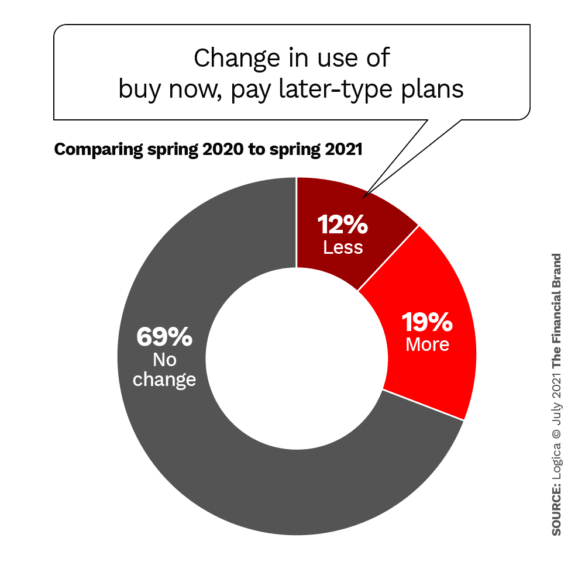

Regarding payments, the study says: “Americans lean toward wanting both choice and standardization in their checkout experience. Top payment methods of debit, credit and apps are mostly showing stabilization for in-person and online payments. Buy now, pay later and installment payment methods are on the rise, particularly with younger Americans and those who are more financially stressed. P2P continues to increase.”

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

How Consumers Want Their Financial Service ‘Delivered’

The survey delved deeply into how consumers engaged with financial brands through the pandemic. Notably, more respondents increased their trust level for financial institutions than had it decreased (15% increased, 13% decreased, 72% stayed the same). By comparison, trust in media/social media decreased for 33% of respondents; trust in employers, government sources, and schools also saw a preponderance of lower scores.

As to what they want from financial institutions, respondents said they would like: tools to help build wealth; better communications with a greater understanding of their individual situation; more advice on managing finances; and better service.

Exactly how respondents wanted to obtain all this was fairly equally split along three lines: 39% preferred talking to a person, 28% preferred digital tools, and 33% wanted both of these, equally.

Split Decision:

If you were looking for a clear signal on digital dominance, sorry, a third of consumers still say they want both face-to-face and digital options for banking.

“People are very astute on how to use digital tools,” said Lilah Raynor, founder and CEO of Logica during a webinar on the survey results. “But there’s also this realization that, well, that doesn’t answer everything. I still need to talk to a person.”

“There’s a need for certain types of tools that you want for different things or in different ways,” said Katrina Noelle, president of KNow Research, which collaborated on the survey. “There are certain comfort levels for using digital tools for balancing your budget or your day-to-day spending and savings. However, when it gets to making a financial plan, or planning for retirement, or going through life stage transitions, there are these moments of needing people, Noelle said during the webinar. “So, it’s this combination approach rather than a landslide in changing behavior.”

Noelle acknowledges that this trend has been seen for several years, “but it has very much escalated.”

Read More:

- The Future of Payments is Fast, Seamless, Safe and Embedded

- Why Bankers Won’t Ditch Branches, Despite Digital’s Explosive Growth

Payment Preferences Shows Signs of Settling Down

Another major section of the survey found that for the first time since the onset of the pandemic payments have stabilized. Logica analysts clearly state that the payments space continues to shift rapidly. The continued rapid growth of P2P payments and buy now, pay later arrangements are evidence. However, the payments section of its Future of Money survey reveals that a year after the pandemic hit the U.S. in full force, radically altering purchase and payment behaviors, there has been some stabilization.

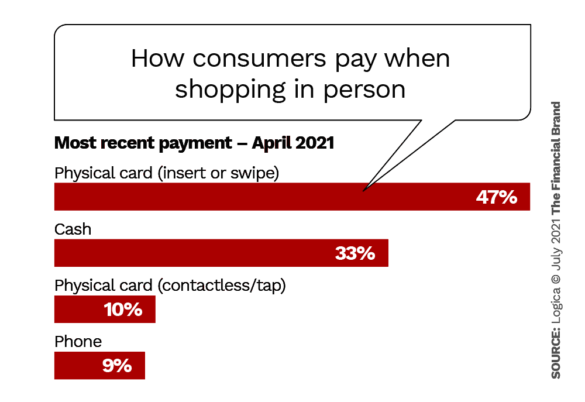

For example, in the Spring of 2020, 36% of consumers preferred debit cards for in-person payments. A year later that was almost identical at 35%. Similarly for credit cards, which took a big hit early in the pandemic, the year-over-year preference dropped only from 30% to 28%. Even preference for cash payments barely moved the needle, dropping from 25% to 23%, despite predictions that greenbacks’ day was done. In fact, 33% of consumers indicated that they used cash for their most recent payment, as shown below.

Lagging far behind for in-person payments are contactless and phone payments — 10% and 9%, respectively, for most-recent purchases.

Behind these numbers is the conclusion that consumers want choice in how they pay, and at the same time they want standardization of payment options at checkout.

“60% like to make a specific choice on how to pay each time versus 40% who always want to pay the same way,” says Raynor. “We have 60% who also like a standardized experience at the checkout versus 40% who don’t care. What that’s really getting at is having that checkout experience in those payment options show up in the same way each time.”

Other big factors in how consumers tend to make payments at checkout are the need to manage to a budget, and to use the most secure means available.

Read More: Banks Could Be the Future of ‘Buy Now, Pay Later’ Lending

Even online payments stabilized

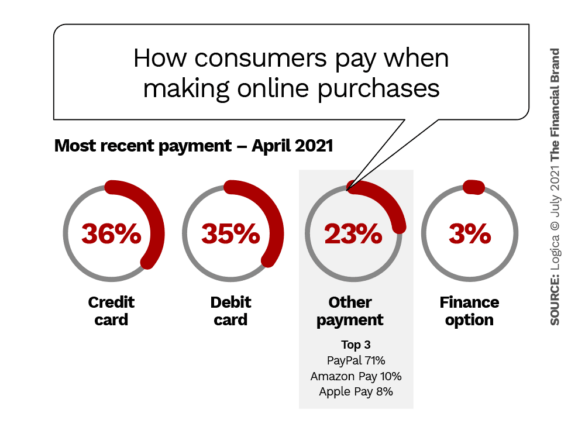

Credit and debit cards also retained their dominance of online payment preferences. 36% of respondents said credit cards and 35% said debit cards were what they used for their most recent payments, well ahead of the 23% who used “other payment options.”

Among these other payments, PayPal dominates at 71%. Other online payment app preferences, in the overall sample, were about a third the size of PayPal. Google Pay hit 26%, while Venmo and Zelle each hit 25%, with Zelle more popular among Baby Boomers.

Younger Generations Quicker to Change

In the nontraditional payment categories, the survey found that about one in three Americans are using P2P, led by Gen Z at 37%, Millennials at 46%, and Gen X at 37%. Only 13% of Baby Boomers use P2P.

Younger generations are starting to use buy now, pay later and similar installment payment plans. Millennials led this category at 27%, followed by Gen X at 24%, and Gen Z at 22%. Again, Baby Boomers trailed at 6%.

“The younger generations are really savvy. Not only are they using tools but they’re also asking for advice, they’re using all resources available to them” said Raynor. “I would definitely pay attention to younger generations, even if they are just starting to earn income. They’re definitely figuring things out pretty quickly.”