The widespread adoption of digital banking technology has not erased the long-running gap between the customer experience financial institutions believe they are delivering versus the perception held by consumers themselves. The gap is most pronounced in the areas of personalization, ease of product opening and engagement, ‘knowing the customer’ and empathy.

A Harris Poll survey, commissioned by Redpoint Global, not only confirms this disconnect between the perceptions and expectations of the two groups, but reveals it to be substantial. In addition, the data uncovered a misalignment across key components of customer experience.

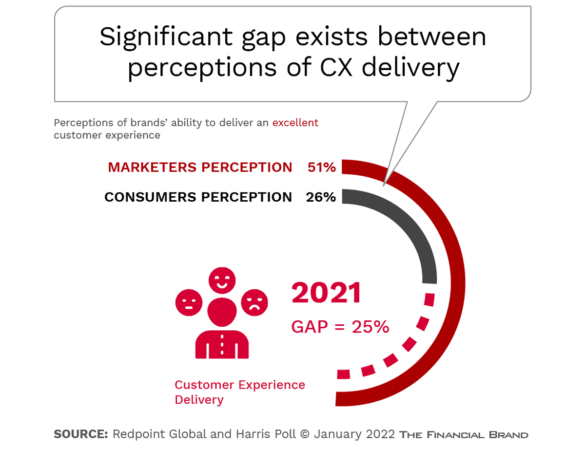

For consumers, the most important CX factor is consistency of experience across channels. The current lack of consistency is a key reason why three quarters of consumers believe that brands are not delivering “excellent” CX. This compares to more than half of marketers who rate their performance as excellent, creating an experience perception of gap of 25%. While this gap has narrowed since the last survey was conducted in 2019 (30%), it still is alarming.

The research also found that consumers have an expectation for omnichannel personalization, but 55% indicated they feel ‘unseen’ and undervalued (48%) by the brands they interact with and that experiences delivered rarely meet their expectations (48%). Comparatively, 95% of marketers believed they were headed in the right direction, were doing an excellent/good job of implementing new customer engagement technologies (96%), delivered personalized CX (93%) and are keeping up with consumer expectations (92%).

Read More: Banking Must Combine Strength of Humans With Power of Technology

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

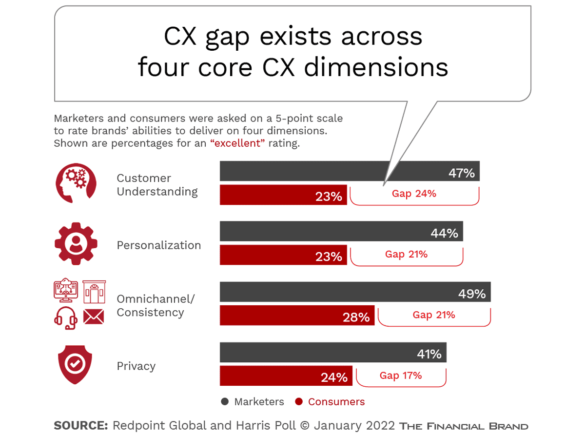

Performance Gap Exists Across Core Dimensions of CX

The gap in customer experience performance exists across all of the key dimensions of customer experience, with marketers consistently rating their ability to deliver CX significantly higher than the customer’s perception. The biggest differences were in the ability to deliver excellent CX in the areas of understanding the customer (24% gap), personalization (21% gap), consistency across channels (21% gap), and privacy (17% gap). With 82% of consumers saying most brands have significant room for improvement in delivering a consistently exceptional CX, marketers need use modern marketing tools to assist in closing these gaps.

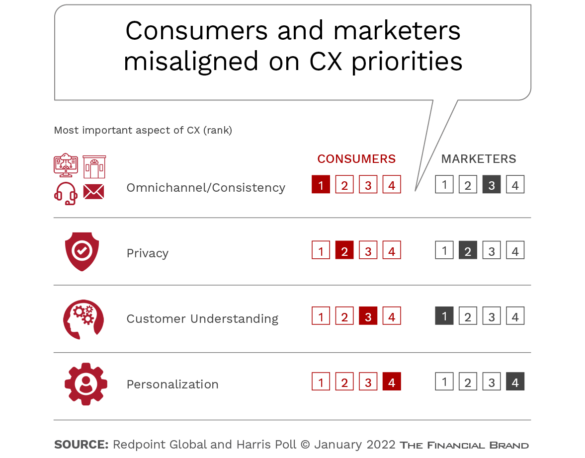

An additional challenge is that the importance marketers place on each dimension of customer experience does not align with customers’ views. For example, the research found that while consumers say the ability to deliver a consistent experience across all channels is the most important component of CX, marketers placed a much lower priority on this dimension. “More than a seamless CX across channels, omnichannel consistency means a flawless experience irrespective of how a customer engages with a brand and where they are in their journey”, stated the research.

What was interesting was that both understanding the customer and personalization were ranked lower than the other dimensions. This should not be viewed as a lack of importance of these components, however, since consumers are frustrated with organizations that don’t know them, understand them and reward them.

Read More:

- Can Banking Industry Meet Consumer’s New CX Expectations?

- Why Most Banks Struggle to Deliver a Killer Customer Experience

- Banking Must Use Real-Time Insight to Improve Customer Experiences

Banking Industry Held to a Higher Standard

When consumers were asked what industries should be doing the best in delivering an exceptional customer experience, retail and financial services were ranked the highest, but with only roughly 25% of consumers saying these industries are doing the best job. This was consistent across each dimension of customer experience, with banking perceived as doing the best of all industries with regard to privacy (but only by 30% of consumers), but doing worse than they should in the dimensions of omnichannel delivery, customer understanding, and personalization.

In another research study by Redpoint Global on customer experiences in financial services, it was found that while 82% of respondents expected banks to personally understand them, only 38% say their bank is effective in doing so. The consistency of communications across all channels was thought to be an imperative. In fact, while 88% of consumers said that a bank should have seamless, relevant and timely communications across all channels, less than half (45%) felt their bank was effective at achieving this objective. According to Brian Morris, Financial Services Partner at Pricewaterhouse Coopers, LLC, “Having an integrated view of the customer is no longer a nice to have – it is table stakes. In the past, that statement might have been considered hyperbolic, but today it is a fact.”

Growing Importance of CX:

Today’s consumers expect their financial institutions to deliver seamless, personalized, relevant experiences, but many organizations are simply missing the mark.

Of concern is that the non-traditional players in financial services are perceived as doing a better job than legacy banks in delivering a personalized experience. For instance, digital-first financial services, such as Apple, QuickenLoans and SoFi were perceived by more than half of consumers (54%) as investing much more in personalization versus traditional banks. This correlated with the perception that these organizations placed the consumer more at the center of the relationship.

Personalization is a Digital Transformation Imperative

When marketers were asked about the requirements for improved customer engagement, creating personalized experiences that are contextual, timely, and valued by the individual consumer was considered the most important, followed by the ability to deliver services across channels that are available at any time 24/7/365.

Understanding the customer ‘beyond the basics’ was also thought to be a significant driver of CX excellence. All of these require an investment in AI, personalization, real-time engagement, omnichannel presence and MarTech, which are foundational components of digital banking transformation.

According to the research from Redpoint Global, the importance of personalization is increasing as consumers understand what is possible and expect the organizations they do business with to keep pace with market leaders. Some of the key underlying trends include:

- Nearly all marketers (95%) and 70% of consumers said they will only shop with brands that personally understand them

- Transparency from brands impact loyalty, especially related to challenges that are caused by the pandemic (store closing, staff shortages, servicing delays, etc.).

- 82% of consumers said they expect brands to accommodate their preferences and expectations,

- CX extends beyond privacy and personalization. A quarter of consumers say they are less likely to do business with brands that do not embody their values.

- Personalization must include website design, advice and recommendations, with 49% saying that personalized content/offers increase the likelihood to make a purchase.

Summing up the overall research findings, John Nash, Chief Marketing and Strategy Officer of Redpoint Global, observes that “Marketers recognize the challenges of delivering optimal customer experiences, even when overestimating their own ability to deliver that experience. Bridging these gaps will require continued investment in solutions that can deliver perfected customer data and simplify orchestration of real-time decisions, interactions and overall customer engagement.”