Financial institutions have long faced the challenge of trying to minimize branch network costs while maximizing branches’ new client acquisition and engagement potential.

With 2023 looking to be a cost-conscious year, figuring out where to invest and why will be under even more scrutiny than usual. While the stakes are higher and focus is increasingly on digital channels, branch technology investment shouldn’t be neglected as it truly is a lever for increasing sales, reducing costs and offsetting some of the staffing challenges nearly every retail banking provider is experiencing.

Besides, even though digital channels are all the rage, a mid-2022 Celent study confirms that the branch remains the No. 1 sales channel. In essence, the branch remains vital.

So, the question is, is it possible to do more with less?

Branches Aren't Dead:

The bank branch might be getting trounced by digital transactions, but it's still the go-to sales channel.

To get an understanding of how others are answering this question, CFM surveyed 332 financial executives and compiled the top initiatives, technology investments, successes, and future plans of leading financial institutions in the 2022 Tech Trends Report.

Tech Investments Drive Results, But Work Remains

Let’s begin with the question of technology effectiveness. Overall, the sentiment of branch technology investments is favorable, with 98% of survey respondents stating that technology is helping to drive (35%) or maintain (63%) sales in the branch.

Interestingly, the assessment that technology has increased sales jumps to 50% among those who have deployed self-service technologies that also allow for assisted and full-service capabilities. Perhaps unsurprisingly, it seems there is a direct correlation between empowering staff to help assist clients when needed and increasing cross-sells.

Additionally, banks and credit unions are feeling slightly more optimistic about their use of technology, but agree they are still behind the curve. The average executive gave themselves a grade of just 62% on how progressive their technology efforts are.

There is optimism on budgets and spending, with 85% suggesting they are maintaining or increasing their current technology budgets to keep making progress.

ATMs, TCRs and ITMs Are Top Branch Tech Priorities

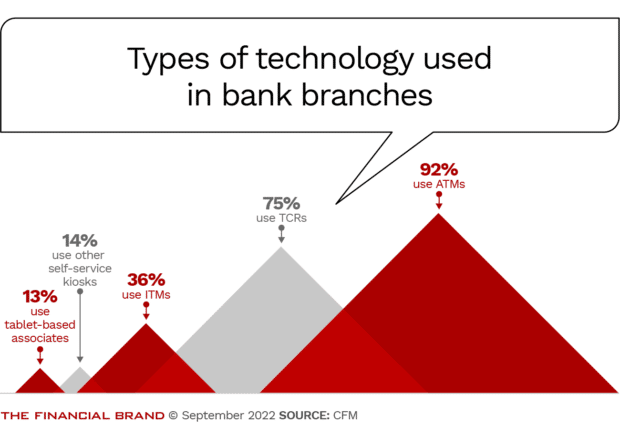

Self-service solutions (ATMs and interactive teller machines, or ITMs) were ranked as the most critical technology to retail branch strategies. That makes intuitive sense as financial executives look to migrate low-value, high-cost transactions to increase efficiency.

Teller cash recyclers (TCRs) continued to show high adoption rates, with respondents reporting an average of two devices per branch. This signifies a shift from the earlier common practice of only implementing TCRs in transaction-heavy branches.

Bankers seem to be recognizing there are a lot more benefits of TCRs that makes the investment worthwhile, including increased cash security, the ability to enable more universal staffing models and self-service capabilities.

“Cash recycling has been on a decade-long growth curve in branches. Previously, institutions often implemented cash recycling when doing so could be cost-justified based on full-time equivalent reduction,” observes Bob Meara, Senior Analyst, Celent. “This limited recycling to high-cash-volume branches. Going forward, cash recycling in teller pods, ATMs and ITMs will be central to post-pandemic branch redesign.”

When it comes to deciding on technology purchases, banking executives favored those that integrate with their banking core, with 60% saying it is the most appealing feature.

ITMs Gain Drive-Thru Market Share

Self-service continues to gain traction, and for good reason. 36% of respondents reported using video ITMs and 14% said they used other types of assisted/self-service kiosks. And 45% of financial institutions have seen a quarter or more of their transactions migrate from tellers to self-service.

ITMs appear to be dominating the drive-thru, but it’s the other types of assisted and self-service kiosks that are gaining popularity in-branch. That makes sense, because clients coming into a branch are likely seeking personal interaction versus video assistance.

The added assisted and full-service capabilities of kiosks like DBSI’s NEXT or Source Technologies’ Personal Teller Machines allow for a more gradual migration to self-service with options that emulate the consumer experiences from other retailers. Live staff can step in and provide assisted and full-service support when necessary, just as they do in grocery stores, home improvement centers and at airports.

Keep in Mind:

85% of bankers suggested they are maintaining or increasing their current branch technology budgets to keep making progress.

This in-branch combination seems to be the perfect blend of all worlds, and ultimately results in even more sales for financial institutions — a 50% increase versus 35%.

One of the key areas ripe for massive return on investment is leveraging self-service kiosks as central transaction stations for both clients and staff. This repurposing of technology can drastically reduce teller, equipment and branch footprint requirements. A few providers, including CFM, offer an associate tablet interface that essentially allows staff to queue up transactions and fulfill them at a kiosk, or monitor activity and step in when needed.

“Making operations more efficient — and more effective at the same time — by incorporating technology can help financial institutions ease the current labor gap significantly,” says John Smith, Chief Executive Officer of CFM. “If you can’t find people, then ‘hire’ integrated technology as your newest employee.”

“You can run a branch effectively with two to three people using core-integrated cash recyclers and self-service kiosks that ensure optimal user functionality and more-universal staffing models,” Smith continues, “while providing security, dual control and automation of transactions.”

Tipping Point for Universal Associates and Tablet-Based Staff

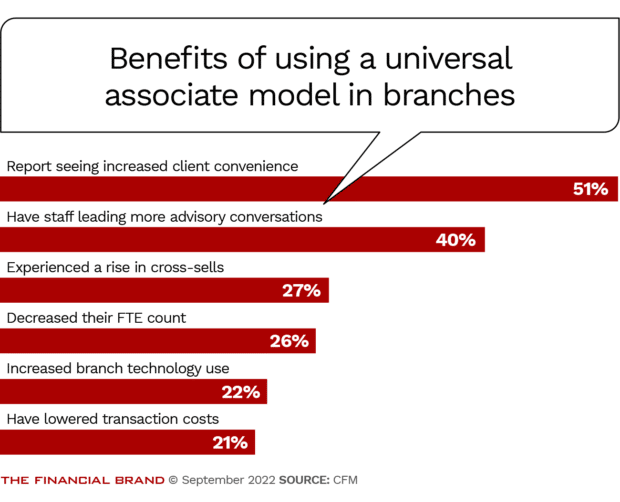

As banks and credit unions look to optimize efficiency and effectiveness, it seems universal associate or tablet-based staffing models are clear winners that deliver on both objectives.

Cross-trained, untethered staff members are able to fulfill nearly every job and transaction in the branch using a tablet device. This essentially eliminates “cash-register-style branches” and specialized roles, offering a more friendly client experience.

In our current report, 45% of respondents agreed that these new staffing models are the way forward, with 36% stating they have implemented them, and 9% with plans to do so this year. The Celent study confirmed this trend, with 59% saying they have implemented universal associates already and another 63% stating they have plans for tablet-based staff.

Most importantly, 100% of the financial institutions surveyed that have deployed a universal associate model said they are seeing benefits. Those that have tablet-based associates experienced the highest satisfaction operating on this model.