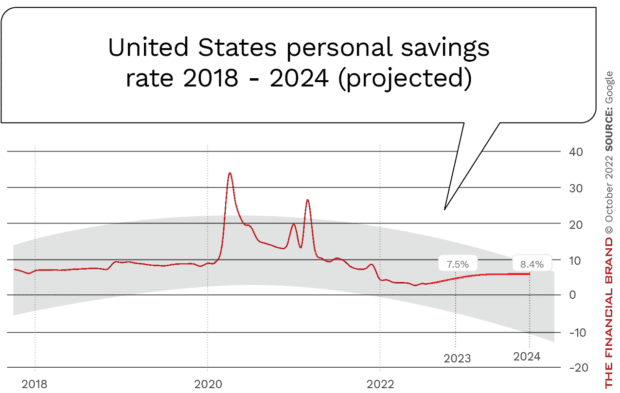

While the Personal Savings Rate in the U.S. is well below what was reached during the height of the pandemic when government stimulus checks were delivered, concerns about the economy have once again resulted in a rise in personal income saved as a percentage of net disposable income, according to analysis by Trading Economics. In fact, the Personal Savings Rate is expected to reach 5.20% by the end of this quarter, with projections of 7.50% in 2023 and 8.40% in 2024.

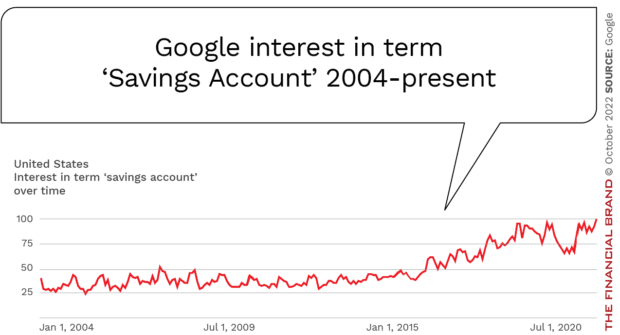

Corroborating this trend, an analysis of Google search data reveals that searches for ‘savings account’ have risen significantly in the U.S. The trend is even more pronounced in the U.K., where interest in the term ‘savings account’ exploded to ten times average volumes within the past month according to Investing Reviews.

The saving rate usually goes up when the overall economy declines, but tends to go back down when there are positive signs of growth. The challenge is that today, as was the case during the height of the pandemic, a large portion of the population lives paycheck to paycheck, with minimal money to set aside for an emergency. In fact, according to the Federal Reserve, four out of ten Americans would be unable to pay an unexpected $400 bill out of their savings.

Read More: Ally Bank Lab Builds Savings Features into App to Solve Pain Points

CFPB 1033 and Open Banking: Opportunities and Challenges

This webinar will help you understand the challenges and opportunities presented by the rule and develop strategies to capitalize on this evolving landscape.

Read More about CFPB 1033 and Open Banking: Opportunities and Challenges

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Innovations to Make Saving Easier

Savings accounts have been offered by financial institutions since the beginning of banking. Today, most financial institutions offer a range of savings products including traditional savings accounts, money market accounts, high-yield savings accounts, certificates of deposit, cash management accounts and specialty savings plans related to retirement, educational savings, etc. Most of these accounts do little to stimulate savings beyond the offering of higher rates.

According to a brief from the Financial Health Network, saving innovations from both fintech firms and traditional banks help make it easier for customers to save and/or make saving more compelling. These firms have used data and algorithms to develop models that can help consumers build up their savings with minimal effort.

With smart automated transfers, flows from checking to savings are personalized based on an individual’s financial situation at any point in time. “These types of smart transfers utilize deposit and payment patterns from consumers’ primary accounts, coupled with real-time data on inflows and current balances, to identify how much money is available for savings,” the brief states.

Much like an auto’s GPS system, instant decisions are made that would be difficult to make without modern technology. The frequency and amount of transfer is based on the customer’s financial history and anticipated changes in funds flows.

Some fintech firms —such as Even and Dave — notify the customer of funds that are safe to transfer (requiring the customer to take action), while other firms (Digit, Acorns, Plum and Chip) move the available funds into the designated savings plan automatically.

According to Digit, consumers who use smart automated transfer capabilities increased their savings by an average of $217 per month.

With savings round-ups, another savings innovation, small savings deposits are set aside when a customer spends money. In most instances, their purchase amount is rounded up to the next dollar (or some alternative amount) with the incremental amount automatically transferred to a pre-specified savings account. In theory, the more spending transactions that are done, the more the consumer saves.

Bank of America pioneered the round-up feature with its “Keep the Change” program. It rounds up purchases on BofA debit cards to the nearest dollar and transfers the difference to a savings account. Similar programs have since been implemented at traditional and non-traditional financial firms, including investing app Acorns and the Goalsetter banking app, as well as at Monzo, Bunq and Starling Bank.

Read More:

- 6 Keys to Designing a Best-in-Class Financial Wellness App

- Are Banks & Credit Unions Losing Out on Savings Apps?

- How to Grow Deposits in a Weird Rate Environment

Innovations to Motivate Savings

Traditionally, banks and credit unions simply used higher interest rates to encourage customers to increase savings balances. A high-yield savings account typically pays 20 to 25 times the national average of a standard savings account. In most instances, financial institutions use higher rates to stimulate new account growth.

The downside of this practice is that the offer is easily replicated in the marketplace, and the rate-shopping customer often transfers balances to institutions with the highest rate. In addition, the balances required for some high-rate savings accounts are not feasible for low- and moderate-income consumers.

Prize-linked savings incentivizes savings by providing an opportunity for customers to win money based on savings behavior. In one instance, a raffle entry is made for each $25 deposit, with prizes offered at pre-stated intervals. In another instance, a digital scratch card gives savers the chance to win money for making a deposit to a linked savings account. The benefit of these programs is a lower cost than offering a significantly inflated savings rate, while still providing the foundation for a consistent marketing message around saving.

Similarly, gamification makes building savings balances more engaging by integrating game-like elements within a financial product or app. In some organizations, the tracking of savings progress allows savers to earn badges or “level up” as they progress toward their savings goals. Other programs make financial education fun and engaging. According to the Financial Health Network, “As mobile games proliferate, gamified financial apps will strive to create a comparable experience that is fun, engaging, and effective.”

Finally, the creation of separate savings funds resemble the goal-based money envelopes used by consumers in the past, labeling each ‘savings bucket’ as a reminder of the individual goals being pursued. Often, this form of designated saving account results in higher savings levels than a traditional ‘pooled’ savings account. At some banks, customers can open multiple accounts. Ally Bank provides the option to create multiple savings buckets within a single savings account. Qapital, Douugh, Starling’s Goals, N26’s Spaces, and Revolut’s Vaults also enable users to save towards multiple purposes.

Digit found that users with multiple savings goals average $114 more in savings deposits over the first five months than those who have one goal.

Why It Matters

Consumers have a strong desire to improve their financial health with better tools for saving, credit management, and general budgeting. The challenge is that these tools must be easy to use and go beyond traditional static offerings. Consumers want digital tools that will anticipate their needs and automatically assist them in reaching their financial objectives on a personalized, real-time basis.

According to the Financial Health Network, “Intelligent savings algorithms and real-time balance and transaction data can reduce effort for users that want to save.” This will make the savings process easier for the consumer, increasing the rate of savings and differentiating the innovative offering in the marketplace.