Financial institutions that are digitally mature are better able to leverage data, analytics, digital channels and technology to drive business growth, improve customer experience and satisfaction, and achieve competitive advantage. But many are not as far as long as they need to be to see those kinds of results.

Numerous digital marketing tools and platforms are available to help banks and credit unions automate and streamline their marketing efforts. For example, marketing automation tools can help manage multiple marketing channels, track campaigns, and analyze data to optimize the messaging.

In addition to investing in technology, banking organizations need to focus on fostering a culture of innovation and experimentation. This means encouraging employees to take risks and try new ideas, sharing data and insights that can make decision-making better and customer engagement stronger. Banks and credit unions that embrace a culture of innovation can better adapt to changes in the market and stay ahead of competitors during times of economic uncertainty.

Most importantly, financial institutions need to focus on delivering a seamless and consistent customer experience across both online and offline channels. This means ensuring that all marketing efforts are aligned with the customer journey and that customers receive the same level of service and experience, regardless of the channel they use.

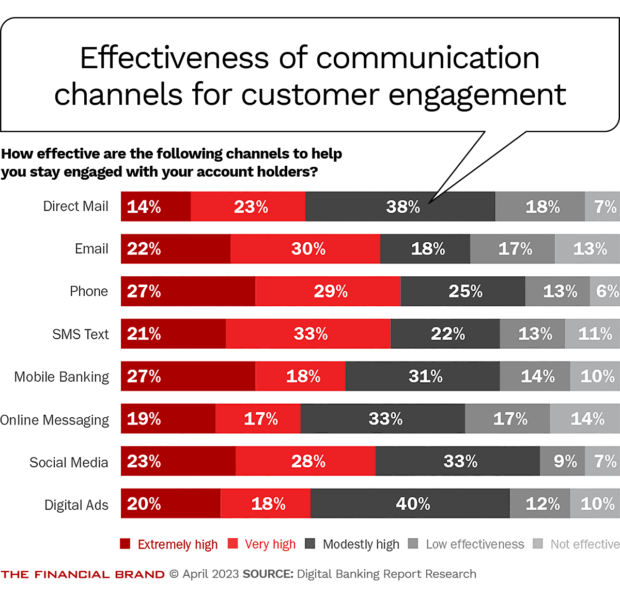

But research conducted by Digital Banking Report and sponsored by Alkami found most banks and credit unions still do not believe they can deliver customer communications that can support high levels of engagement or deliver strong sales results.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

A Gap Between the Use and Effectiveness of Digital Channels in Banking

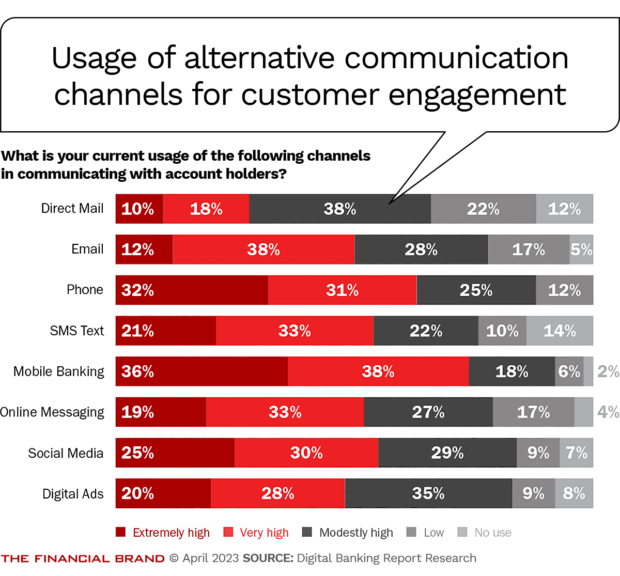

Many financial institutions think they already engage in multichannel communication — or are close. In response to the growing call for comprehensive digital experiences, a healthy percentage of banks and credit unions feel like they’re well on their way to integrated use of online and offline channels to build customer engagement.

Financial institutions of all sizes have been increasingly using digital channels. However, the extent to which they effectively use these channels varies depending on the institution and its strategies.

Some financial institutions have made significant investments in digital channels and have been able to achieve impressive results. For example, online banks and fintech startups have disrupted traditional banking by providing convenient and user-friendly digital experiences to customers.

Traditional financial institutions generally have been slower to adopt digital channels and may not be using them to their full potential. Some may have limited digital offerings or may not have optimized their websites or mobile apps for selling services.

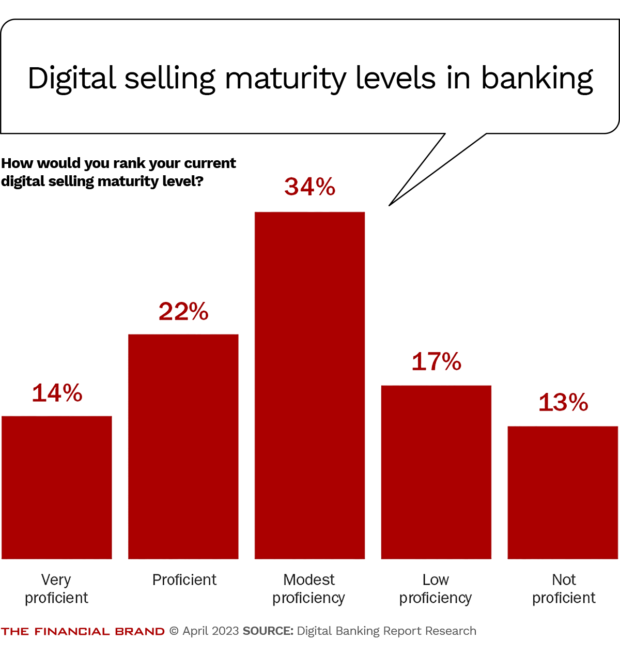

The impact of not successfully leveraging all channels is that sales effectiveness is not optimized. In fact, when banking executives were asked about their digital selling maturity, only 36% rated their institutions as either “proficient” or “very proficient.” By comparison, nearly a third — 30% — said their institutions have low or no proficiency in digital selling.

Read More: 62 Digital Marketing Statistics Every Marketer Should Know

Banks and Credit Unions Must Improve Use of Mobile Apps for Selling

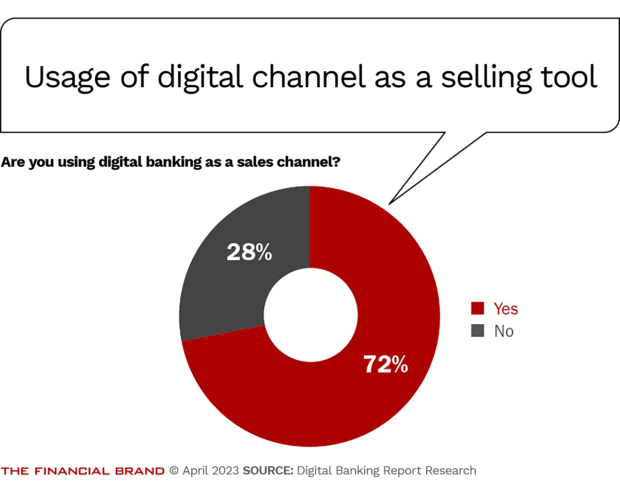

One of the best ways to sell financial products and services digitally is on the mobile banking app itself. With consumers accessing their mobile banking multiple times each week (or day), this platform provides unparalleled capabilities to engage and drive sales activity.

Financial institutions use mobile banking apps for selling services in several ways. Some examples:

- Personalized Offers: Mobile banking apps can collect data on a customer’s transaction history, account balances and financial goals. With this information, financial institutions can offer personalized product recommendations and targeted promotions either before or after mobile banking sign-in, increasing the chances of a sale.

- Simplified Access to Services: Mobile banking apps can allow customers to easily access and purchase services such as loans, credit cards and insurance policies directly through the app, with a streamlined application process and instant approval.

- Notifications: Financial institutions can send push notifications through the mobile banking app to inform customers of new products, services and promotions. These notifications can be tailored to the customer’s interests and behavior, making them more likely to drive engagement.

- In-App Chat: Mobile banking apps can offer a chat function, enabling customers to communicate directly with a customer service representative or a financial advisor. This feature will certainly increase in use in the future, with the integration of new capabilities facilitated by conversational artificial intelligence (AI). In-app chat should be a way for customers to get answers to their questions and get assistance in making informed decisions about financial products and services.

- Integration with Digital Wallets: Mobile banking apps can be integrated with digital wallets such as Apple Pay, Google Pay or Samsung Pay, enabling customers to make payments or purchases with a simple tap on their smartphone. This feature can increase customer convenience and encourage the adoption of additional products and services.

- Access to Targeted Content: The interoperability of the mobile banking app and hyper-personalized content beyond the chat function opens doors to financial wellness education and the ability for financial institutions to actively display empathy during times of economic uncertainty.

Mobile banking apps can facilitate a convenient and user-friendly customer experience while promoting products and services. However, use of the mobile banking app for selling is not universal, according to the research. Currently, only 72% of banks and credit unions use the mobile banking platform for selling. And many of these institutions leverage only the most rudimentary functionality.

As with other areas of digital transformation, we find that the most future-ready organizations tend to be the largest financial institutions as well as many of the smallest community banks and credit unions. These agile smaller players generally have partnered with third-party solution providers that can integrate selling on the mobile banking app at speed and scale.

Read More:

- How Banks Can Engage Customers Who Ignore Their Digital Marketing

- 7 Things to Do (And Avoid) with SMS/Text in Bank Marketing

- 5 Ways to Ensure Your Banking Website Works in a Digital-First Economy

The Power of Chat Can Improve Engagement and Sales Effectiveness

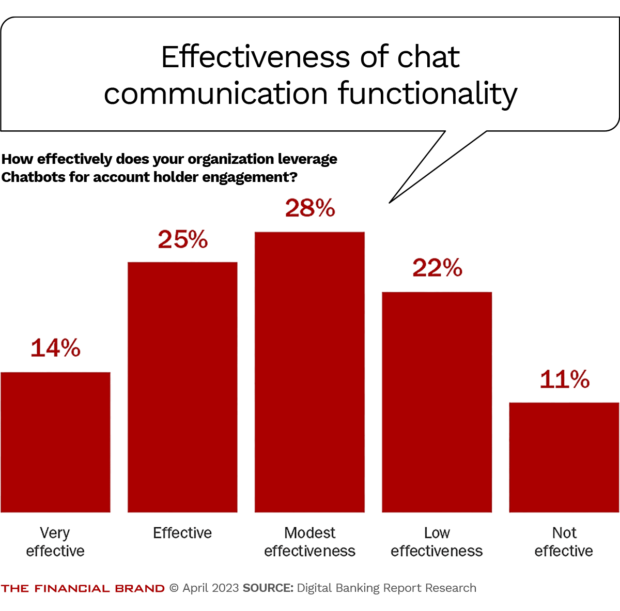

Financial institutions have been increasingly using chat functionality for customer engagement in recent years, whether on mobile apps, within online banking, or on their website. The research indicates that the extent to which organizations effectively leverage this functionality varies.

For instance, the greatest usage of high-level chat communication is evident from the largest financial institutions. Others who are advanced tend to be the smaller financial institutions that have collaborated with the most advanced third-party chat communication providers in the industry.

The research also found that the level of focus on chat communication is greatest for those organizations that integrate chat as part of the overarching customer service business model.

Chat functionality can be used to meet several business objectives, including customer engagement and support, sales and account management. Here are some of the ways financial institutions currently leverage chat functionality:

- Customer Engagement and Support: Financial institutions are using chat functionality to provide timely and personalized customer support. People can communicate with customer service representatives in real-time, enabling them to get quick answers to their questions and resolve issues more efficiently. The advancement of conversational AI is expected to exponentially improve the level of chat communication and integration with human support in years to come.

- Sales: Financial institutions are using chat functionality to sell products and services to customers, often on a proactive basis leveraging data, analytics and advanced modeling. Chatbots can be used to incrementally guide customers through the sales process and answer questions along the way. Human agents usually step in when necessary to provide more personalized assistance.

- Account Management: Financial institutions are also using chat functionality to help customers manage their accounts, help with budgeting needs and begin basic activities, such as bill payments, account transfers and cashflow projections.

With the advances heralded by ChatGPT and other conversational AI tools, chat functionality will become an increasingly valuable tool for financial institutions to use when engaging with their customers. By providing timely and personalized support, offering relevant products and services, and assisting with account management, financial institutions will increase customer engagement and simplify the overall buying process for the customer.

Despite the potential power of chat communications, it will be important for financial institutions to ensure that their chat functionality is user-friendly, with a continued focus on privacy and data management. Done well, chat will most likely not eliminate human engagement, but move the level of potential human engagement to a much higher level.

Read More: Pros & Cons of ChatGPT and Other ‘Generative AI’ for Marketers

Bankers Believe Conversational AI Will Be a Game-Changer … Eventually

The level of acceptance and use of conversational AI is likely to continue growing over the next several years as the capabilities and deployment across multiple applications in every industry continues. While there has been unprecedented coverage of ChatGPT in the past several months, financial institutions will most likely be more hesitant than other industries to embrace the technology because of regulatory, privacy and risk tolerance issues.

Here are some thoughts around the impact of conversational AI in banking based on the research.

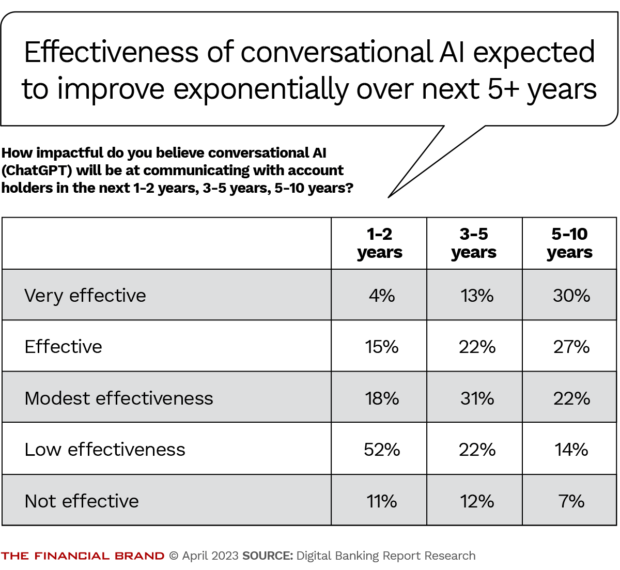

In the next one or two years, conversational AI is likely to become more widely adopted at tech and fintech firms than in traditional financial institutions. As customers become more familiar with using chatbots and virtual assistants for customer support, sales and account management, they will increasingly come to expect this type of communication and engagement from their financial institutions. The response from financial institutions globally reflects hesitation in full deployment.

Over the next three to five years, conversational AI will become more sophisticated, leading to wider use by consumers in every demographic category. This acceptance will come with increased expectations around the avoidance of biases, adherence to privacy concerns, and the integration of consumers themselves in the development of contextual communication.

As understanding of the capabilities of conversational AI increases, financial institutions will most likely also begin using this technology for more complex tasks, such as financial planning and investment advice.

Beyond the five-year timeframe, conversational AI is likely to become an integral part of the customer experience for financial institutions and other industries. This is reflected in the research: Respondents said they believe that more than 50% of implementations are “effective” or “very effective.” They see only 21% of implementations being ineffective.

As more customers become comfortable interacting with chatbots and virtual assistants, many may prefer these channels over traditional customer support or engagement methods. Conversational AI may also be integrated into other technologies, such as augmented reality and voice-activated devices, creating new metaverse opportunities for customer engagement.

Overall, the pace of adoption in the financial services industry will be at the mercy of functionality advancement, customer preferences, regulatory requirements and technological limitations.

Future of Digital Engagement and Selling in Banking

The future of digital engagement and selling in banking will be influenced by a range of technological, behavioral, and market trends. The use of artificial intelligence and machine learning will play an increasingly important role in digital engagement, with AI-powered chatbots and virtual assistants assisting customers with product recommendations and purchases, while machine learning algorithms will help banks and credit unions identify customer needs and preferences, making it easier to personalize engagement.

Social media platforms will continue to increase in importance, reaching new segments, building brand awareness, and increasing as a major sales channel. Virtual and augmented reality (VR/AR) will also become more prevalent in digital engagement and selling, with advanced technologies being used to provide customers with immersive experiences, such as virtual product demos or interactive shopping experiences.

Finally, as consumers increasingly use their mobile devices to make purchases and interact with brands, financial institutions will need to ensure that their digital selling strategies are optimized for mobile devices. It is clear that the most future-ready organizations are using mobile commerce to increase sales, improve customer engagement, and provide customers with a more convenient and seamless buying experience.

It’s time for more banks and credit unions to follow their lead.