It’s no secret that the fast-growing Hispanic-American market represents a golden opportunity for financial marketers. What’s less clear is whether the majority of financial institutions recognize the nuances that can make or break a marketing campaign to tap this attractive, large and evolving market segment.

“While most marketers today know the facts and figures about U.S. Hispanic population growth, few in the financial sector have recognized the financial viability of this consumer,” says Univision’s Roberto Ruiz. The number of Hispanic households earning $100,000 or more is up 313% since 2001, he observes.

New research from Bank of America offers useful data relating to financial habits and aspirations of Hispanic-Americans. The insights can assist banks and credit unions not only in deciding what products are a good fit, but how to more effectively shape their marketing creative.

- BofA’s data confirms that Hispanics’ financial attitudes tend to skew more conservative than those of the typical American consumer. For example: 53% of Hispanic-Americans say they track their expenses every month, compared with 48% of non-Hispanics

- 31% of Hispanic-Americans plan and stick to their budget every month compared with 24% of non-Hispanics.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Tapping an Aspirational Market Segment

A significant distinguishing characteristic of the Hispanic market overall is that Hispanics and non-Hispanics differ in their definitions of prosperity, observes Roberto Ruiz, EVP of Strategy and Insights for Univision Communications. For Hispanics, prosperity is about progression, moving-forward, living the American Dream. Non-Hispanics focus on stability, freeing themselves from stress, being comfortable. Financial marketers should shape their messaging accordingly, says Ruiz.

This aspirational focus of Hispanics translates into a much greater interest in learning about personal finances than the population as a whole. The BofA study, conducted by Ipsos, found that 84% of Hispanic-Americans say they’d like to learn more about financial matters compared with 69% of non-Hispanics. Investing and saving were the two topics cited most often by both Hispanics and non-Hispanics, but there was a particular gap between the two segments in two areas: learning about buying a home (23% Hispanics vs. 10% non-Hispanics) and using/managing credit (23% Hispanics vs. 14% non-Hispanics).

Taking the findings to heart, Bank of America made all of the content from Better Money Habits — its free financial education platform — available in Spanish. The bank notes that home-buying information is among the site’s most accessed content. BofA’s website and mobile app are already available in Spanish, which includes Spanish-language versions of Zelle and the bank’s spending and budgeting tool.

Hispanics’ interest in credit makes sense for a several reasons identified by a Univision/Harris study:

- The Hispanic market is younger. The median age for Hispanics was 29 in 2017 versus 43 for non-Hispanic whites

- One in four Hispanics hopes to start a business

- A higher percentage of Hispanics use payday loans or similar services than non-Hispanics.

A Raddon report found that almost half of Hispanic households would welcome a short-term borrowing opportunity with their primary financial institution.

Read More: Deposit Hungry Institutions Can’t Afford to Fumble Hispanic Opportunity

What Hispanics Stress About Financially

According to Bank of America’s research, the top financial stress point for Hispanic-Americans is the same as it is for non-Hispanics: “Not saving enough” (43% and 42% respectively). Big differences appear, however, between the two in three categories.

- 30% of Hispanics reported stress about buying home or paying their rent or mortgage versus 15% of non-Hispanics

- 25% of Hispanics said they’re worried about losing their job versus 11% of non-Hispanics

- In the other direction, 39% of non-Hispanics report stress over health costs compared with 28% of Hispanics.

Finance is a Family Affair

The Bank of America study probed several aspects of the integral role played by family in Hispanic financial matters. Overall it found that 52% of Hispanic-Americans are financially tied to their families compared to 33% of non-Hispanics. Providing some granularity to that broad statement, 28% of Hispanics said they “Support, or expect to support, parents financially” (vs. 12% non-Hispanics), and 25% said they had “Helped support my family as soon as I was old enough to work” (vs. 15% non-Hispanics).

Even more striking is that 36% of Hispanic Millennials (who comprise 22% of U.S. Hispanics overall) say they expect to support their parents financially compared to 19% of non-Hispanic Millennials.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

How Banks And Credit Unions Can Reach Hispanics

Raddon’s research uncovered that nine out of ten Hispanics living in the U.S. already have a banking relationship. Despite that, there is still a significant gap between Hispanic and non-Hispanic use of checking/savings accounts, credit cards and mortgages. Univision/Harris found that 50% of Hispanics polled had a checking or savings account versus 72/% of non-Hispanics. Further, the relationship between banking providers and Hispanic customers is not as strong as it could be. Overall, 51% of U.S. Hispanics feel very or somewhat undervalued by the financial services industry and 69% say financial institutions do not meet their expectations, according to Univision/Harris.

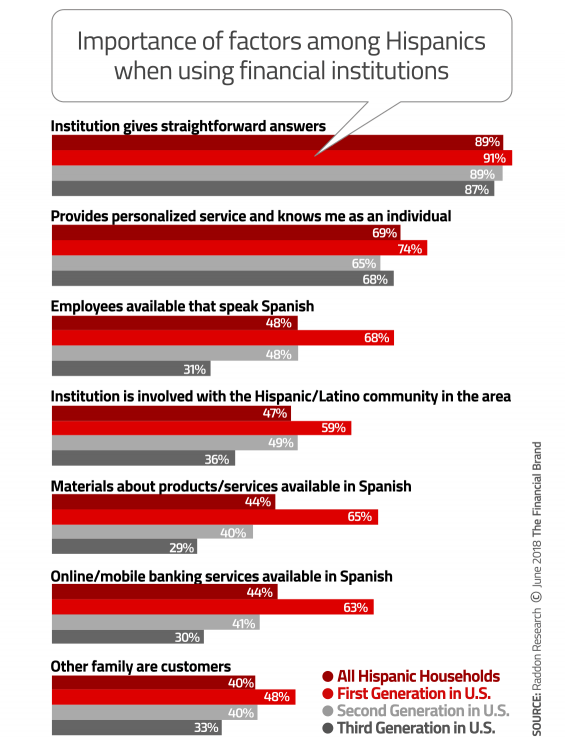

Raddon’s research points to several factors that banks and credit union marketers should consider. High on the list, the firm notes, is a strong desire to be known as individuals and receive personalized service.

Here are several suggestions financial institutions can consider to increase their success with Hispanic-Americans:

Meet their need for financial knowledge. Three quarters of Raddon’s Hispanic research sample said they’d had to figure out how to manage their finances by themselves. The firm suggests that education from providers would be valued by Hispanics.

Bilingual in all ways. Research by Nielsen found Spanish-language advertising was more effective in reaching bilingual Hispanic Millennials, especially when the ads were emotional. Beyond ads, banks and credit unions should have: bilingual staff in branches and contact centers; IVR messaging available in Spanish; product information and documents in Spanish; in-language email marketing and social media.

Consider cultural differences. “Successful multicultural marketing campaigns require more than translation,” notes a white paper from LanguageLine Solutions. “Marketers need to have a deep understanding of the cultural context of their target audience.” The paper observed that “The simple fact of recognizing the prevalence of multigenerational living arrangements among Hispanic home buyers makes this ad more relevant.”